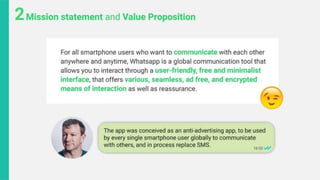

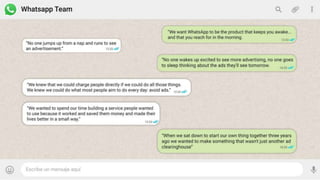

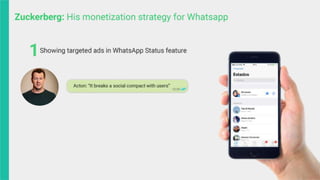

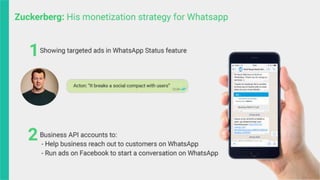

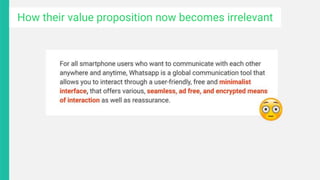

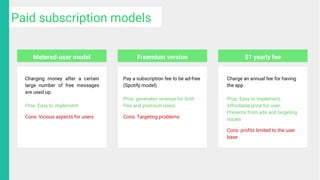

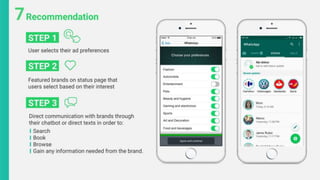

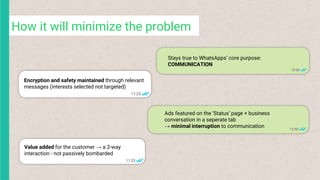

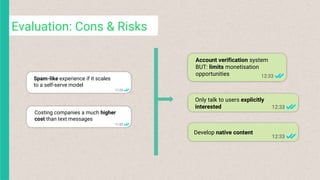

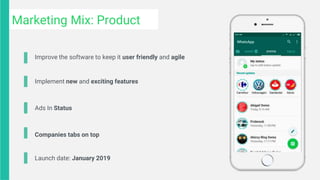

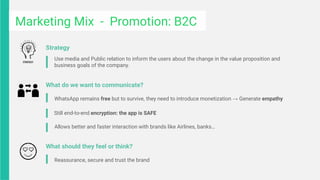

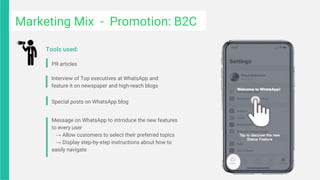

The document analyzes WhatsApp's monetization strategies amidst challenges of user privacy and brand integrity, highlighting recent shifts towards advertising and in-app payments. It presents various revenue models, potential risks to user experience, and the impact on WhatsApp’s core messaging functionality. Recommendations include creating a separate business messaging tab and implementing ads on the status feature to ensure minimal disruption to user interaction while maintaining encryption and safety.