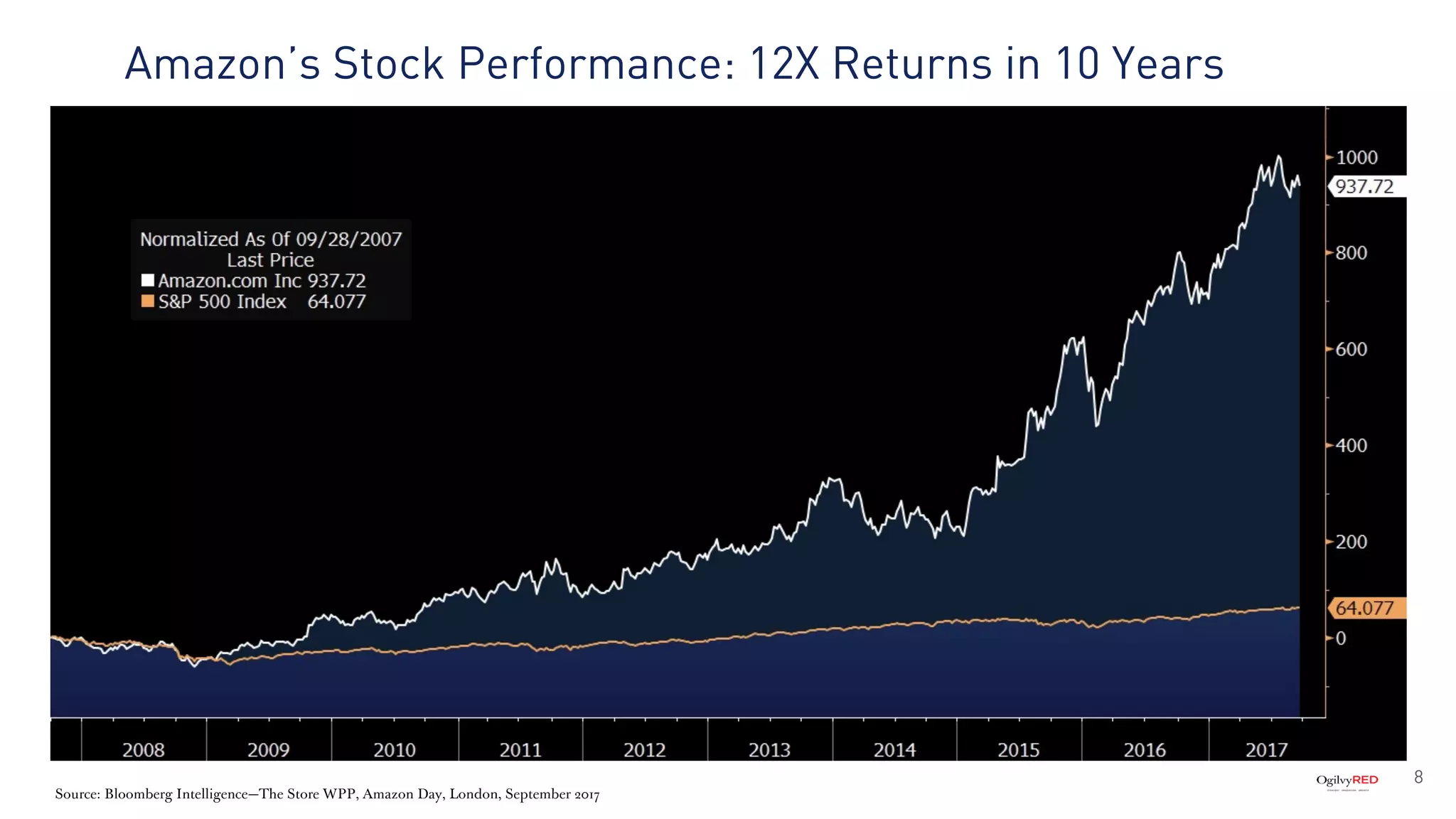

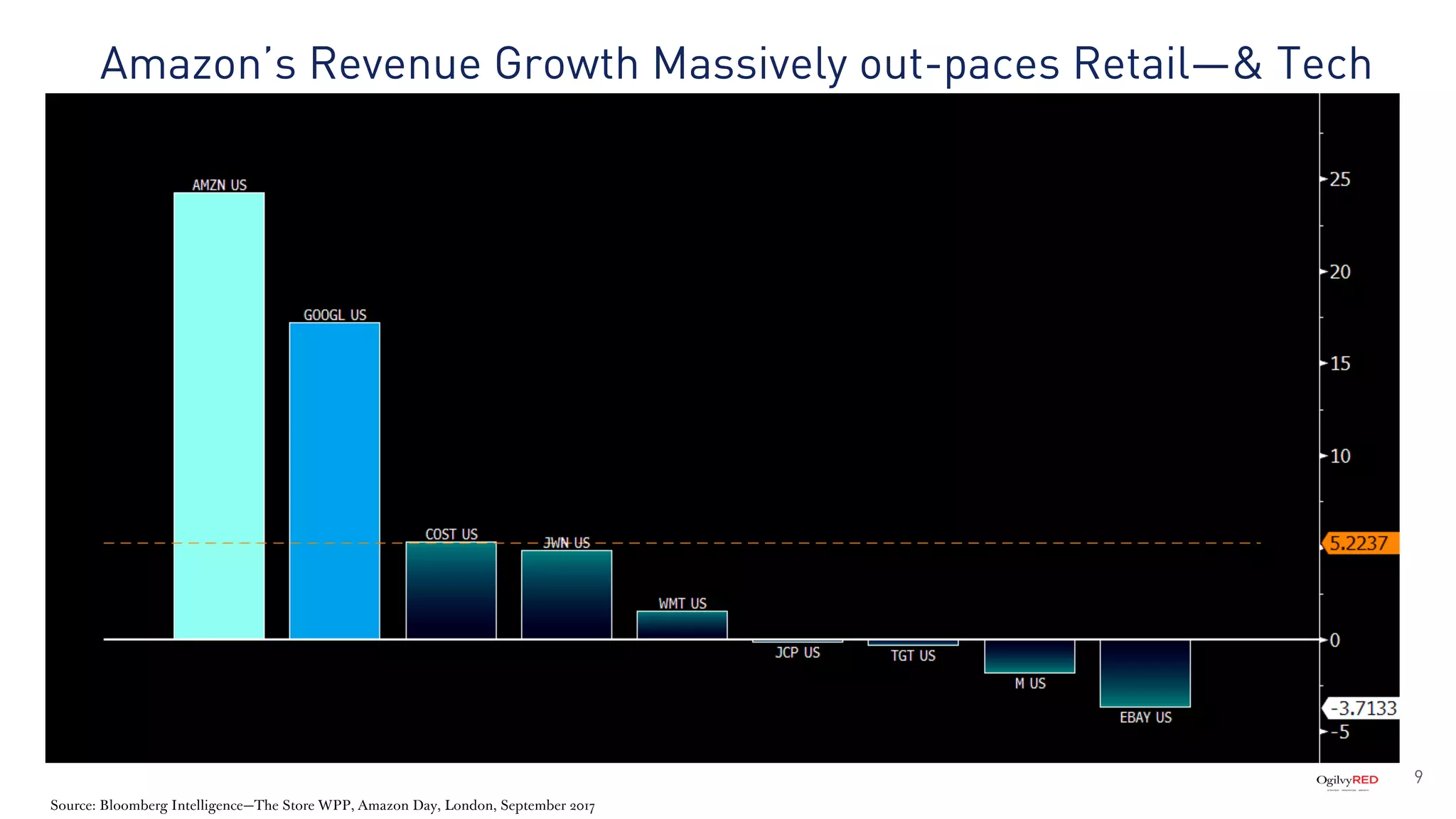

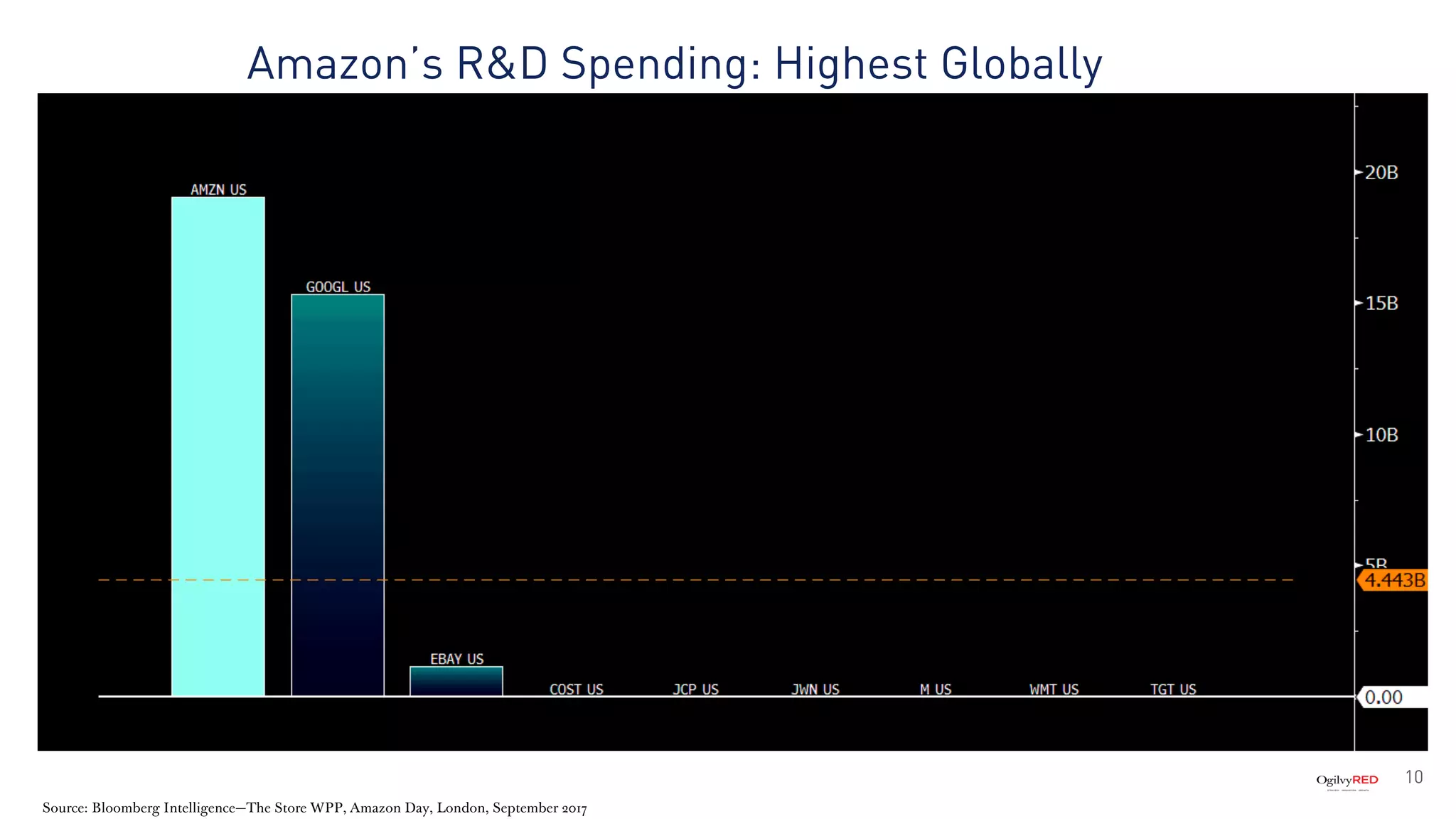

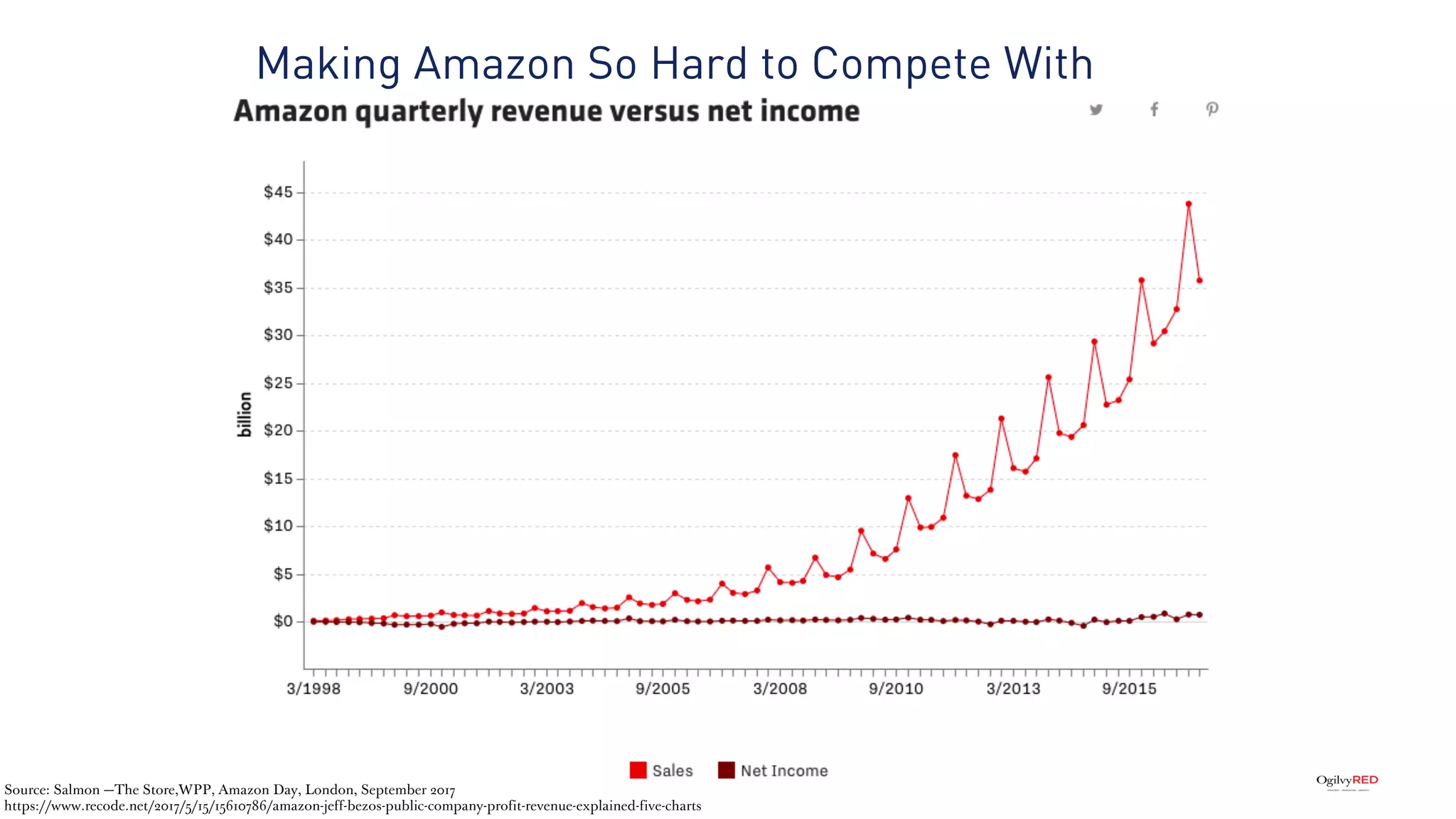

