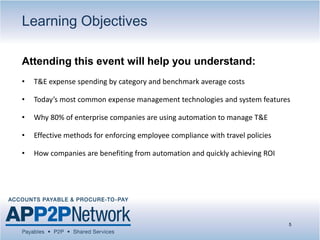

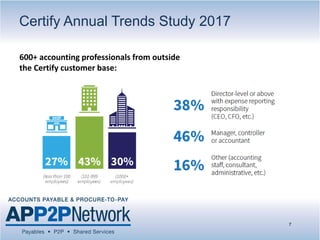

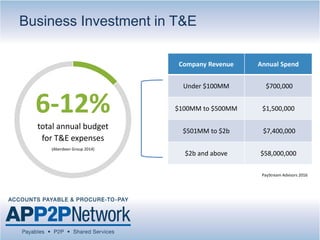

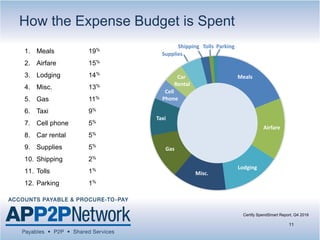

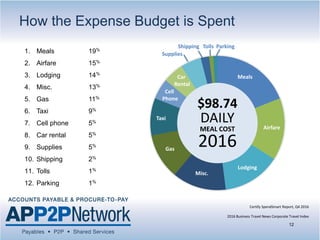

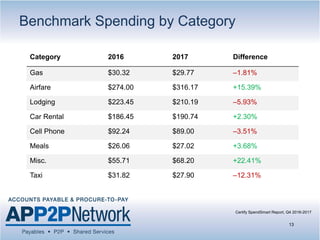

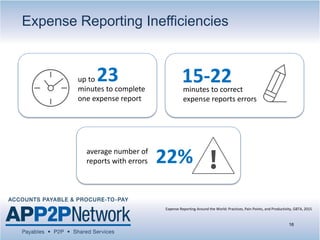

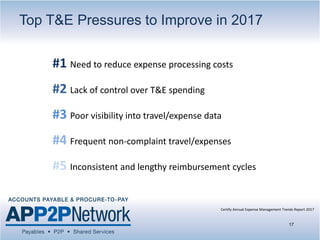

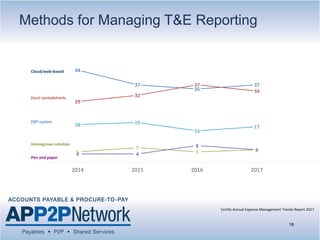

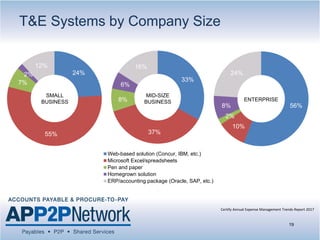

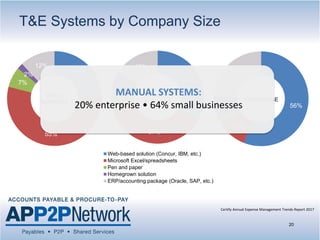

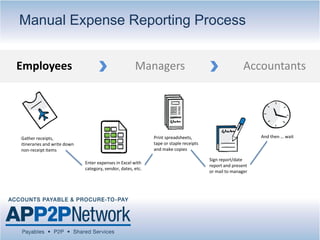

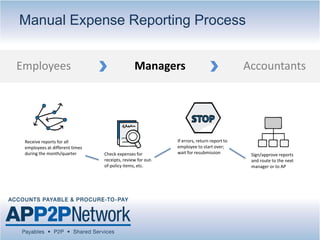

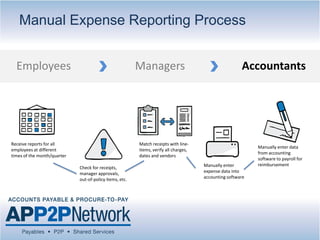

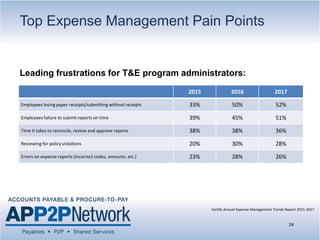

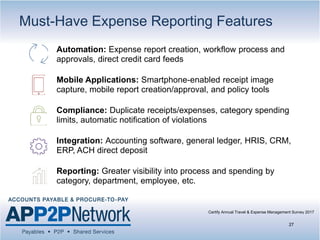

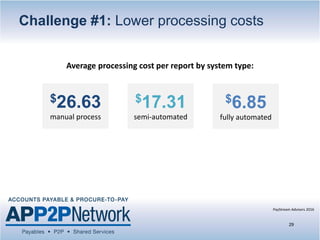

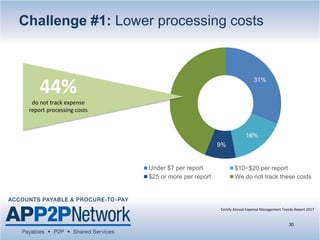

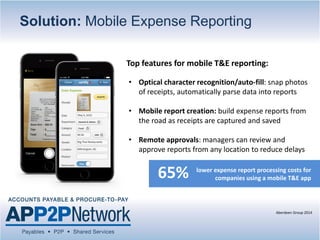

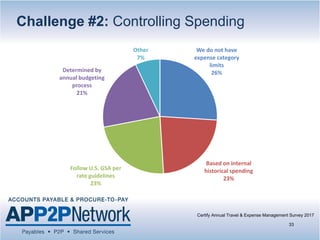

