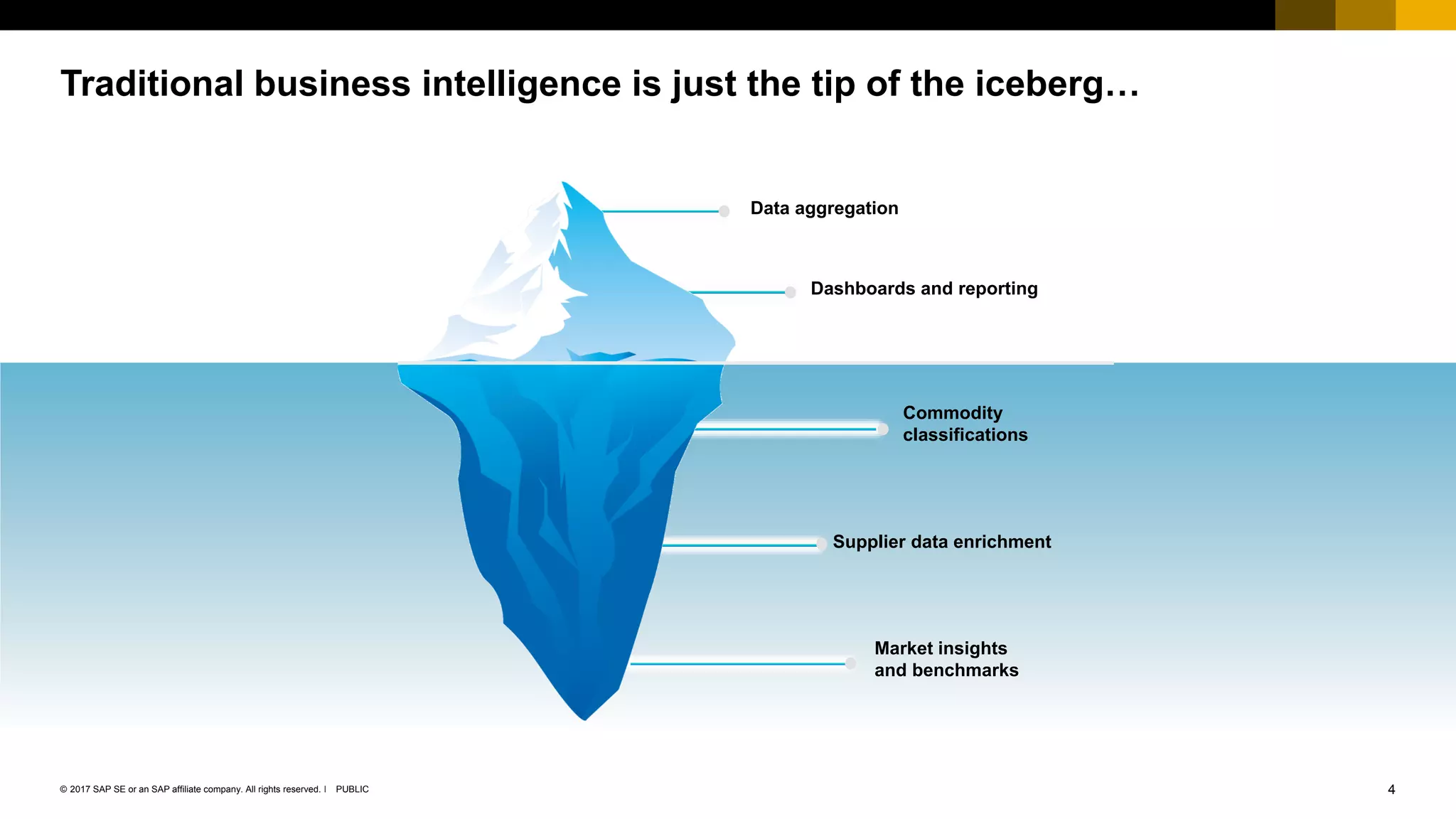