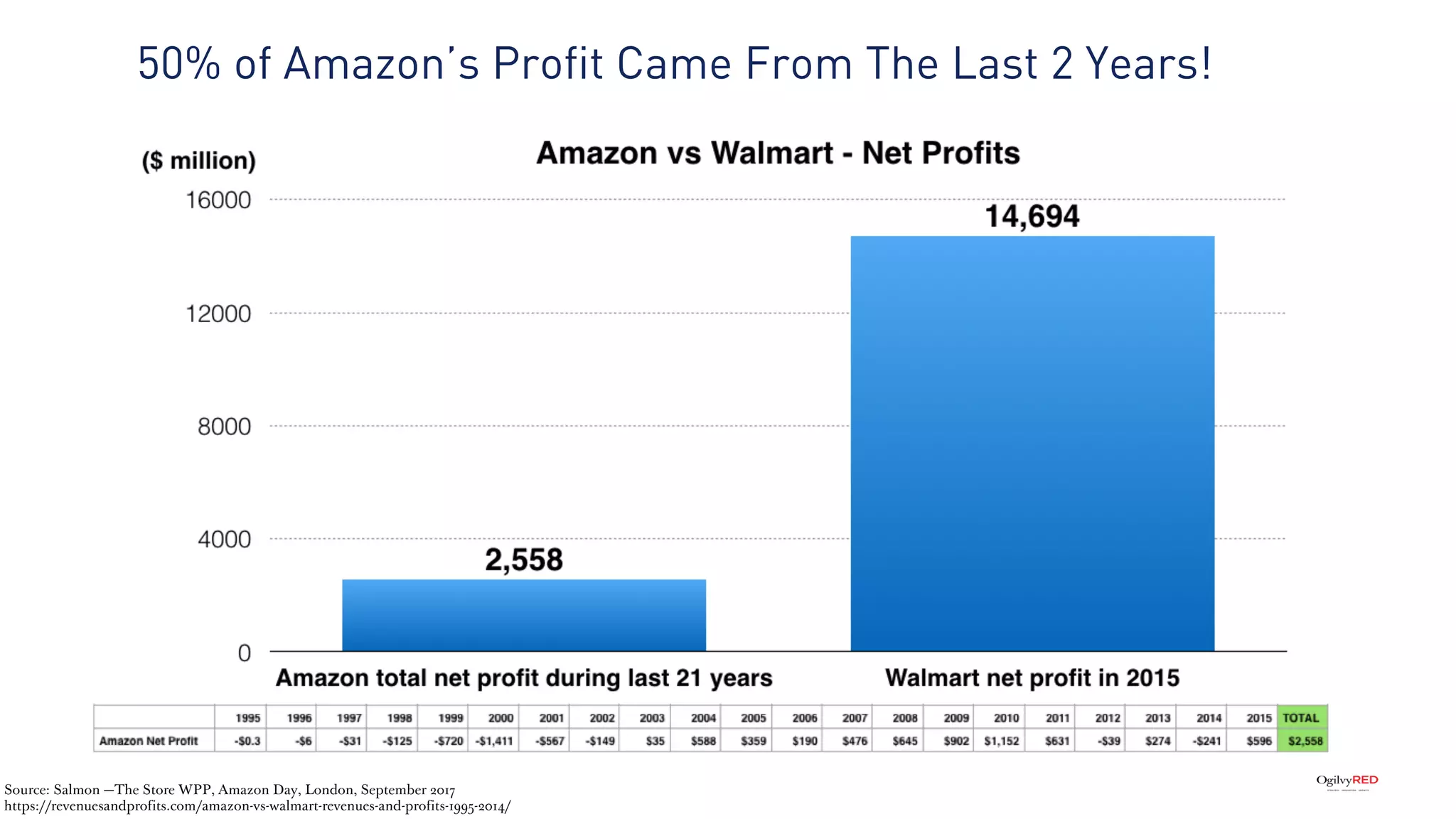

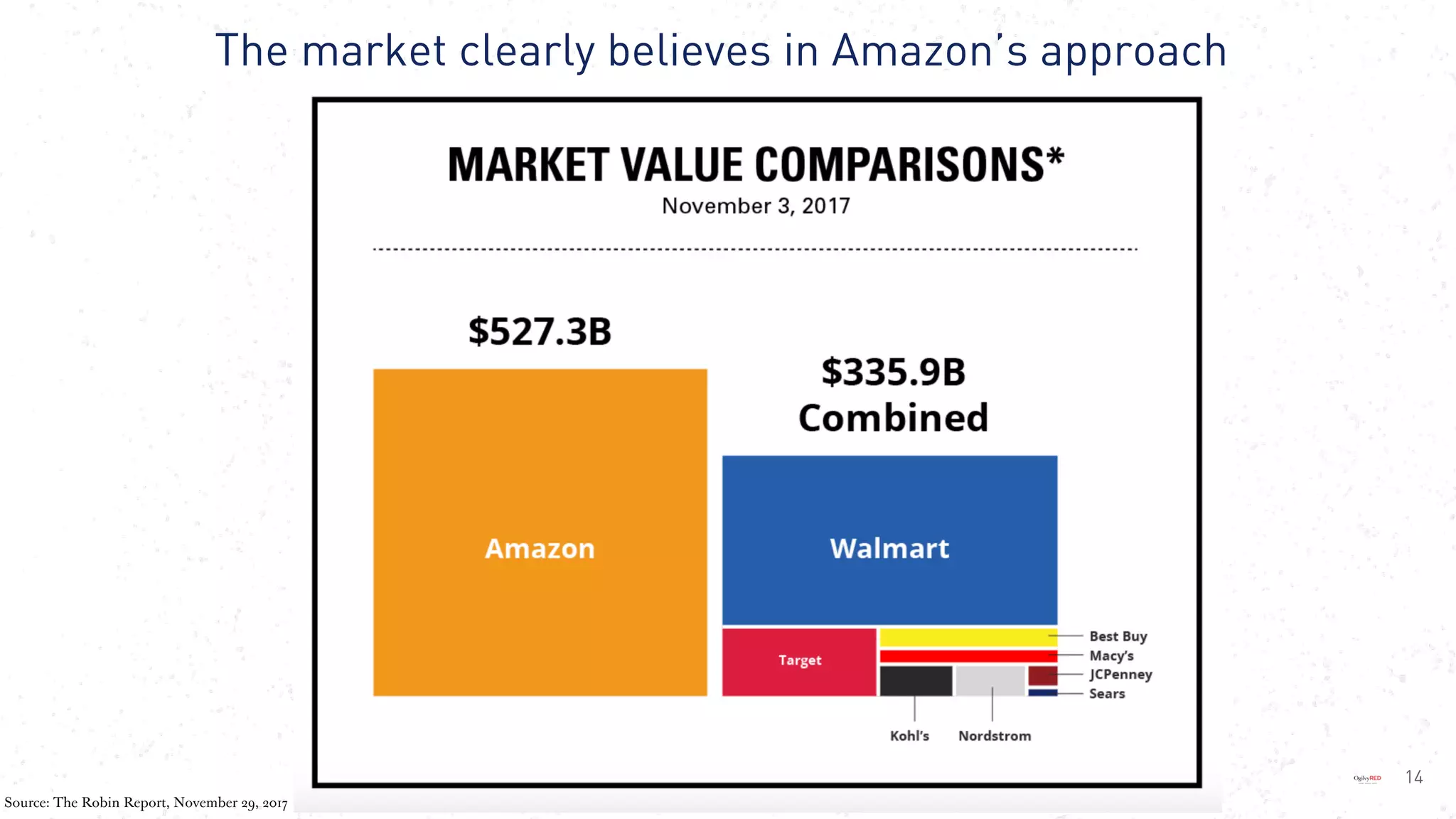

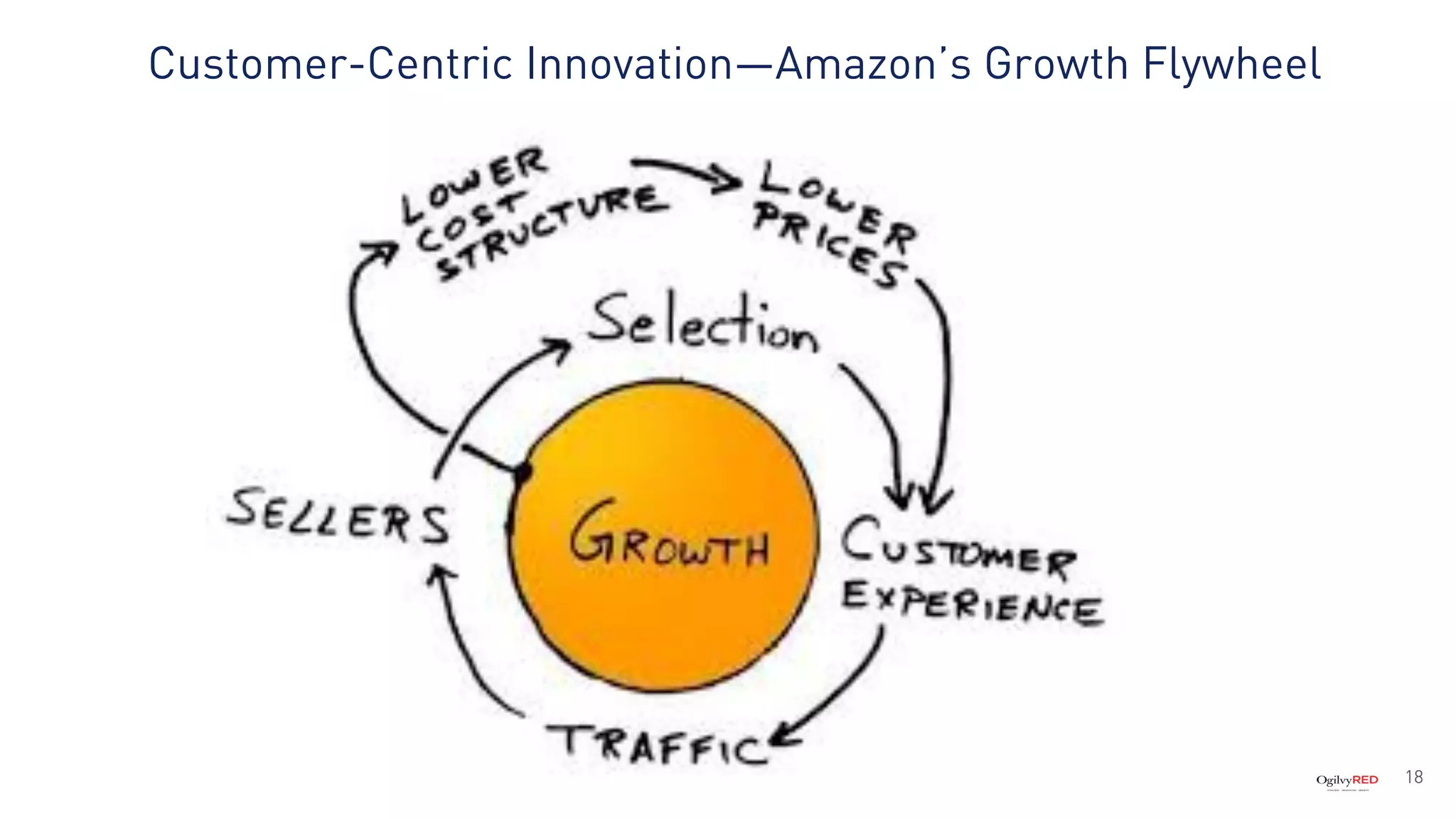

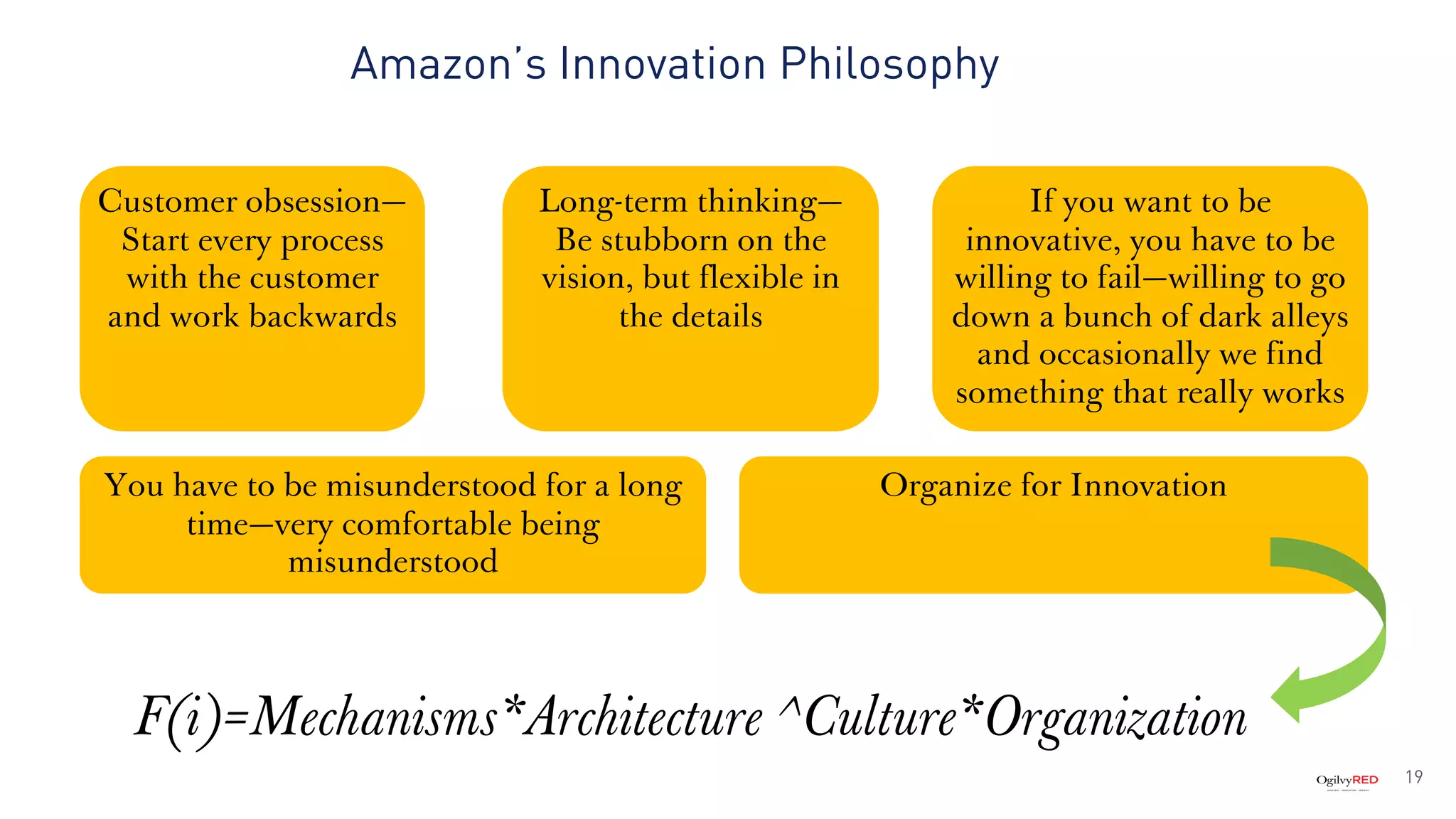

