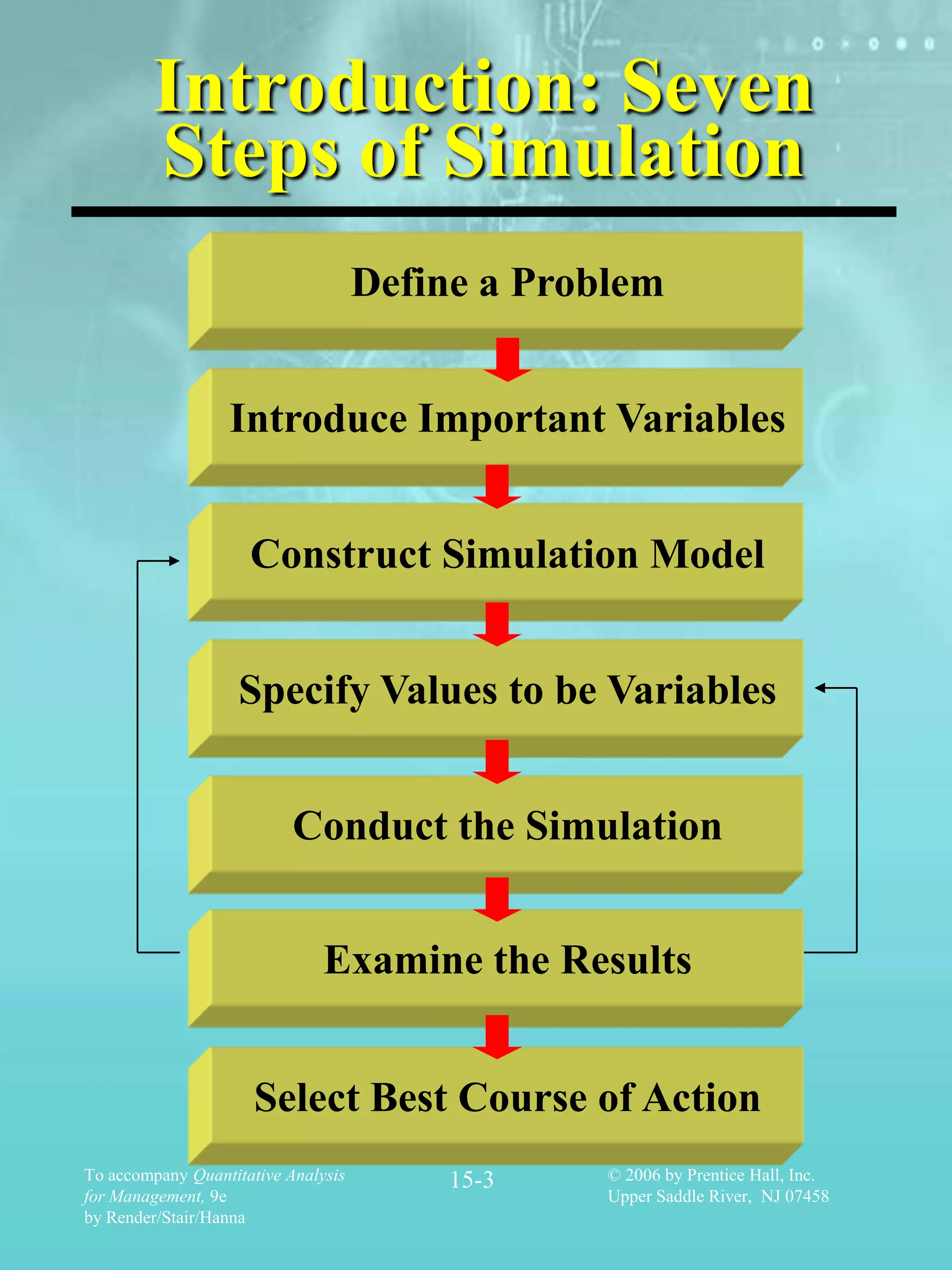

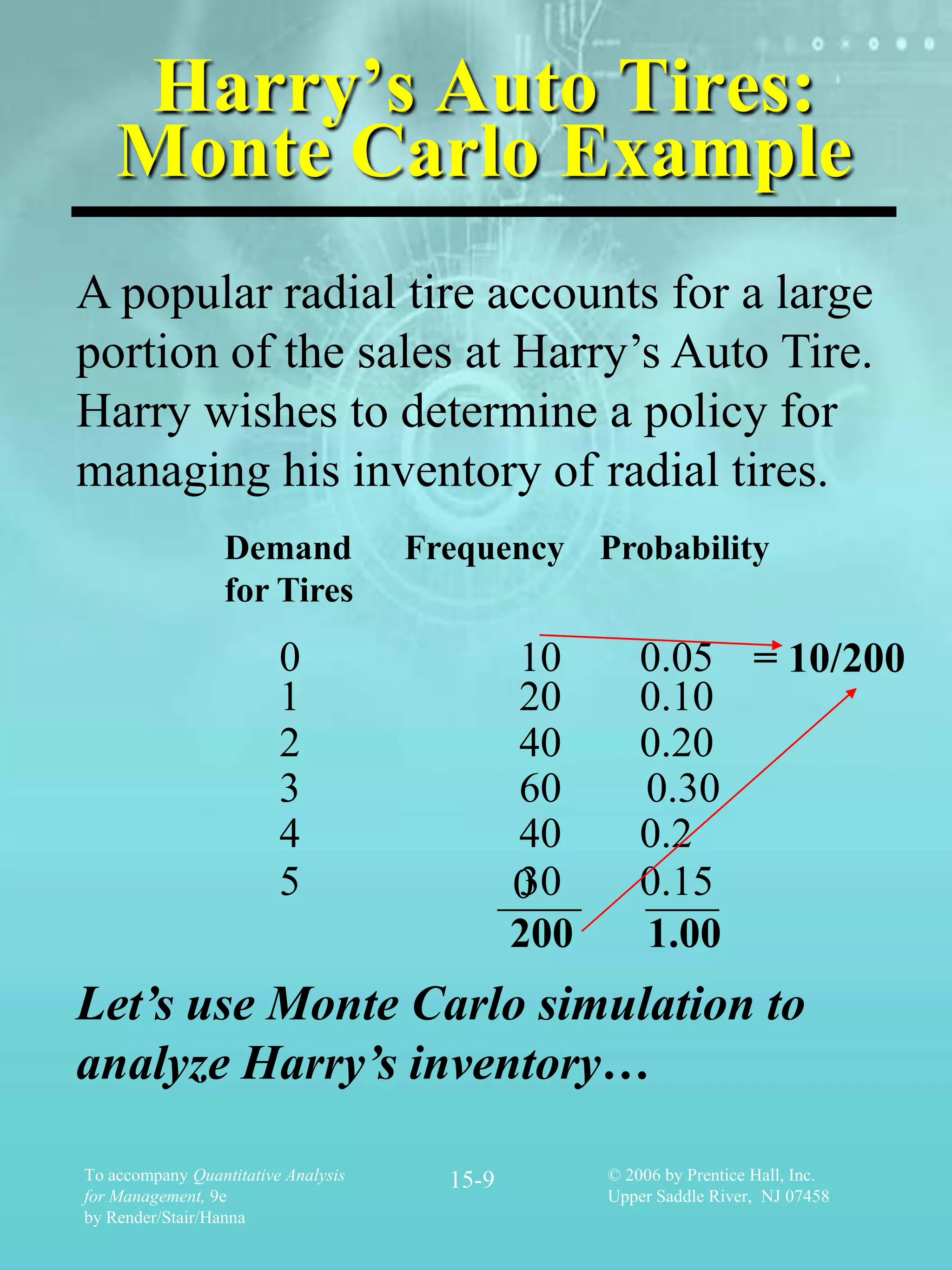

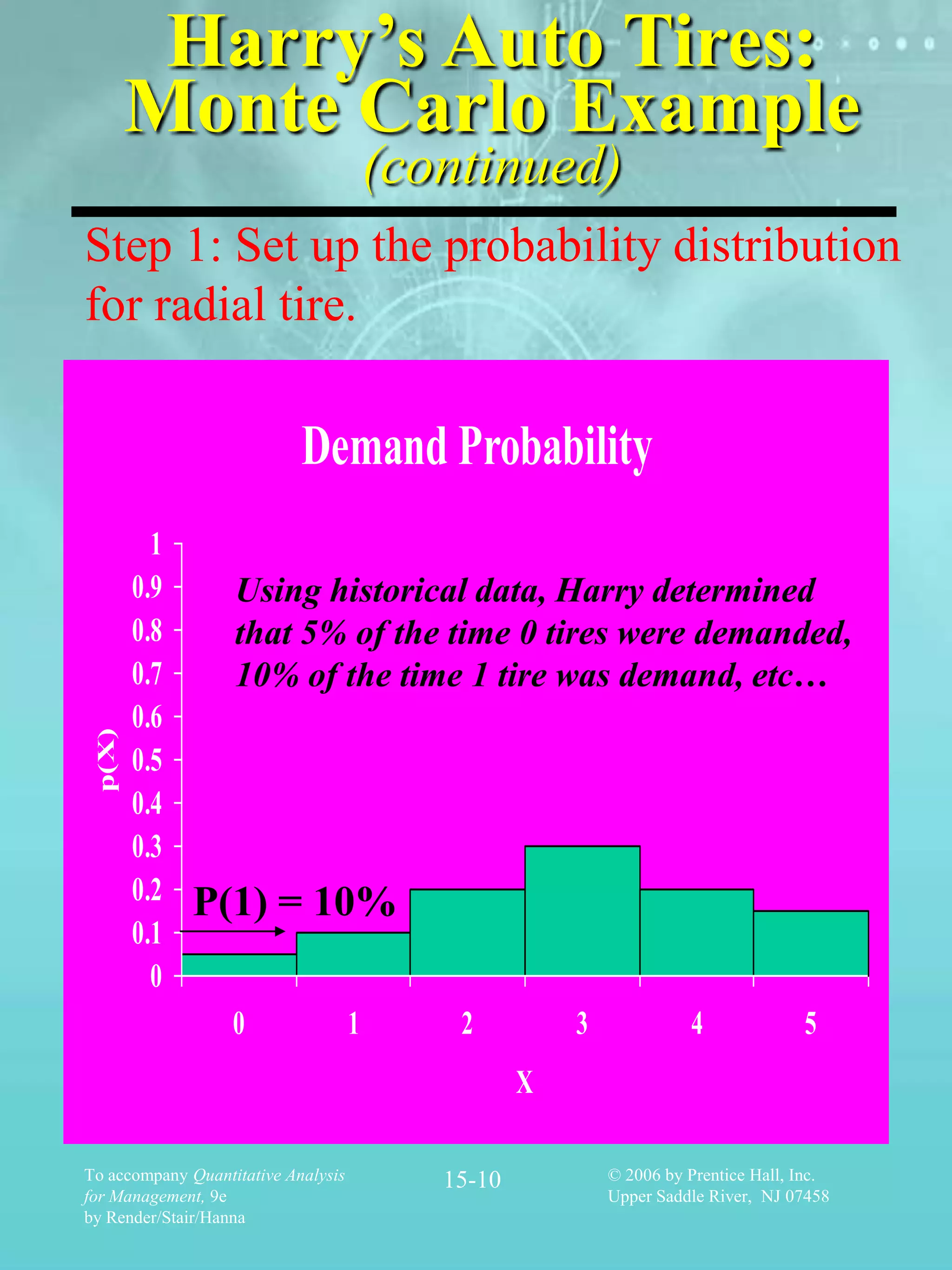

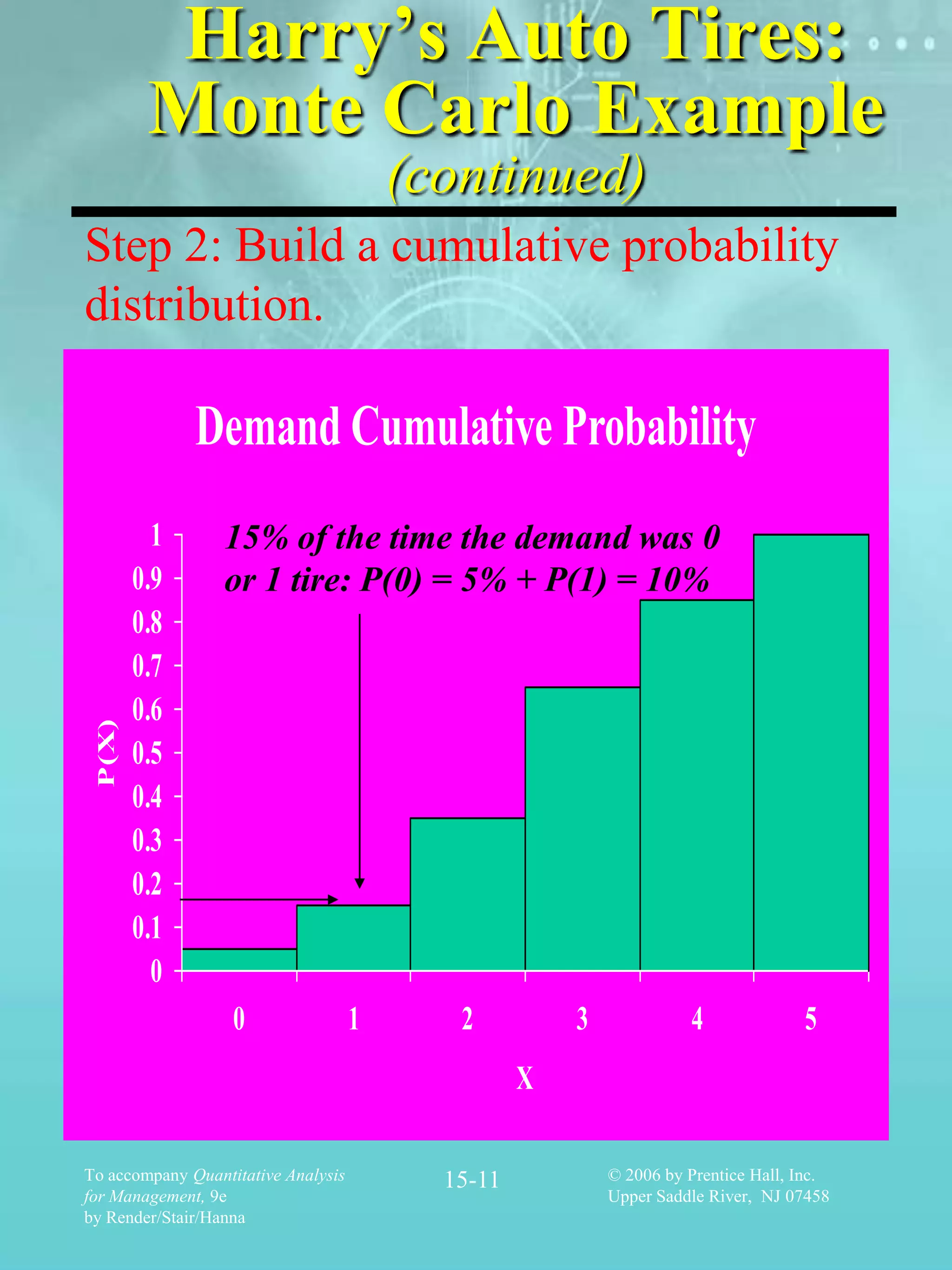

