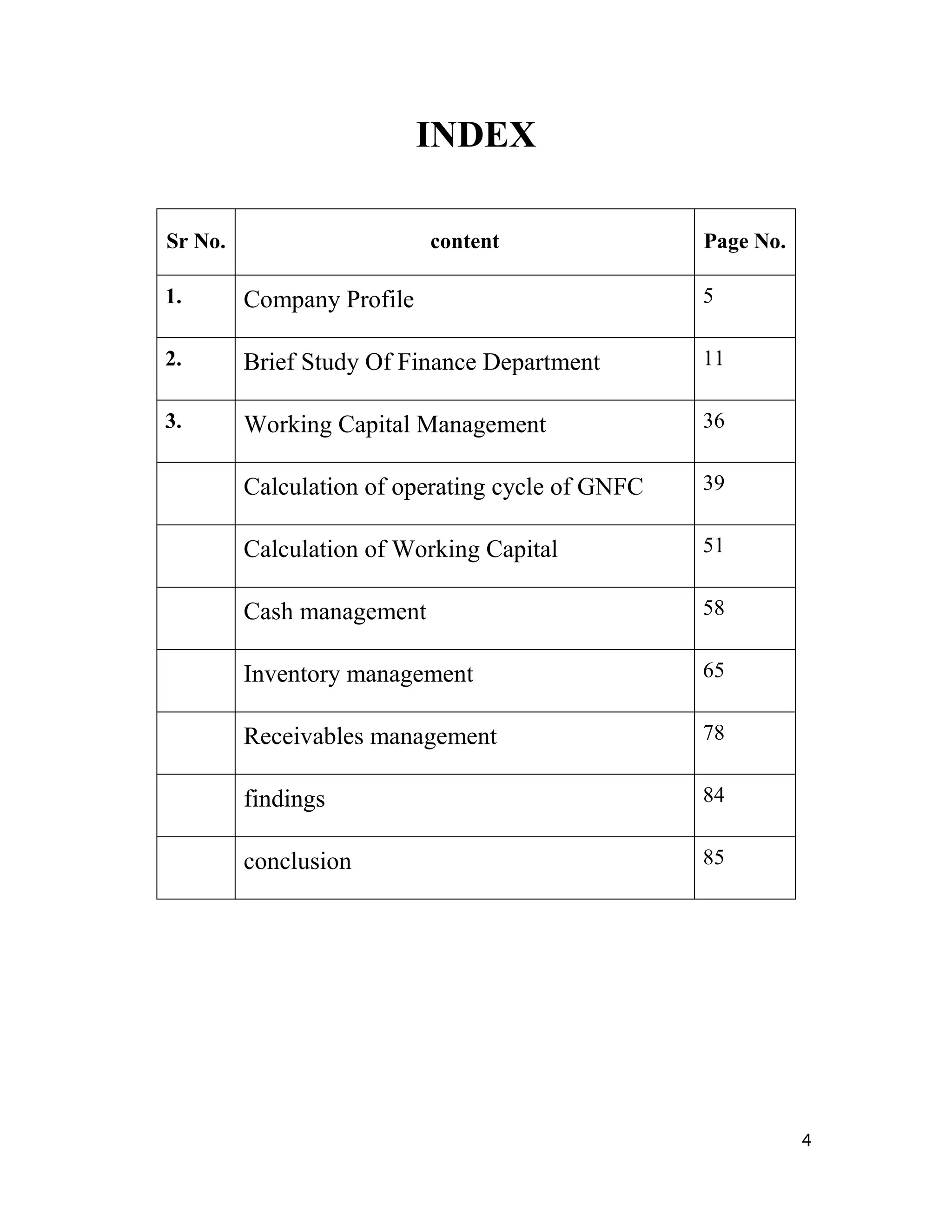

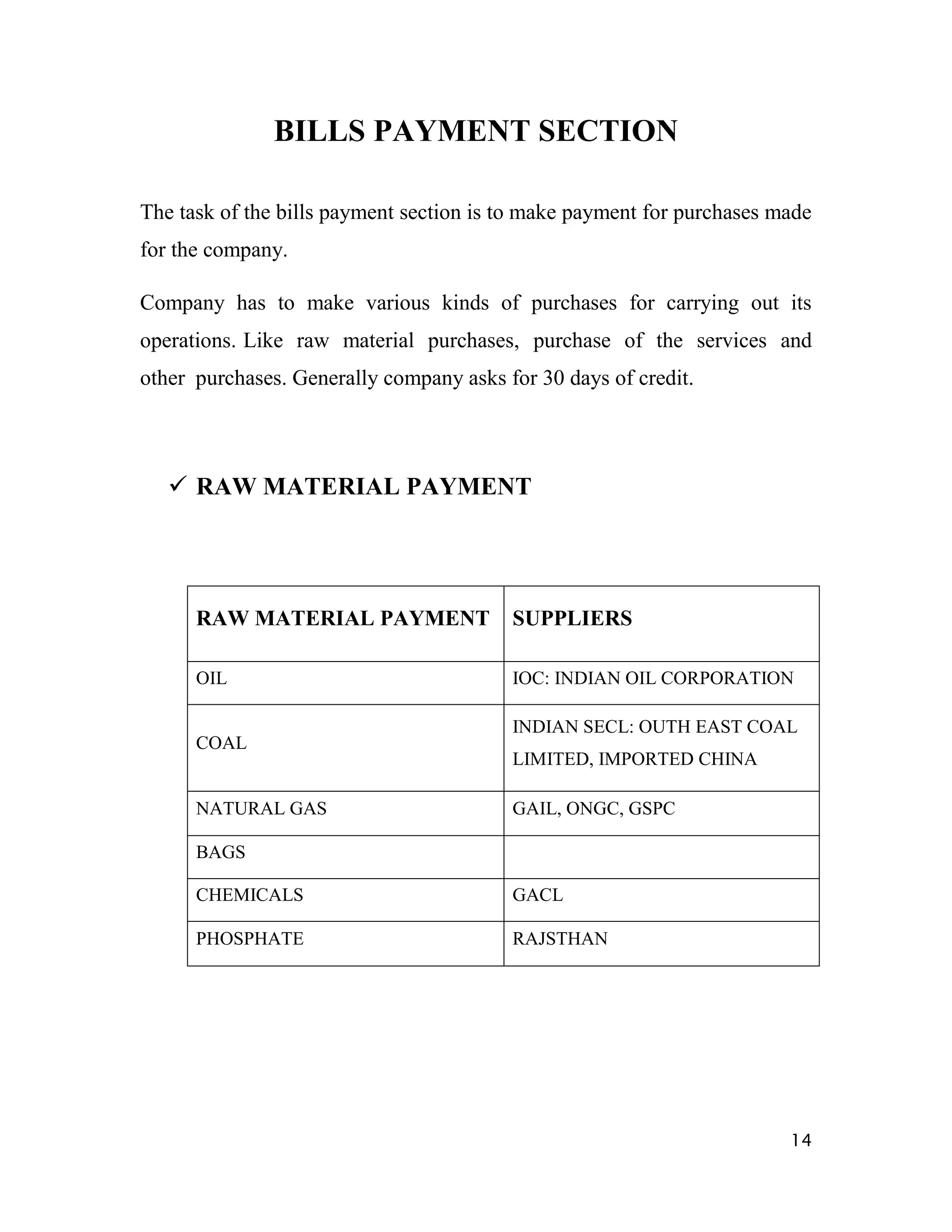

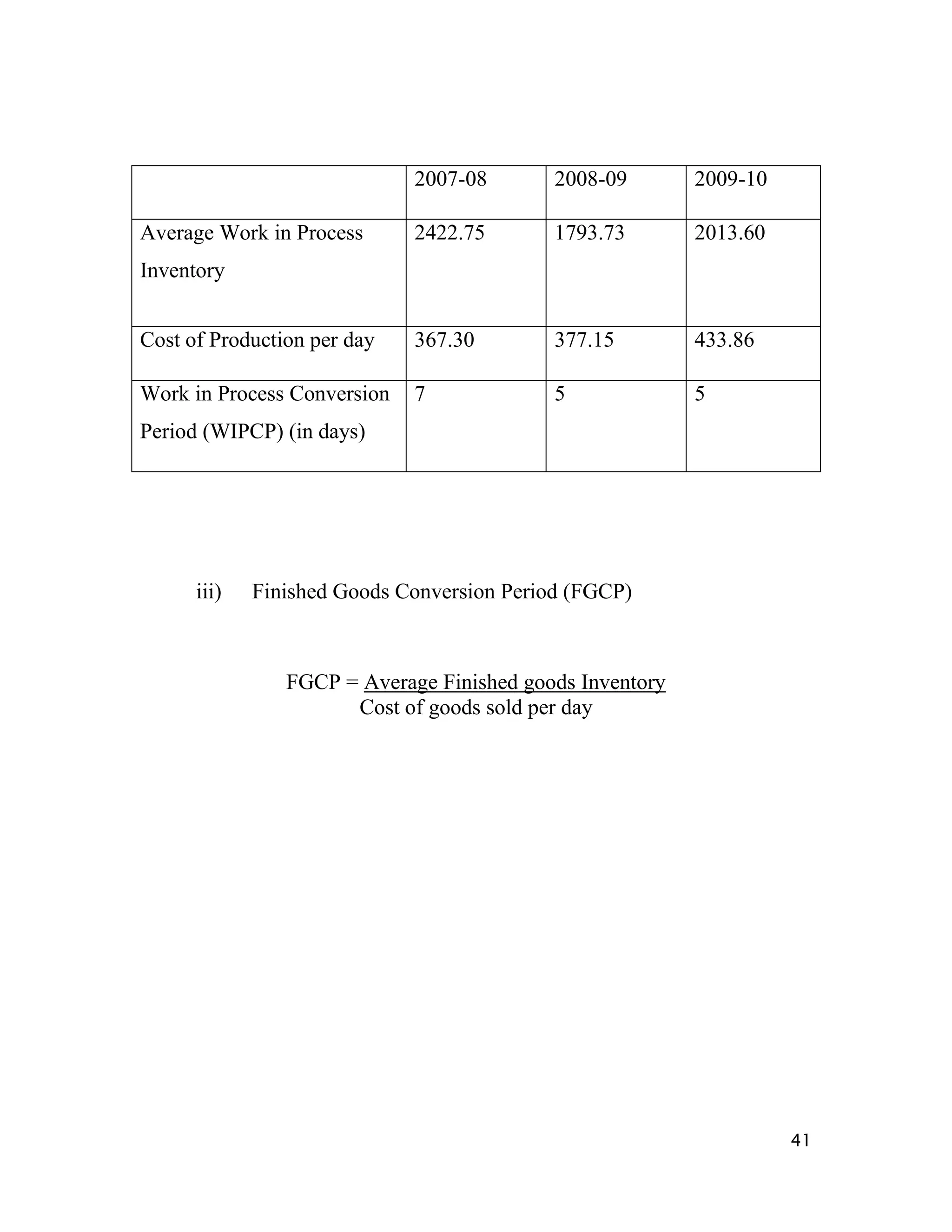