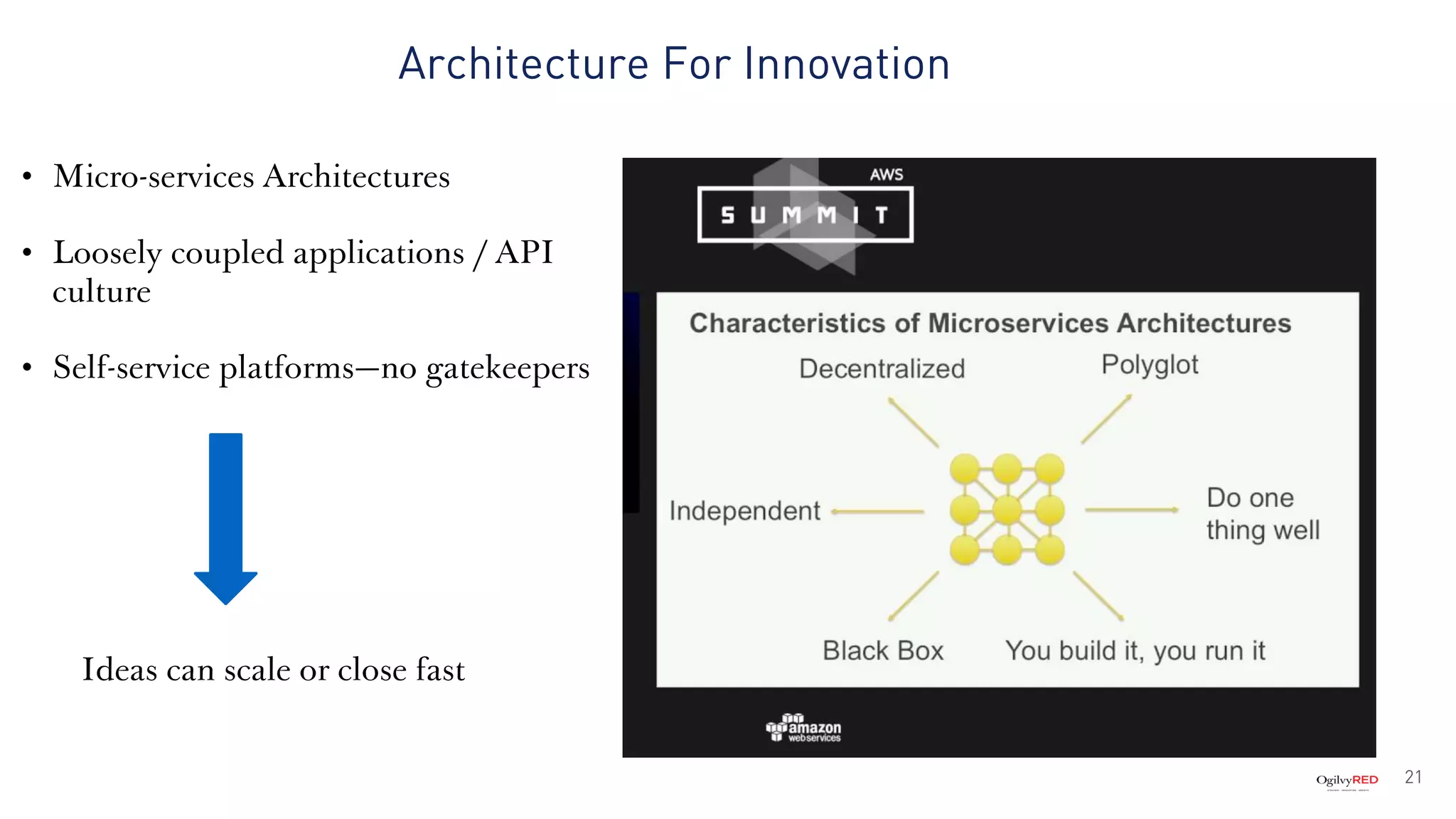

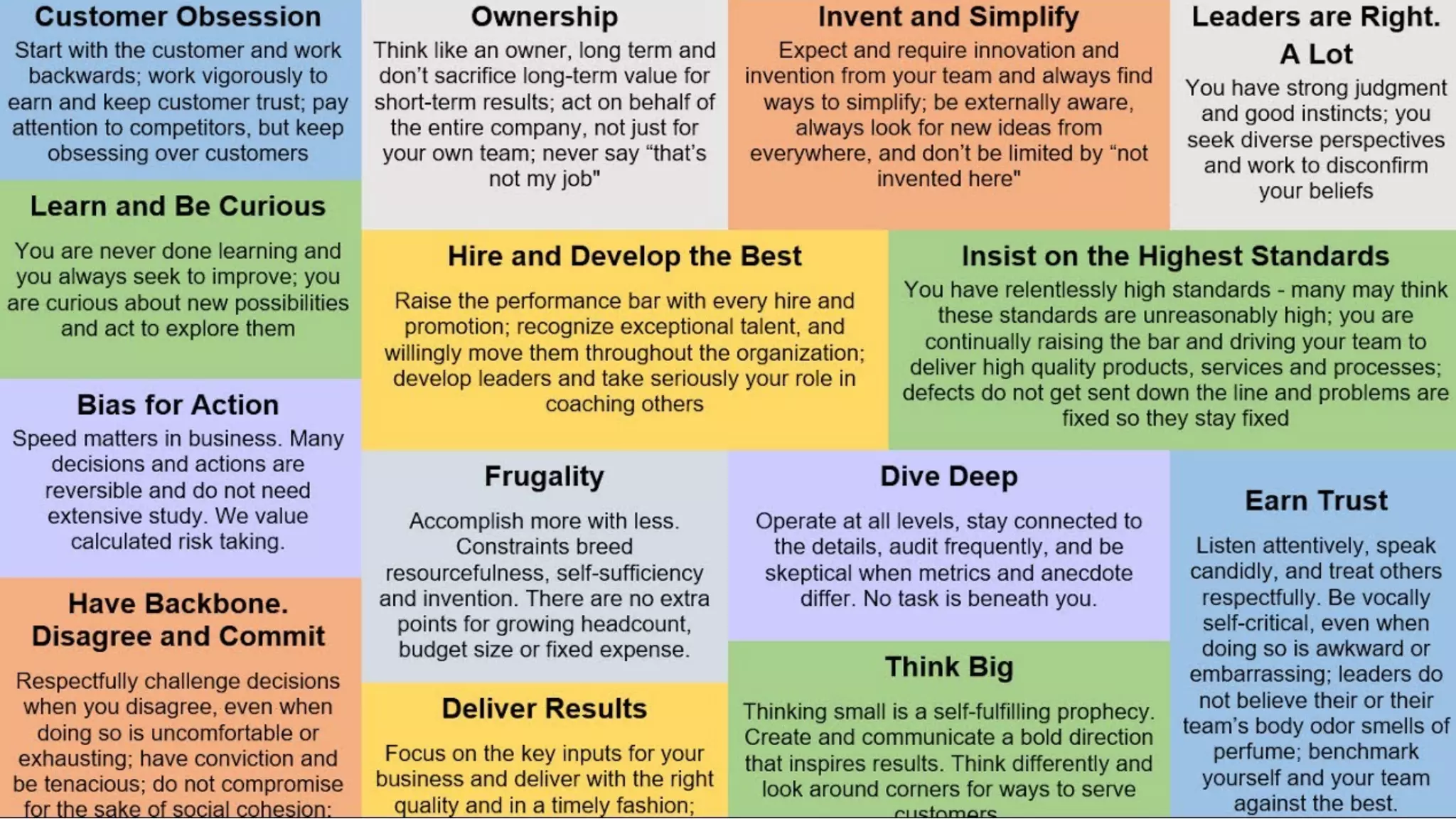

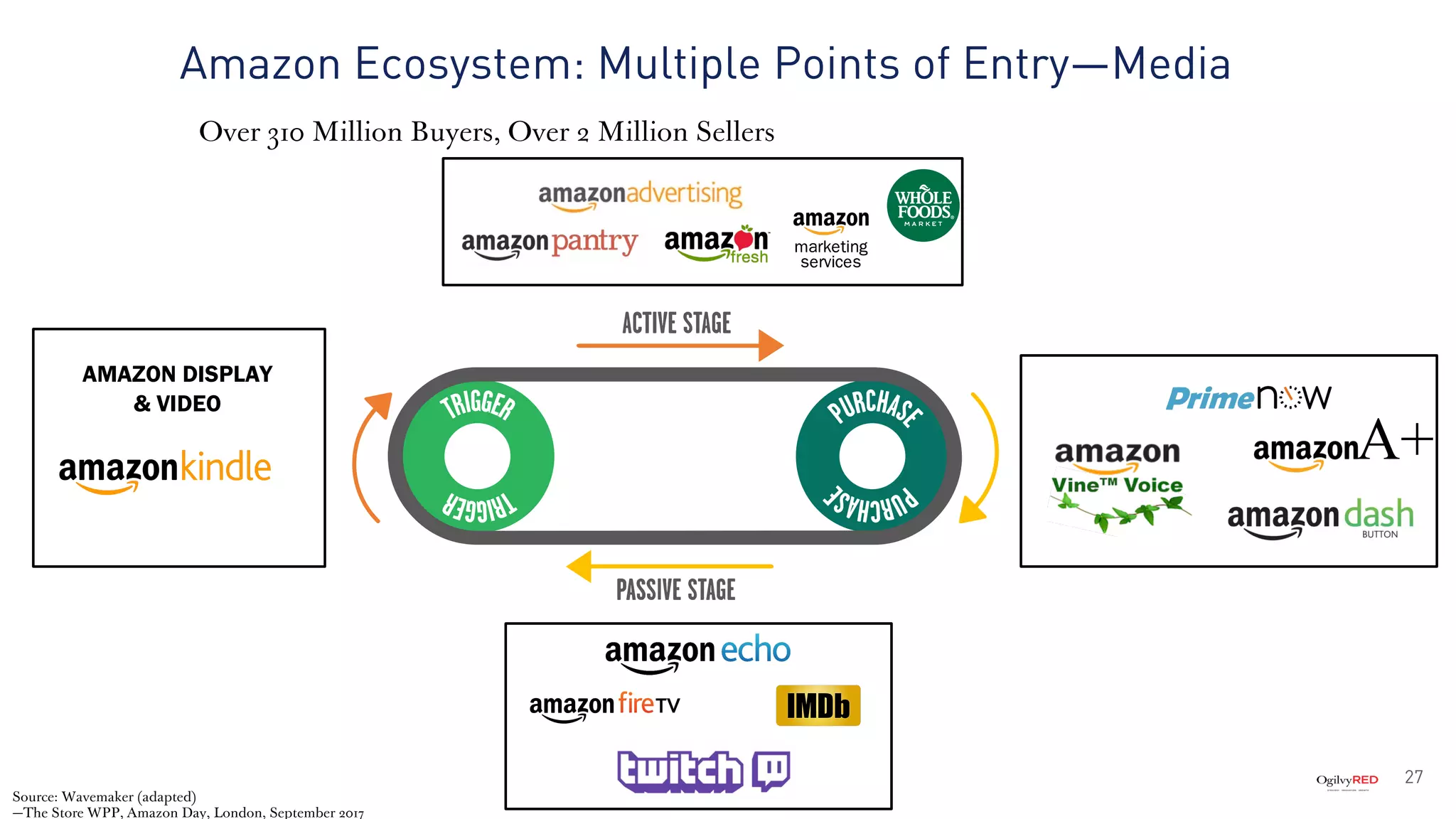