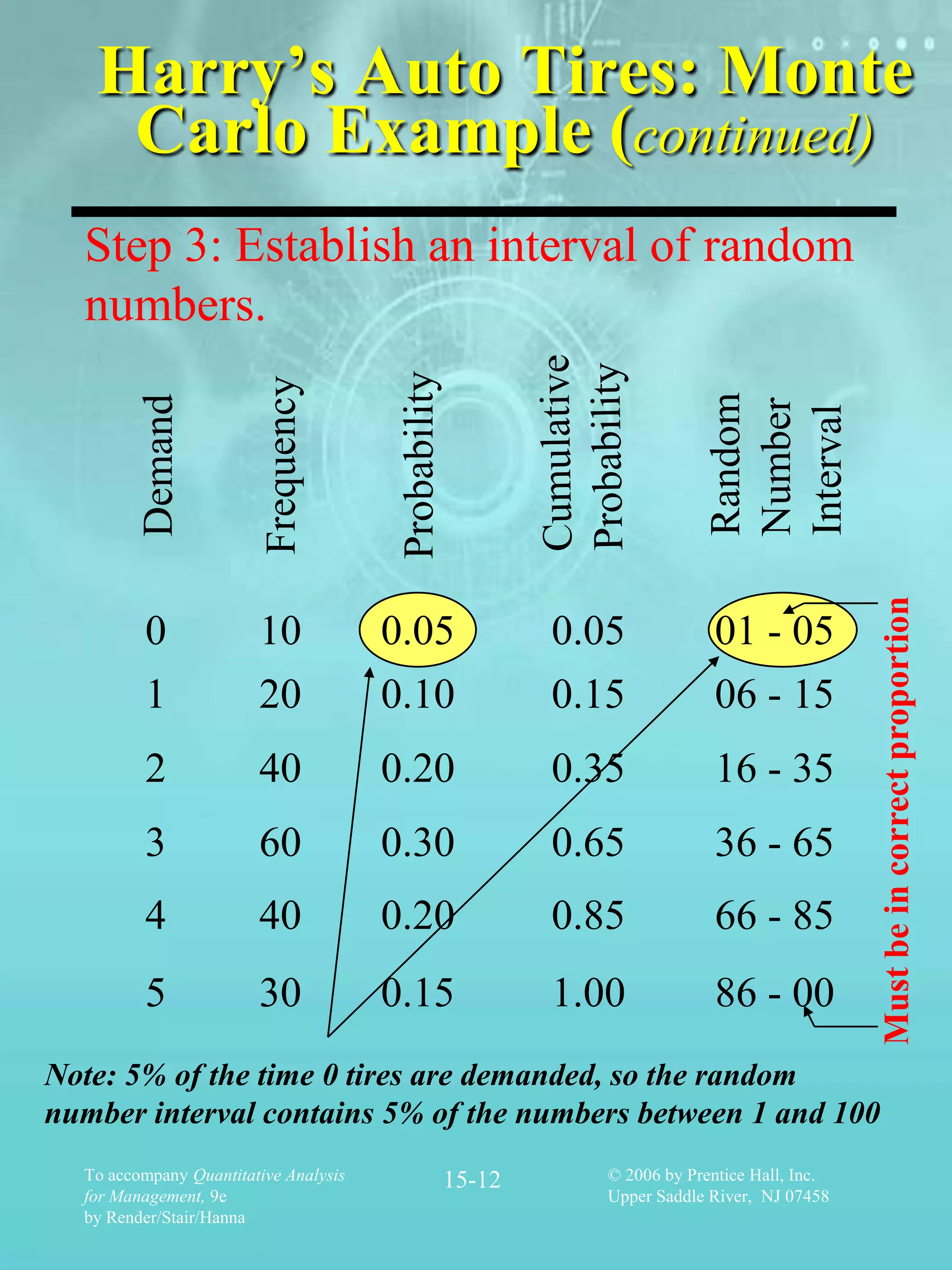

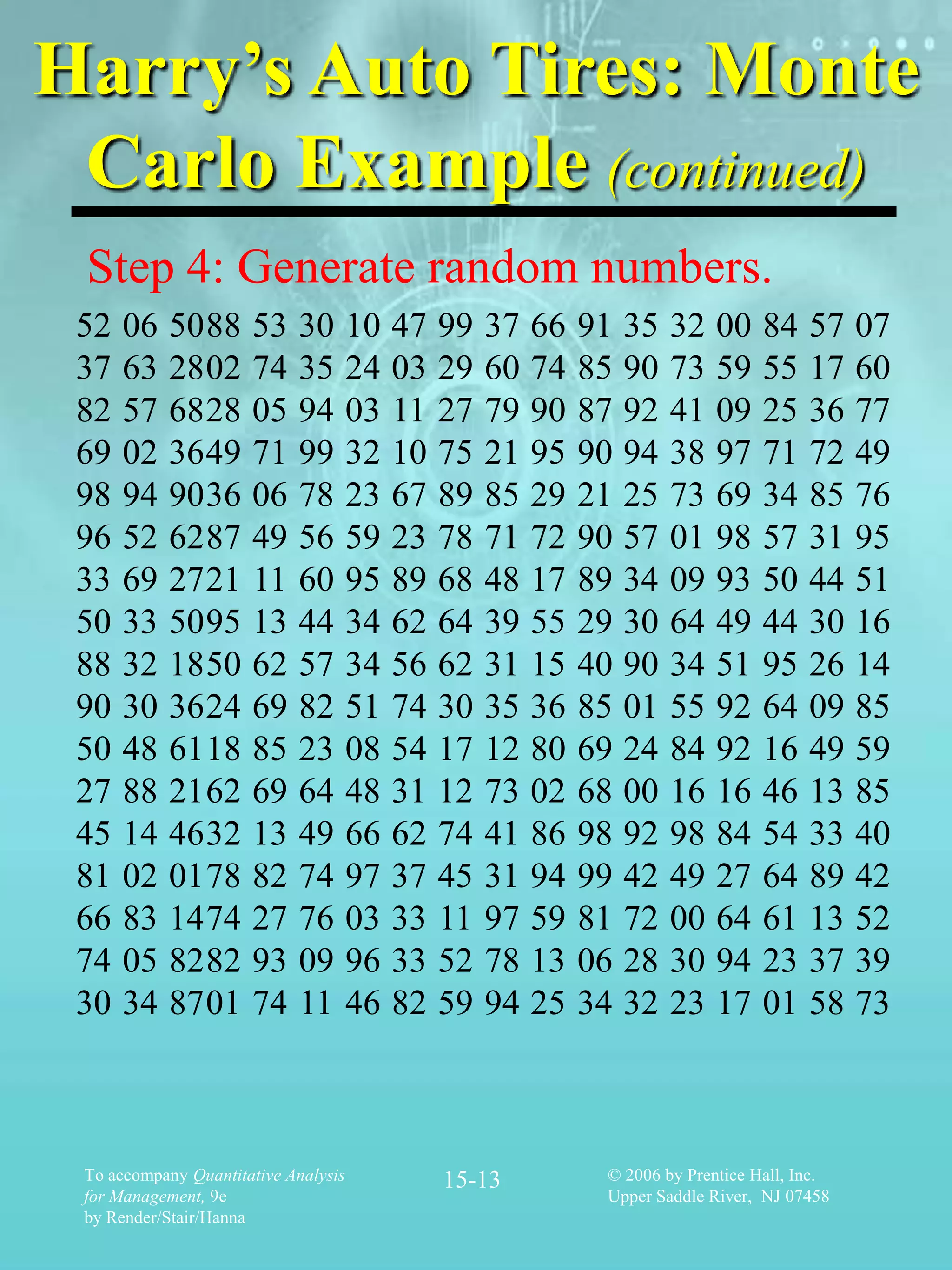

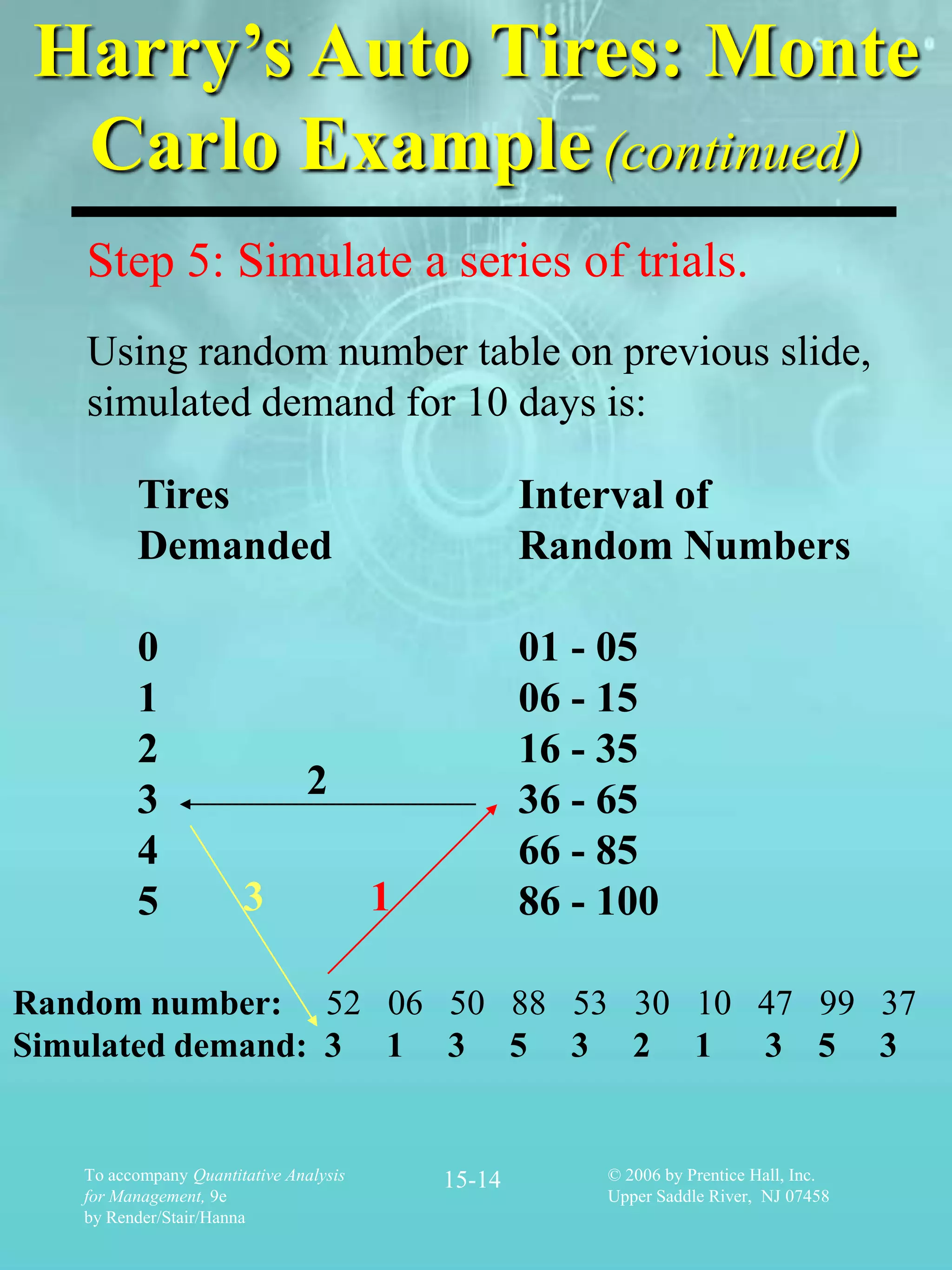