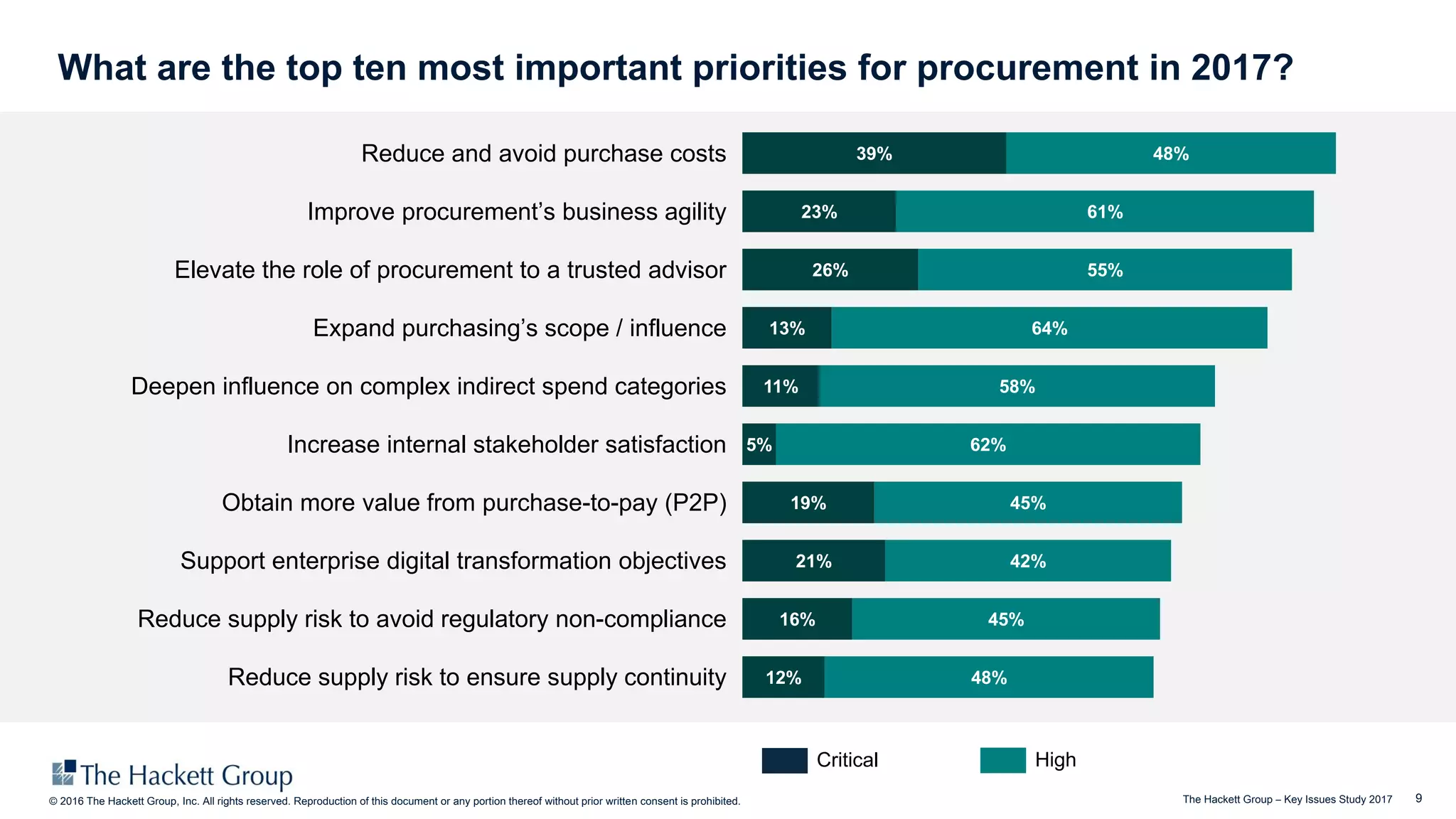

