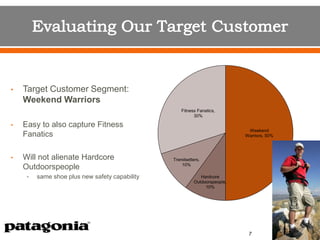

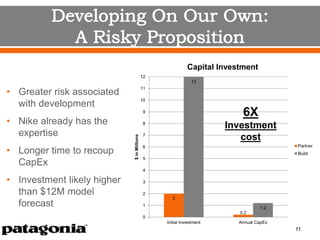

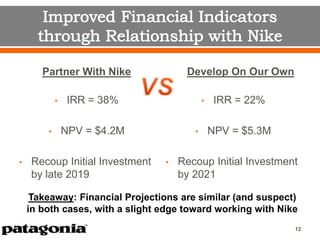

This document proposes a partnership between Patagonia and Nike to develop a hiking boot powered by Nike's wearable technology. It considers the wearable technology market, entry strategy, branding, and financial implications. Key points analyzed include developing the boot independently versus partnering with Nike, targeting different customer segments, marketing to promote sustainability, and minimizing effects on each company's brand. The recommendation is to partner with Nike to leverage its expertise while protecting Patagonia's brand, ensuring customer data ownership, and gaining access to Nike's customer base and technology at a lower investment risk.