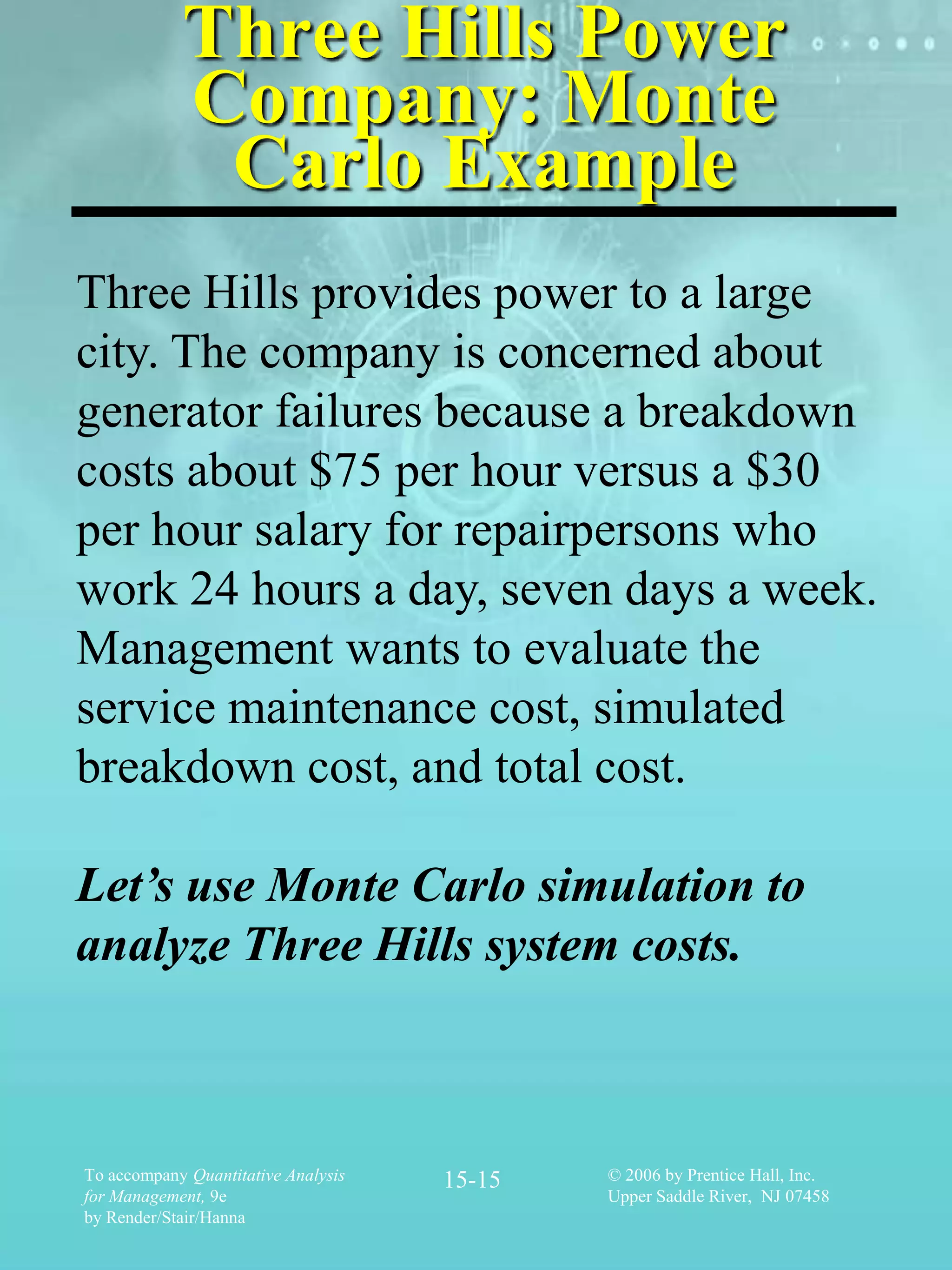

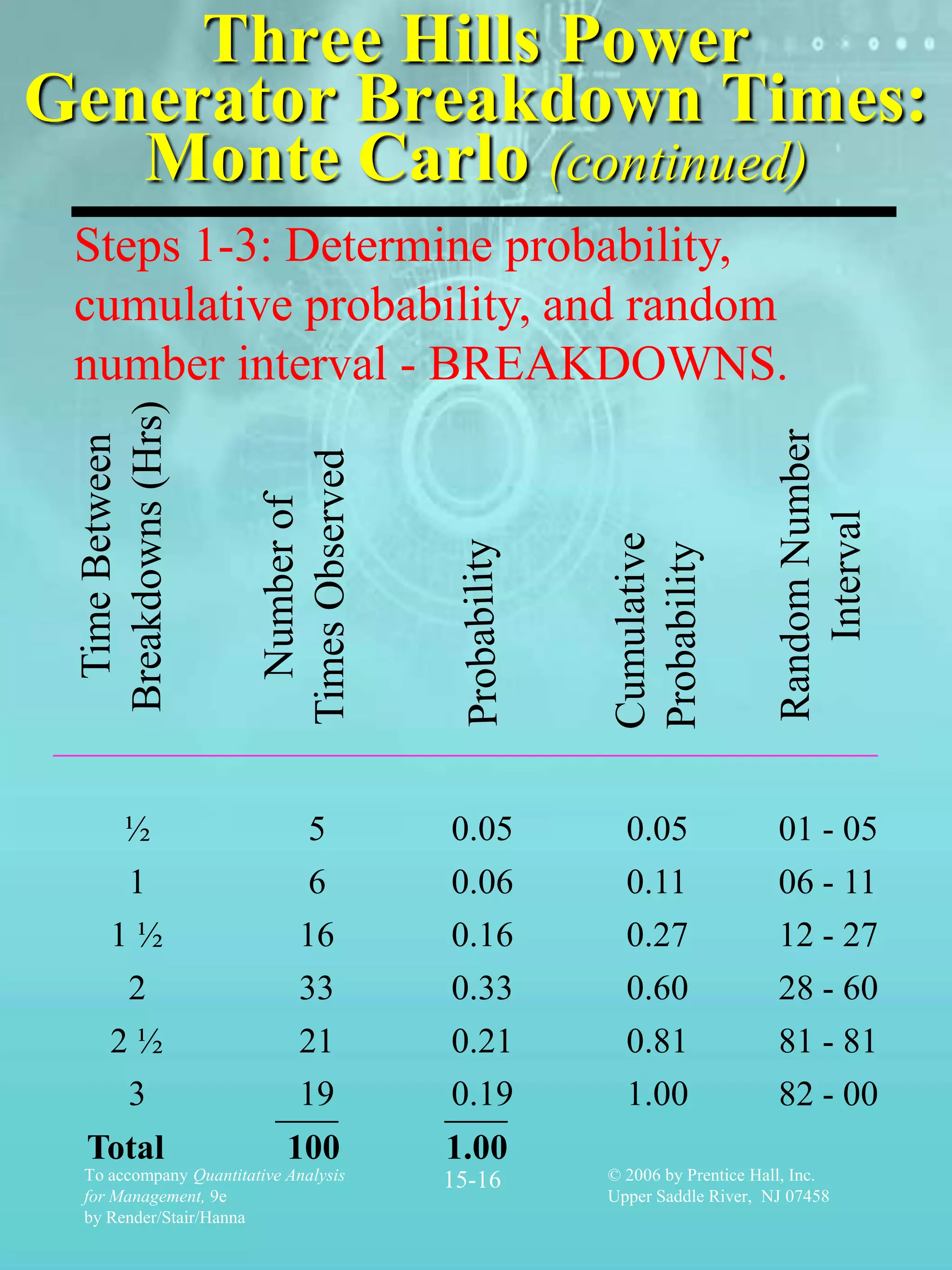

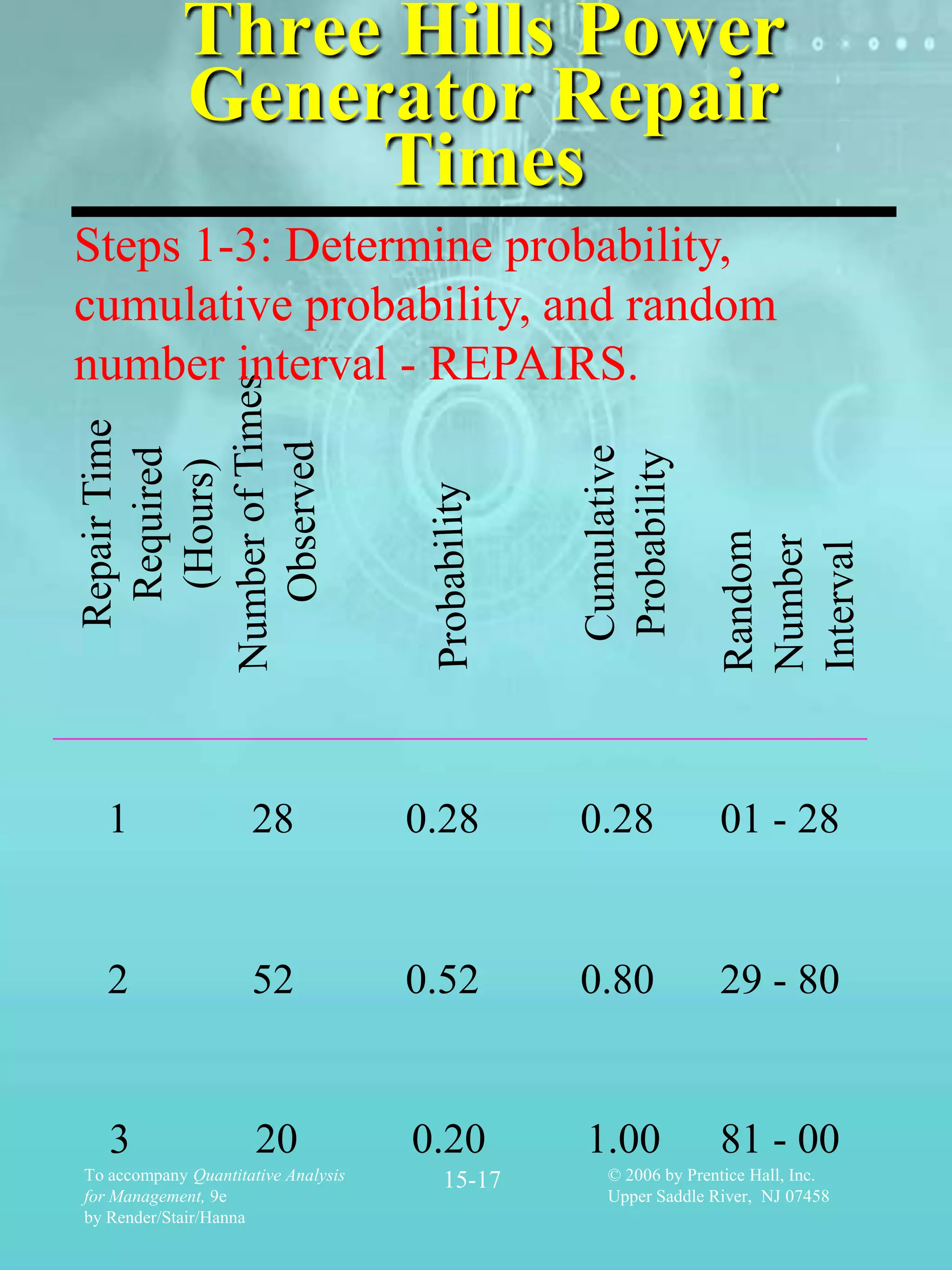

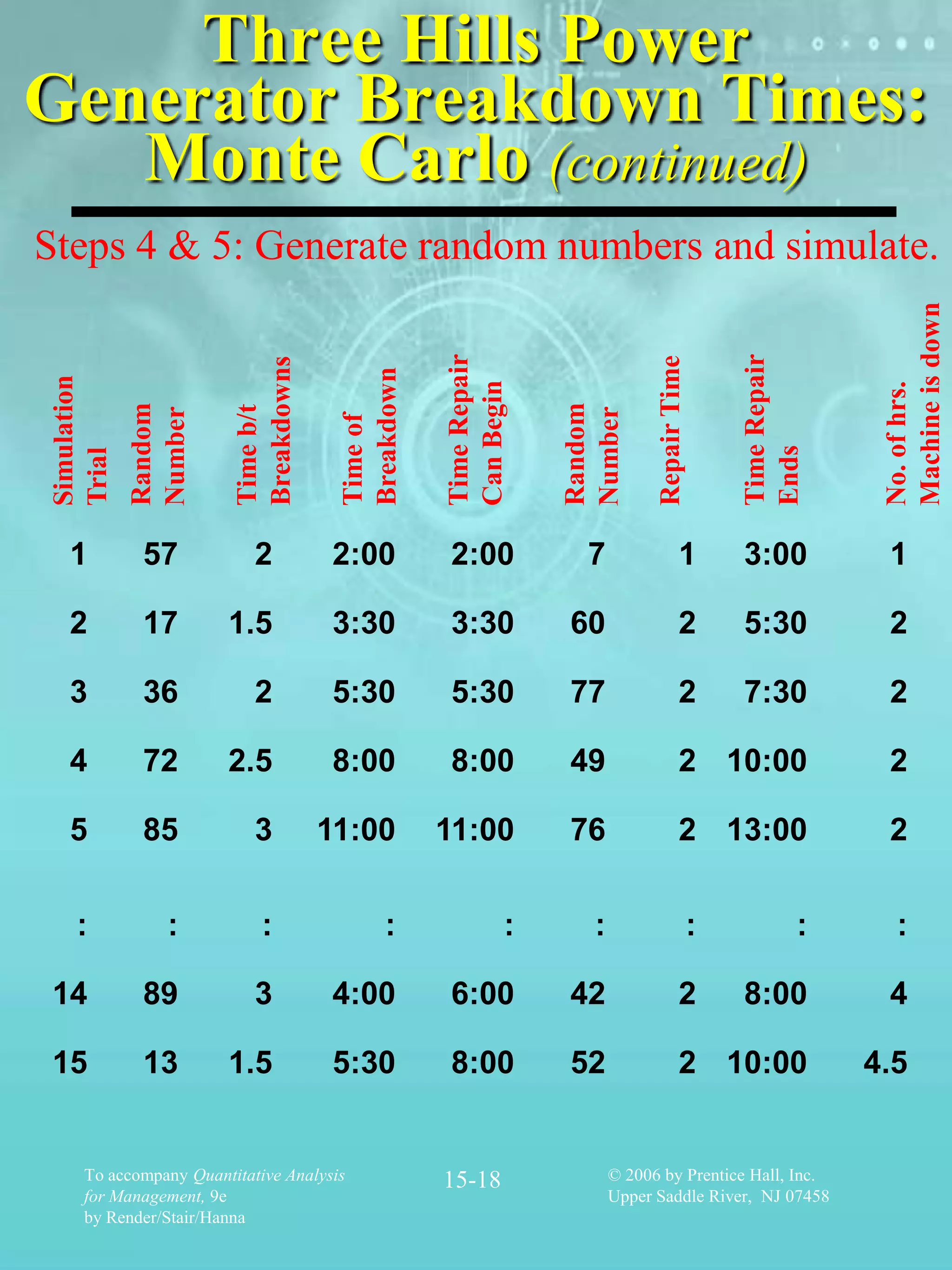