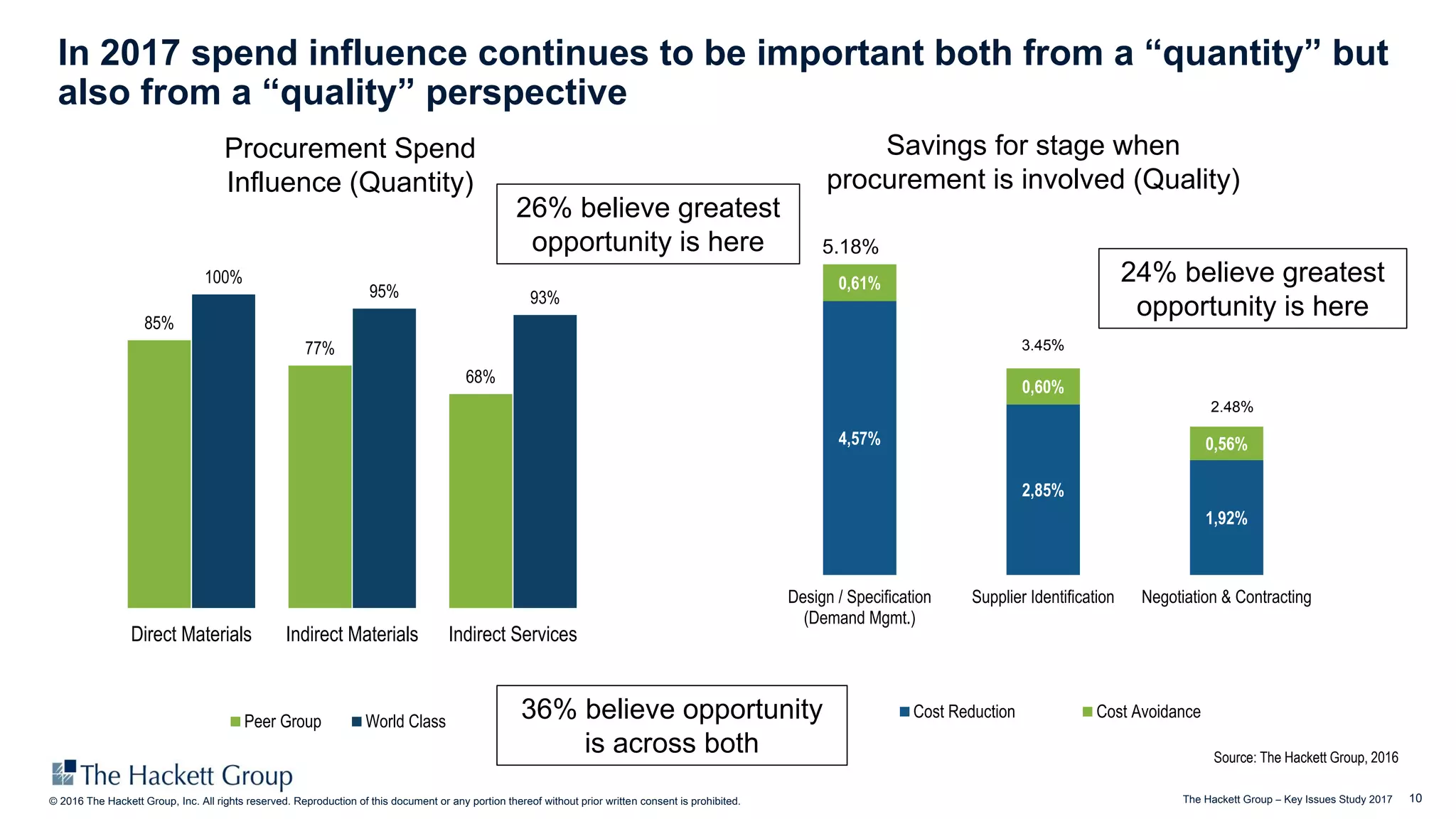