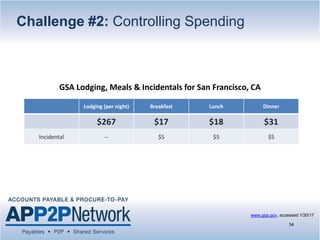

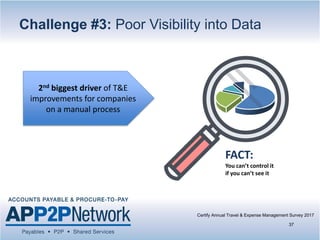

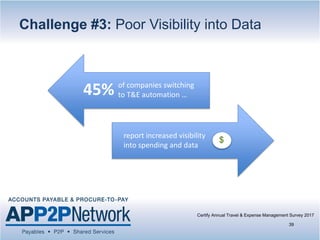

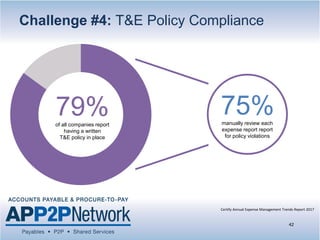

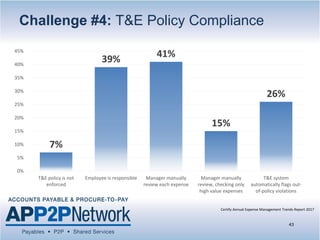

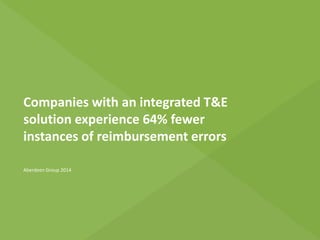

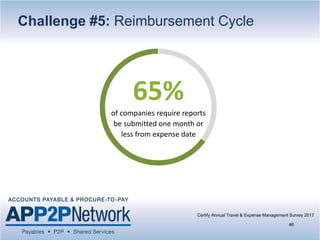

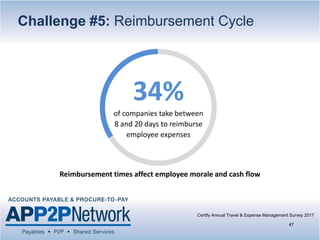

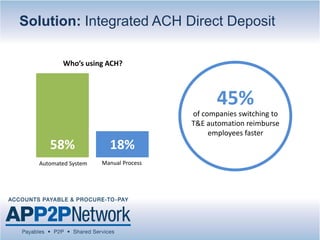

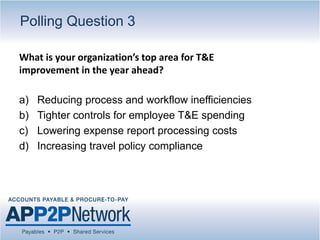

The webinar focuses on addressing challenges in travel and expense (T&E) management, discussing topics such as industry trends, automation benefits, and compliance enforcement. Key features highlighted include mobile reporting, expense visibility, and the importance of reducing processing costs. Participants will gain insights into common expense management technologies and methods to improve compliance and efficiency within their organizations.