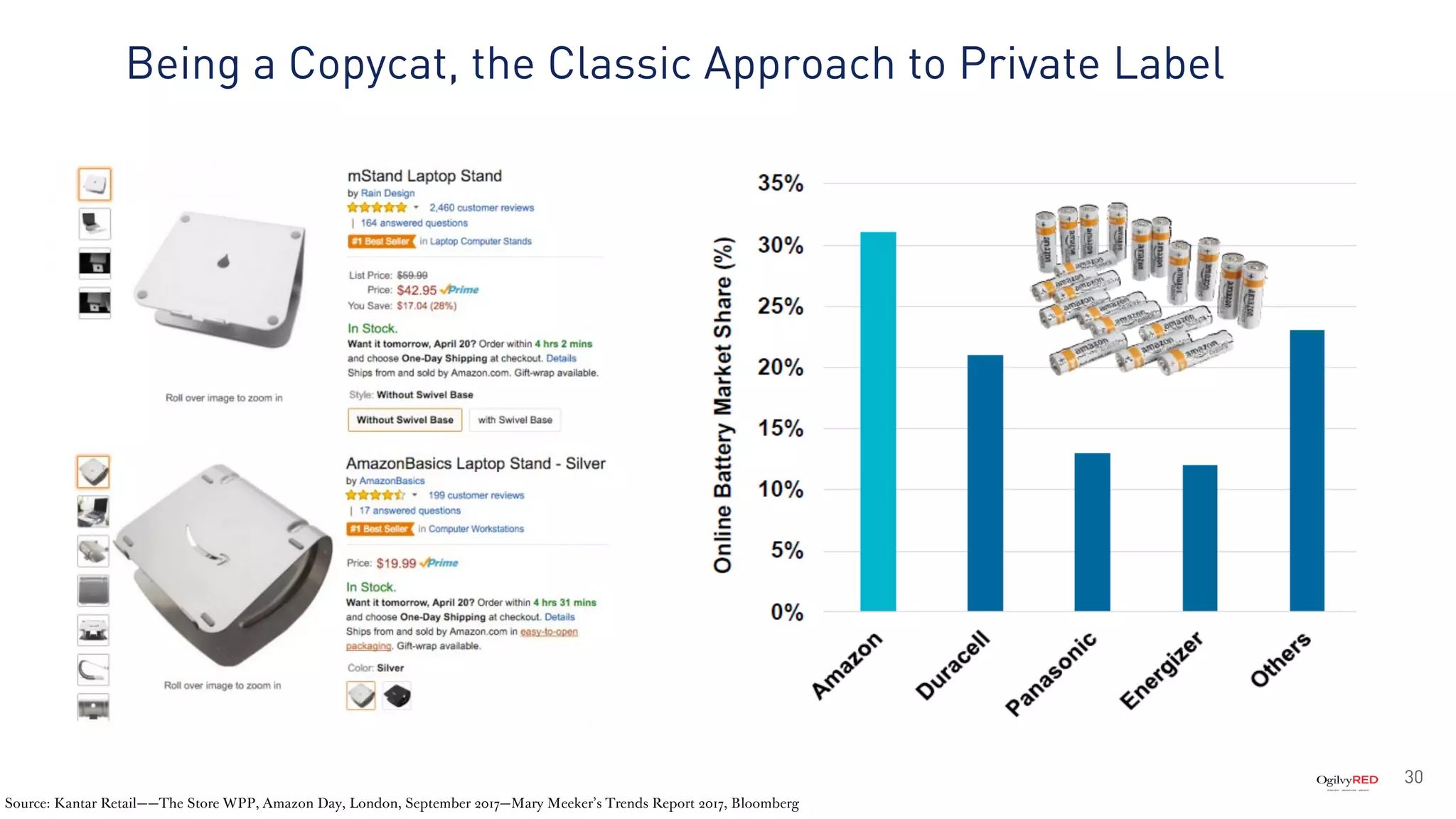

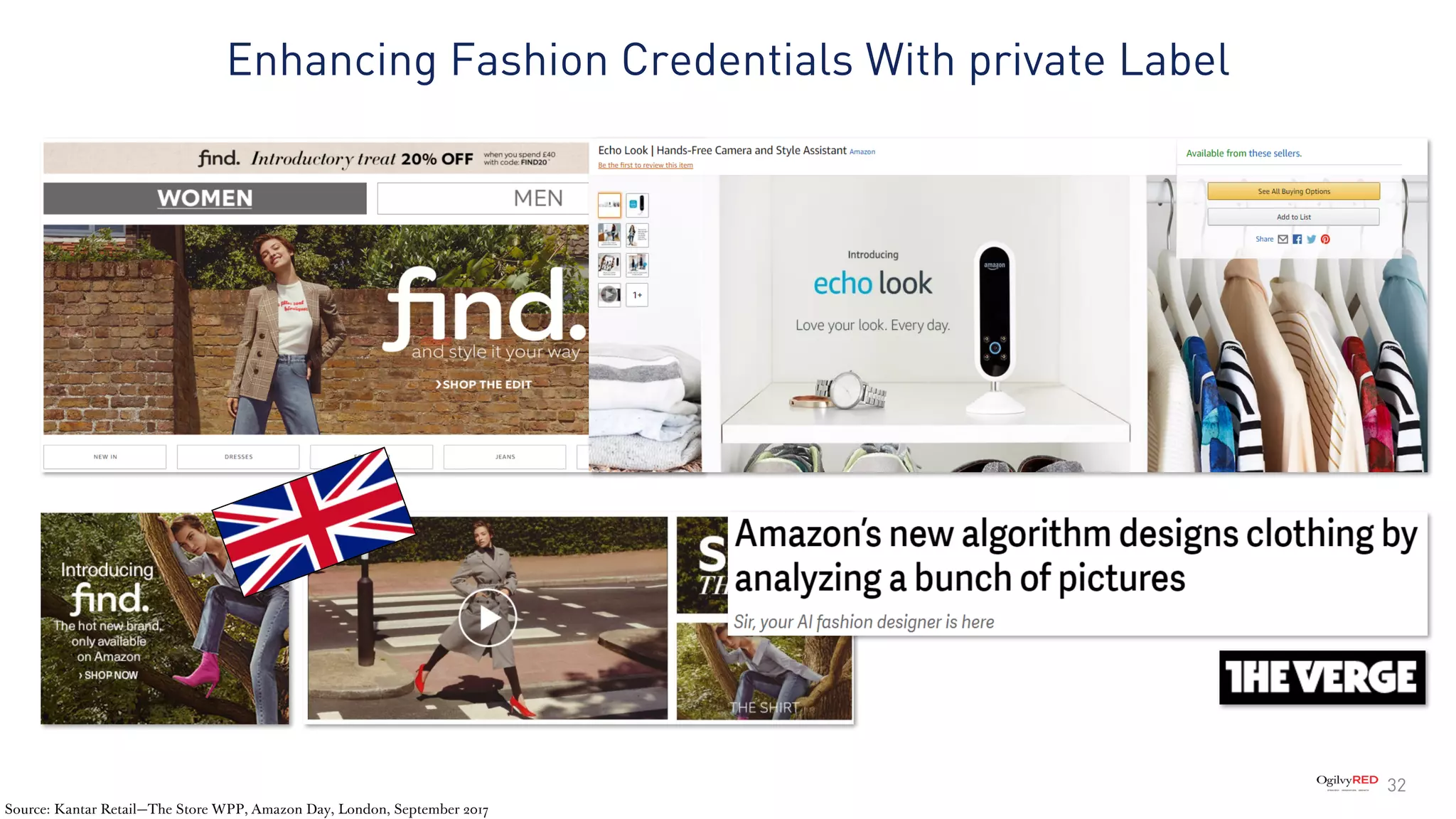

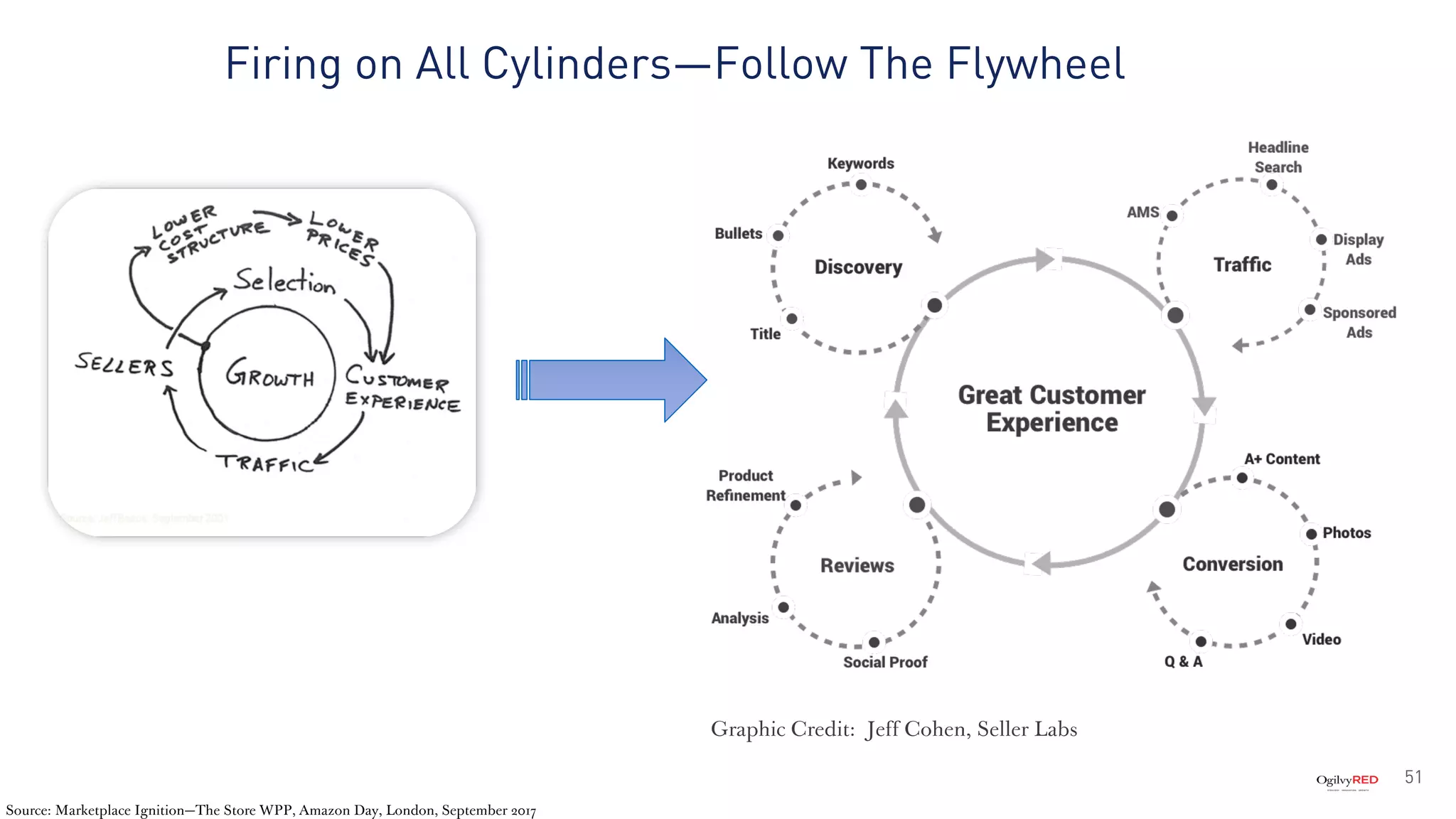

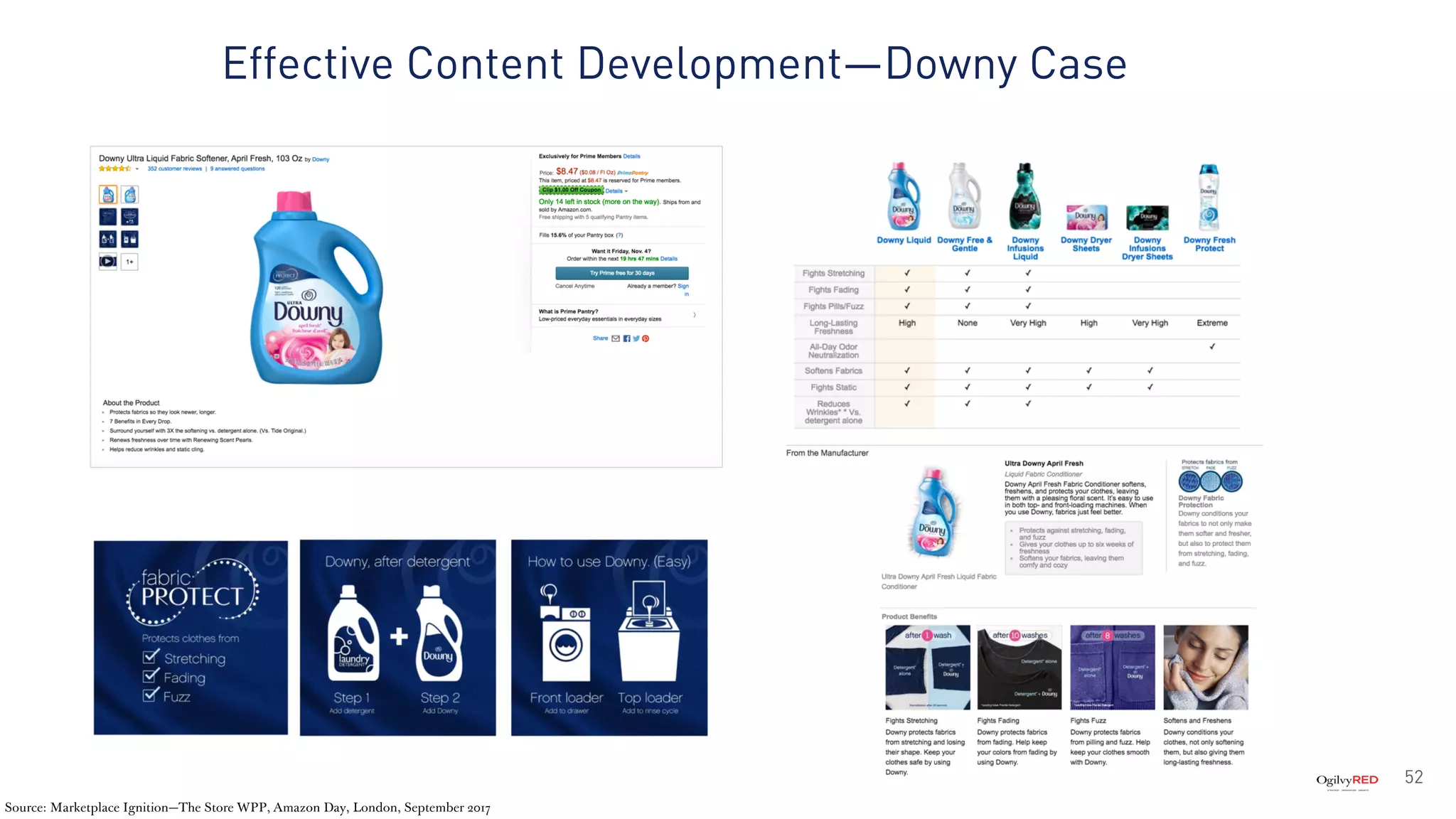