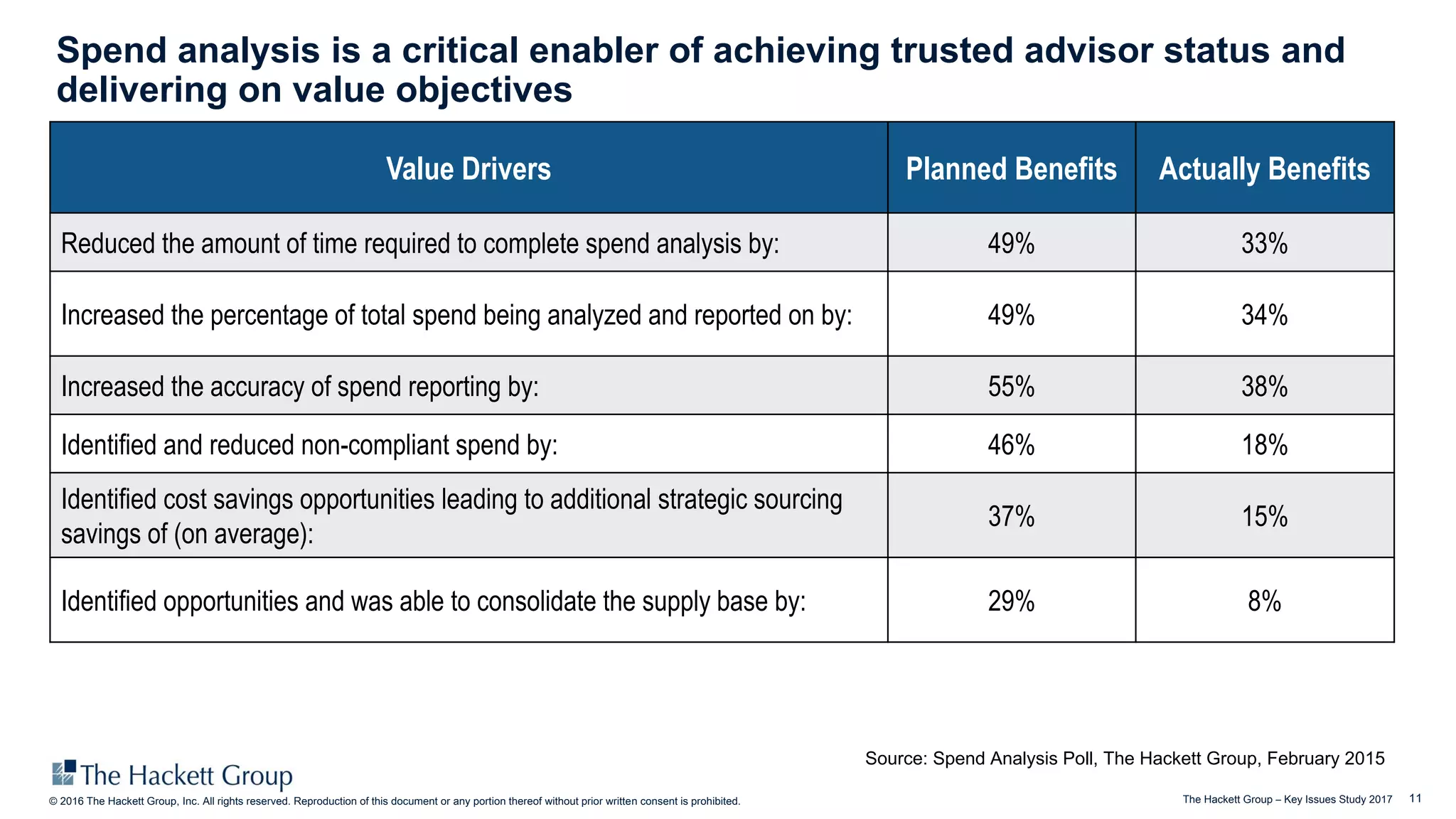