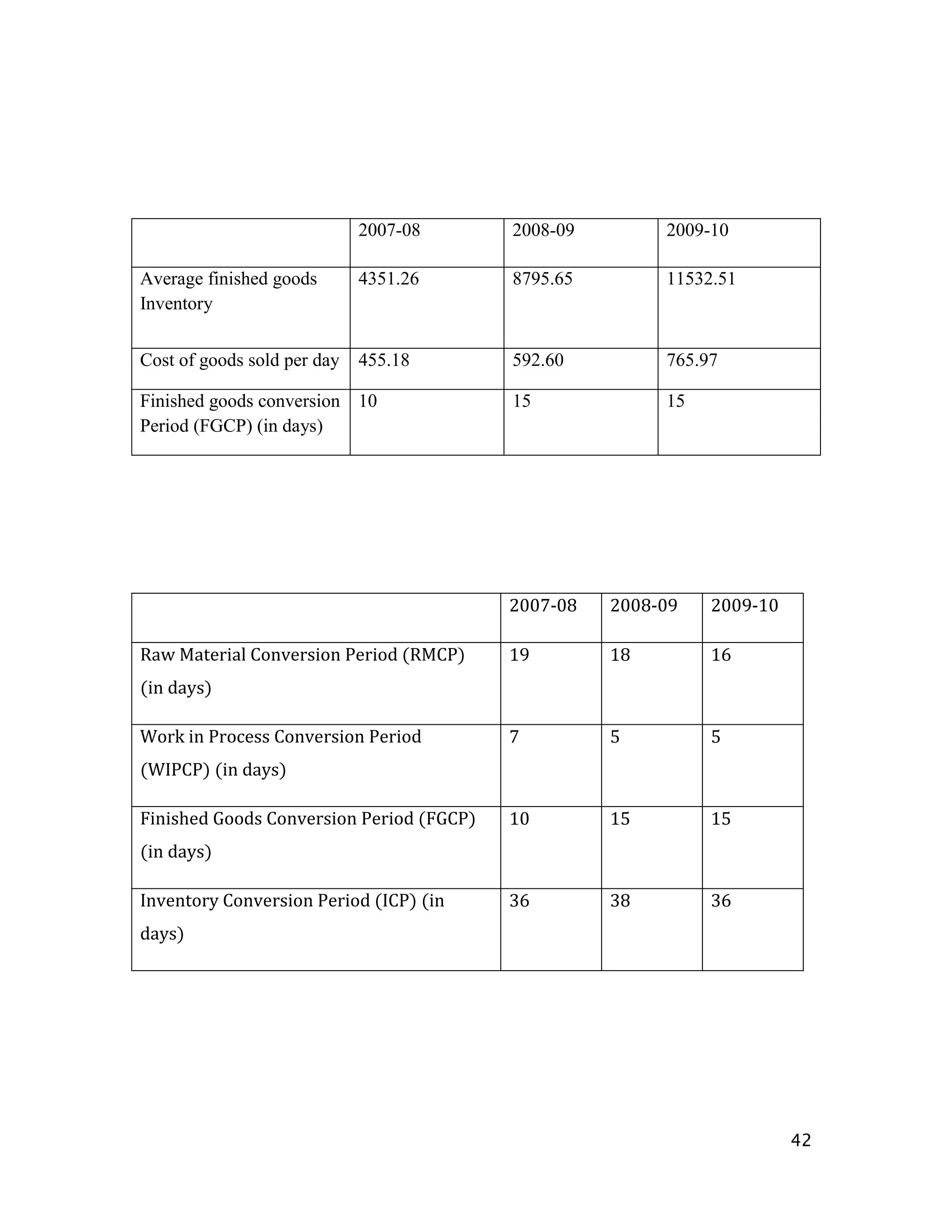

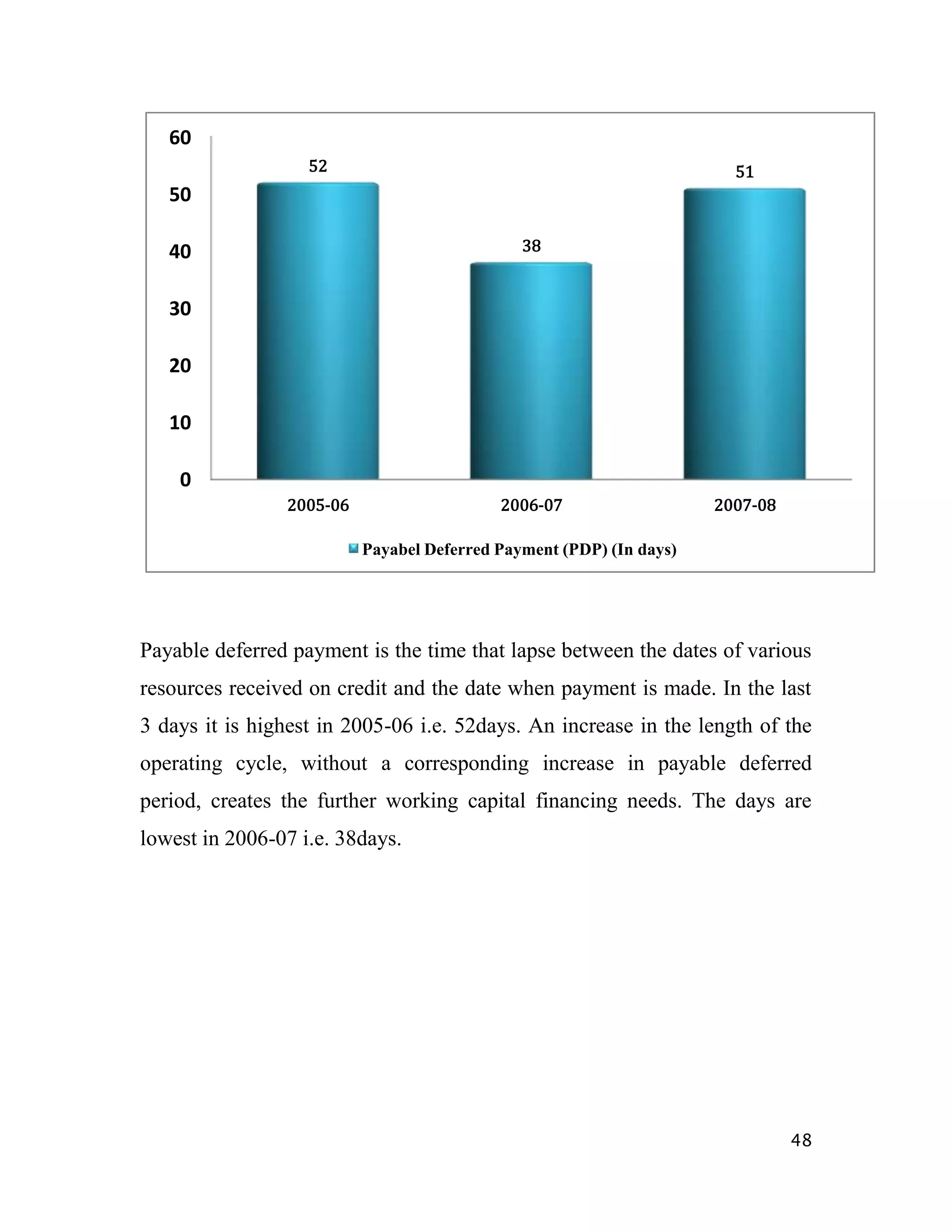

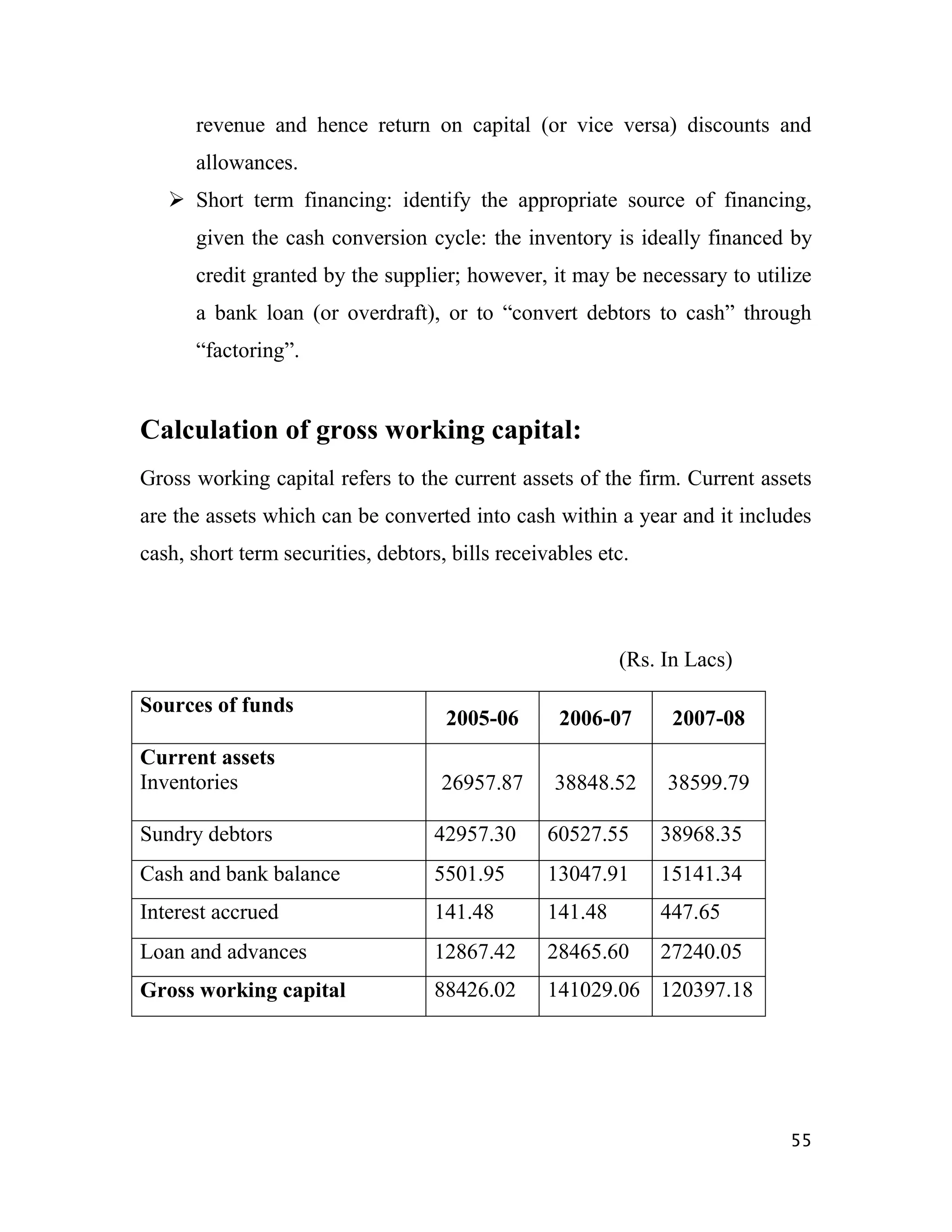

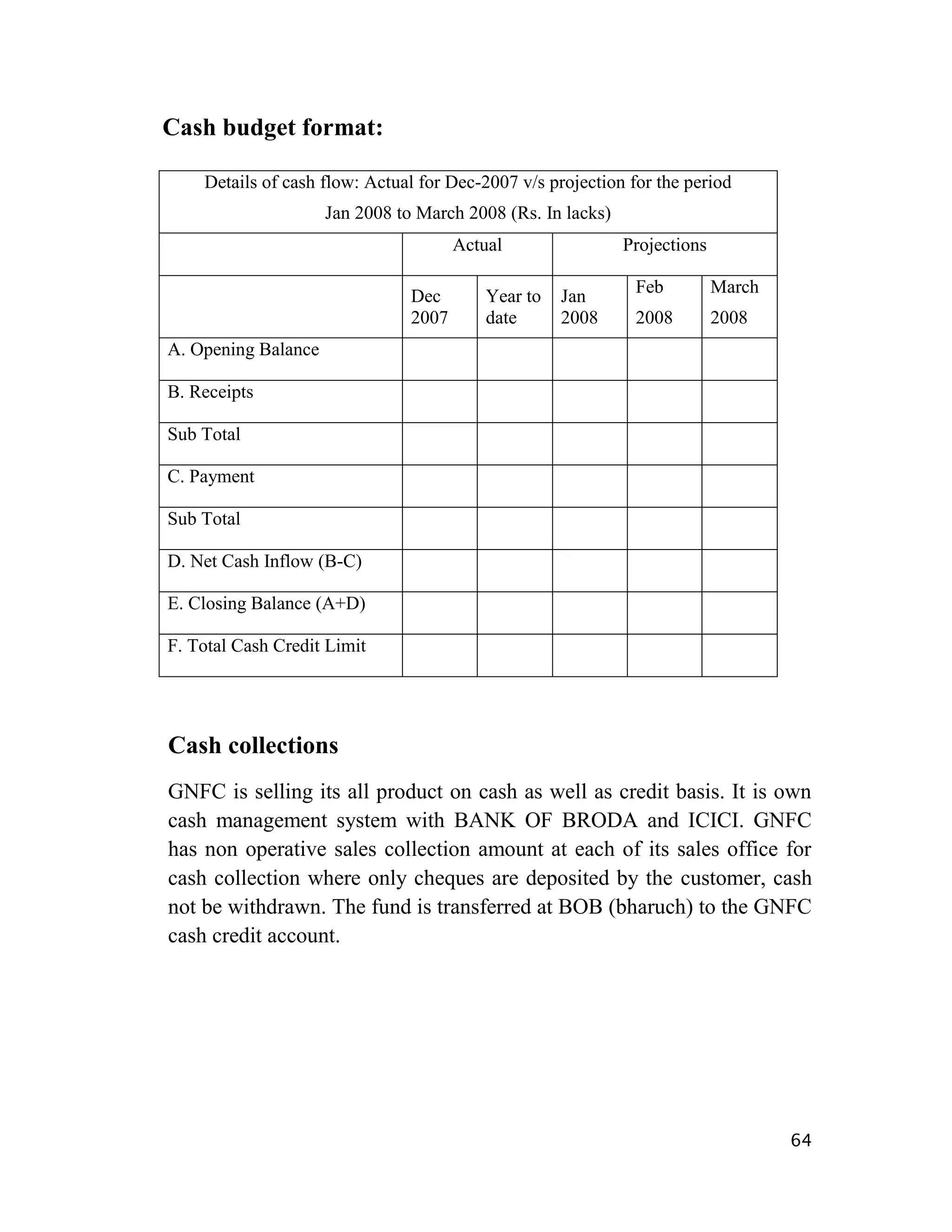