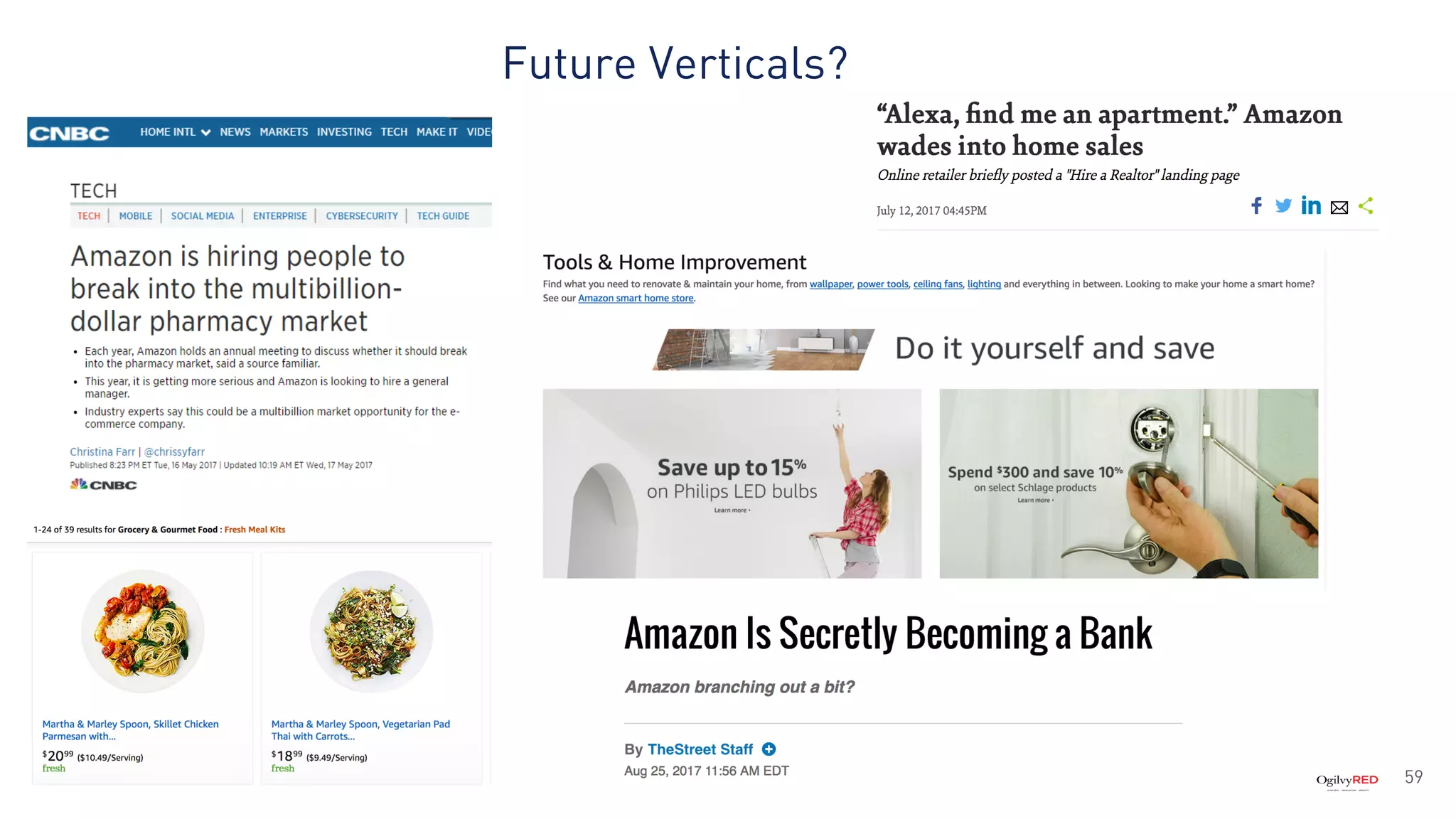

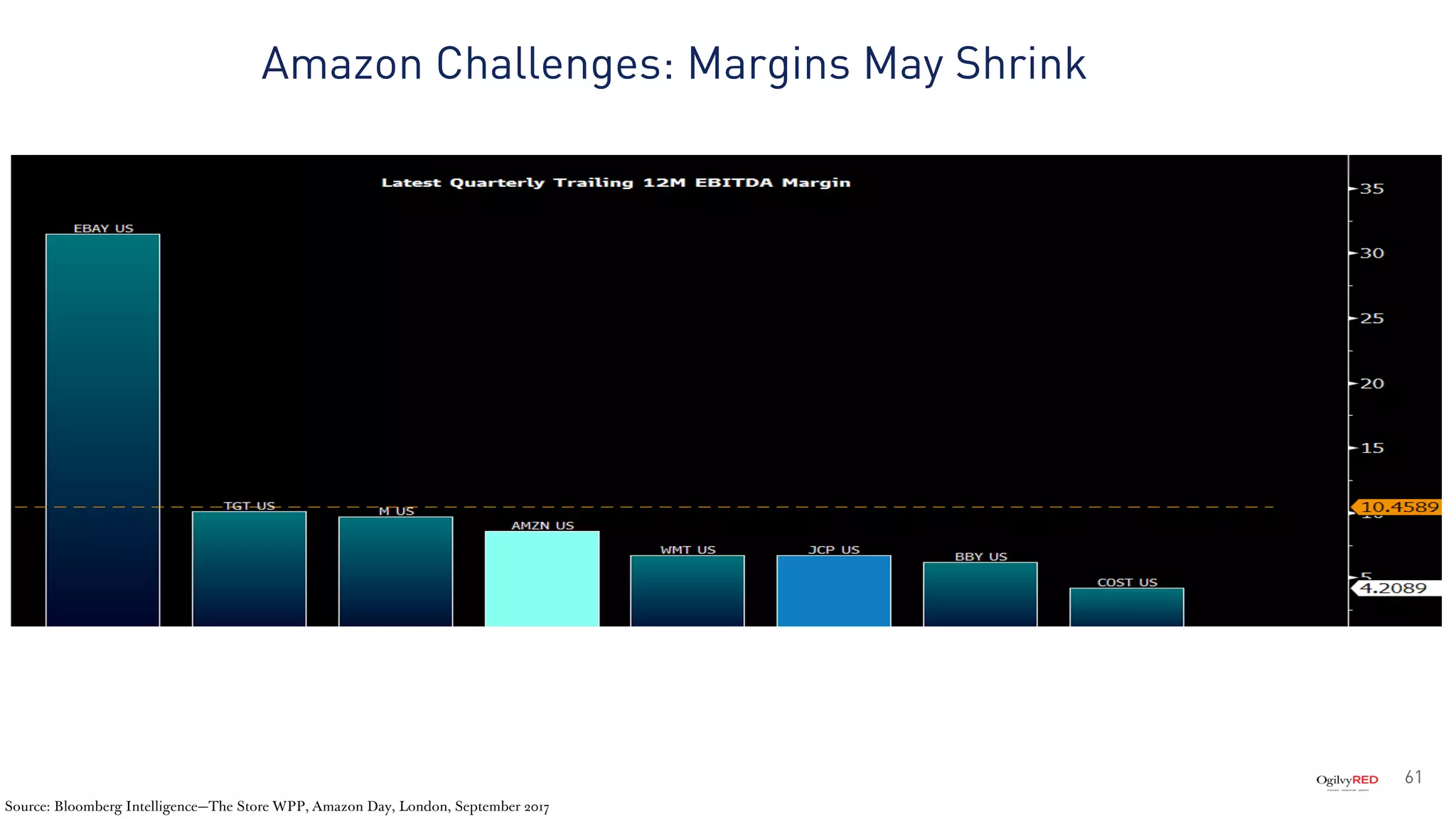

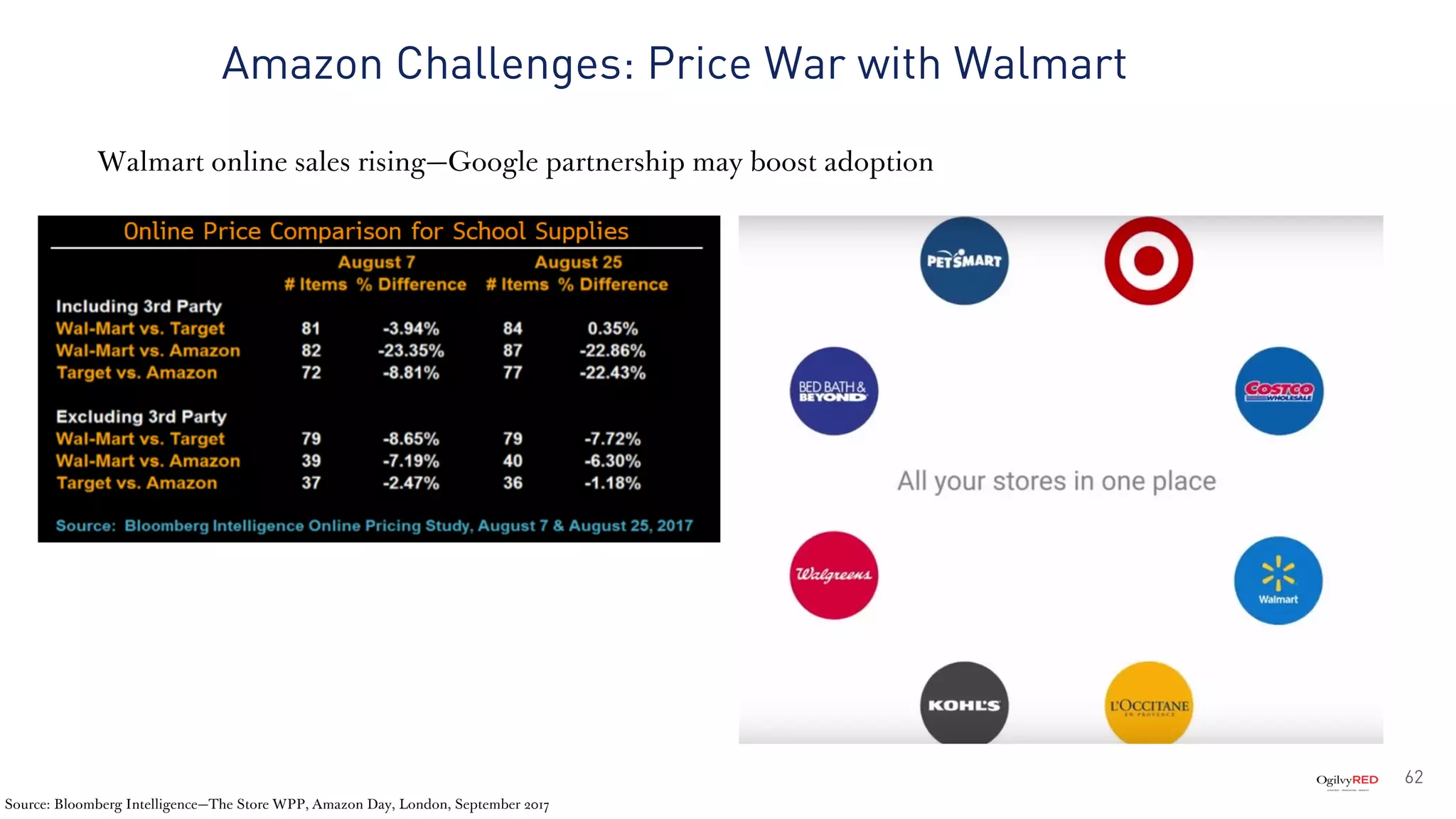

The document presents an in-depth analysis of Amazon's customer-centric culture, innovation strategies, and ecosystem during a webinar on December 7, 2017. It covers Amazon’s significant scale, robust revenue growth, and strong emphasis on customer obsession as key drivers of innovation, alongside its future outlook and how agencies can collaborate with Amazon. Key insights include the importance of third-party sellers, Amazon Prime's growth potential, and the strategies to succeed within Amazon's marketplace.