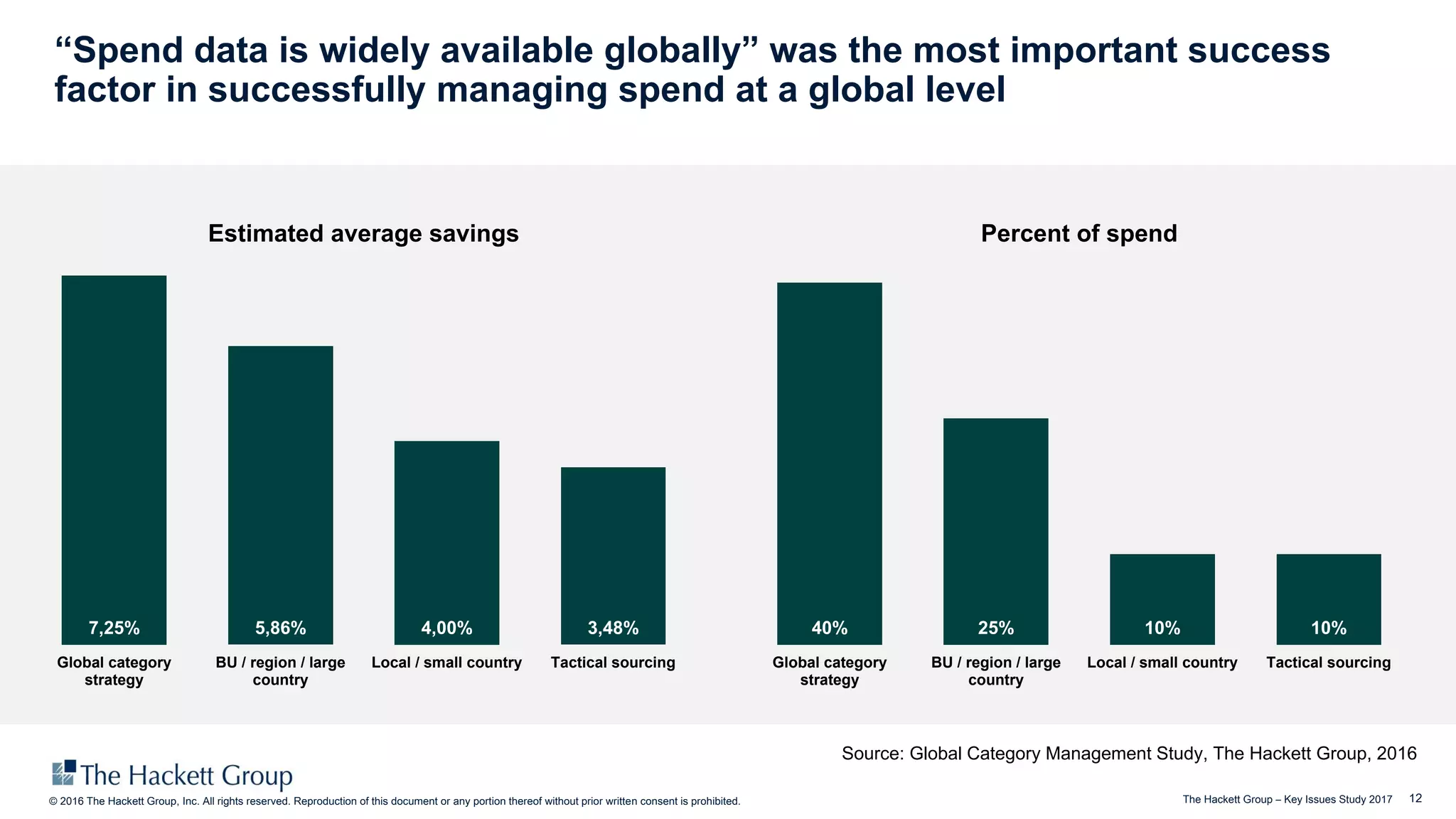