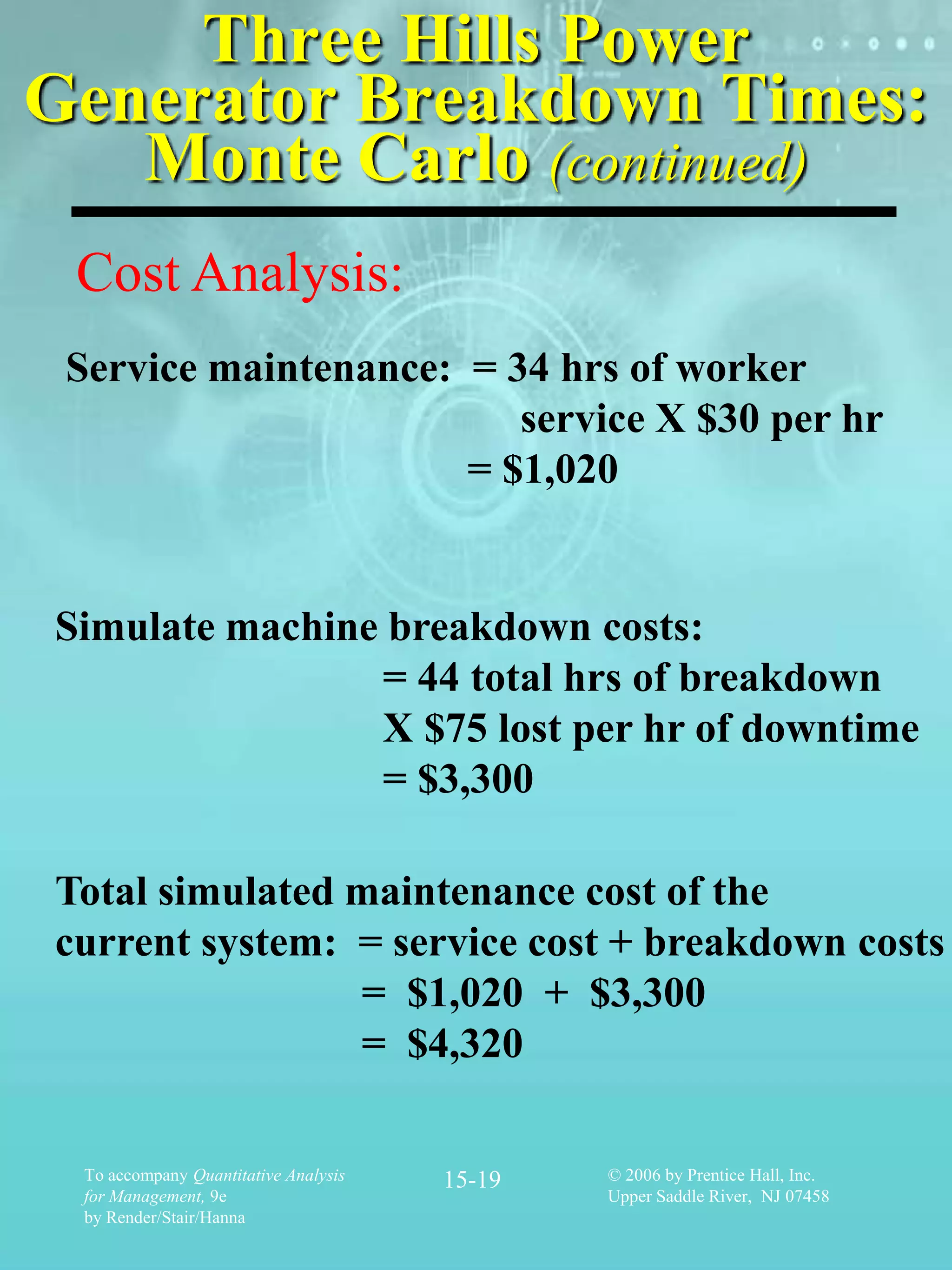

The document provides an overview of simulation modeling. It discusses that simulation is used to mathematically imitate real-world situations in order to study their properties, operating characteristics, and draw conclusions. It outlines the seven steps of simulation as defining a problem, introducing important variables, constructing a simulation model, specifying variable values, conducting the simulation, examining results, and selecting the best course of action. Monte Carlo simulation is described as using random sampling to experiment on probabilistic elements. Two examples of Monte Carlo simulation are provided to analyze inventory management and power generator maintenance costs.