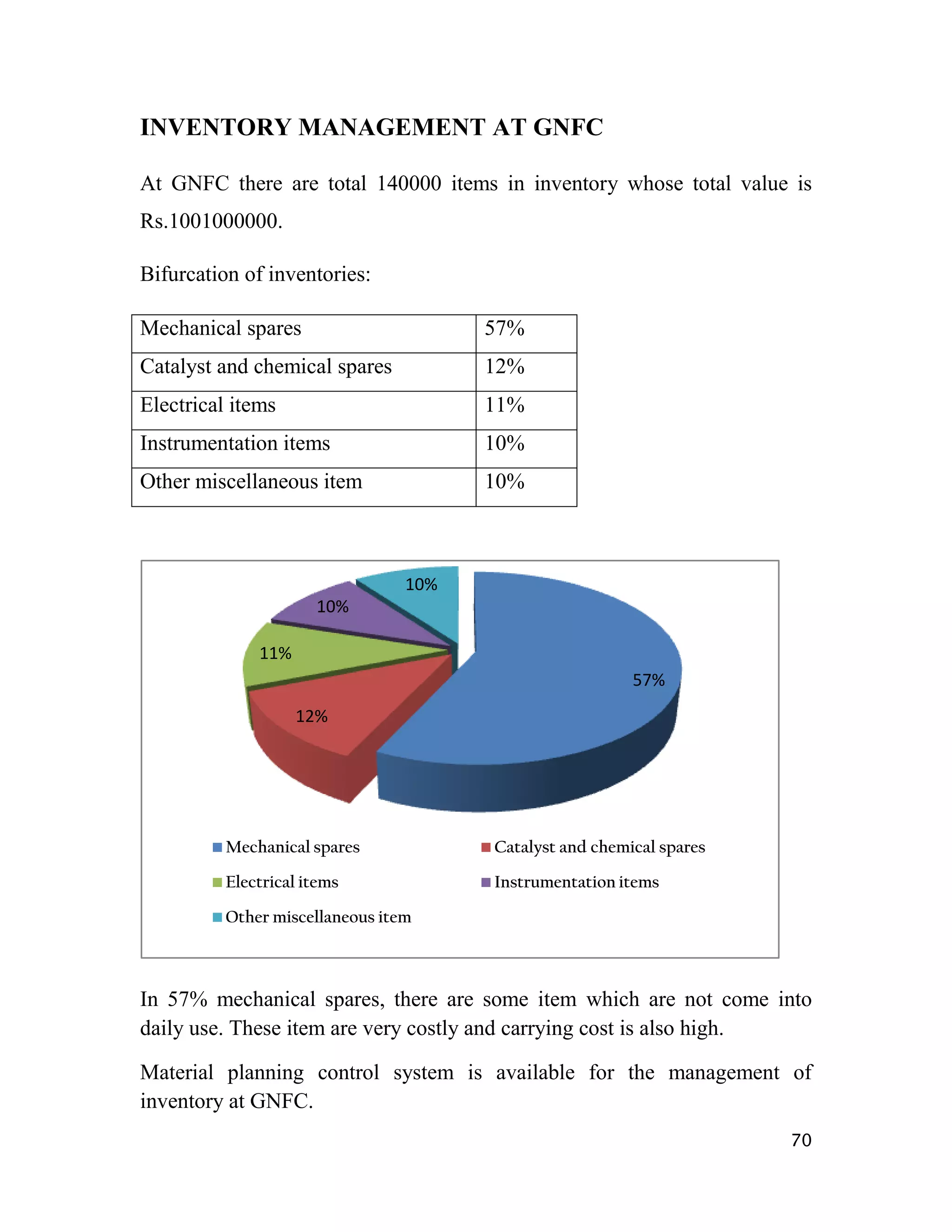

This document provides a summary of the internship project conducted by Vivek Patel at Gujarat Narmada Valley Fertilizer Company Ltd (GNFC) in Bharuch, Gujarat, India from 2008-2010. The project involved studying working capital management at GNFC. It includes an acknowledgment section thanking those who guided the project. It also includes sections on the company profile, an overview of the finance department and its various sections, and a focus on working capital management concepts including calculation of the operating cycle, working capital, cash management, inventory management and receivables management.