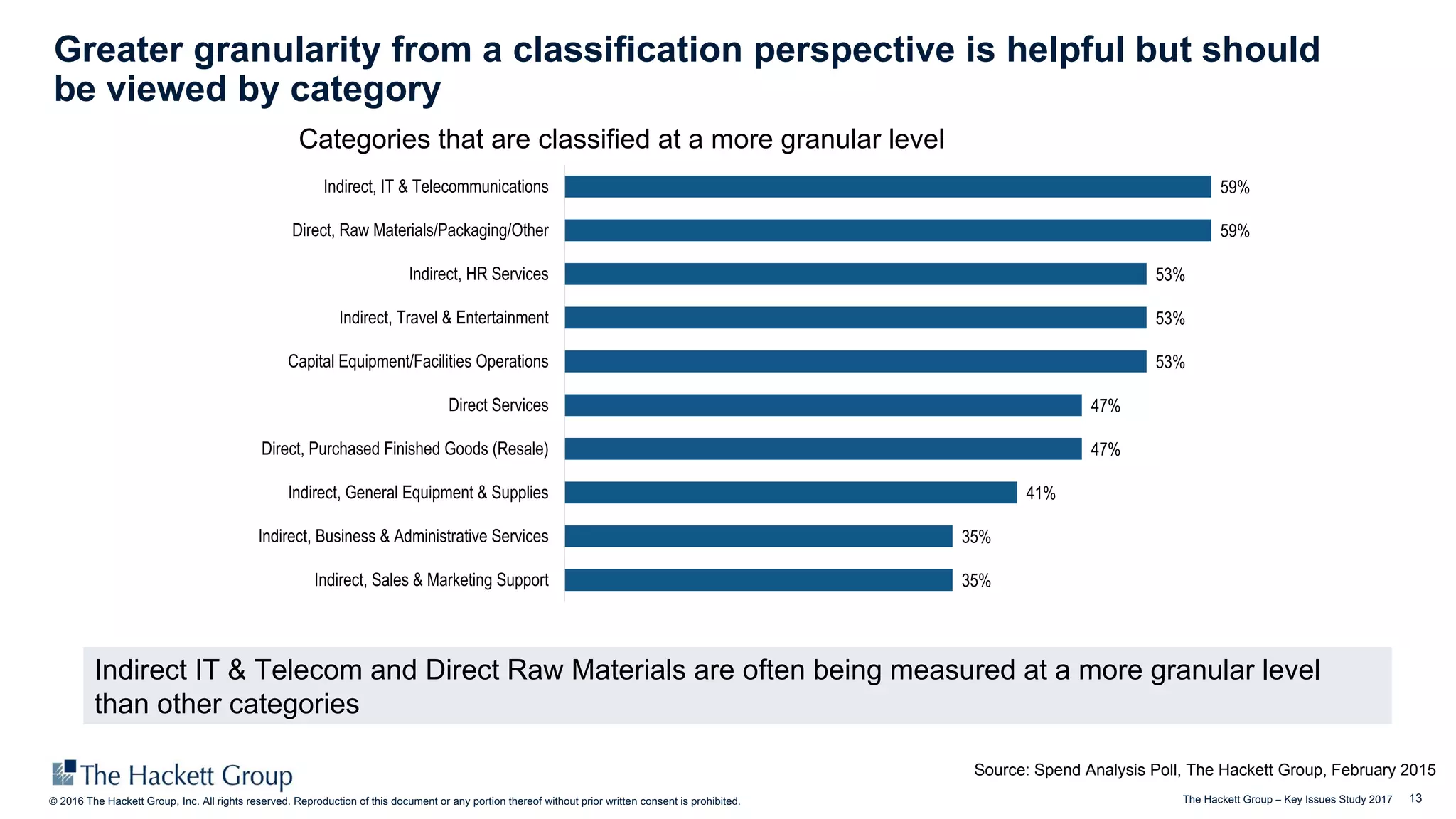

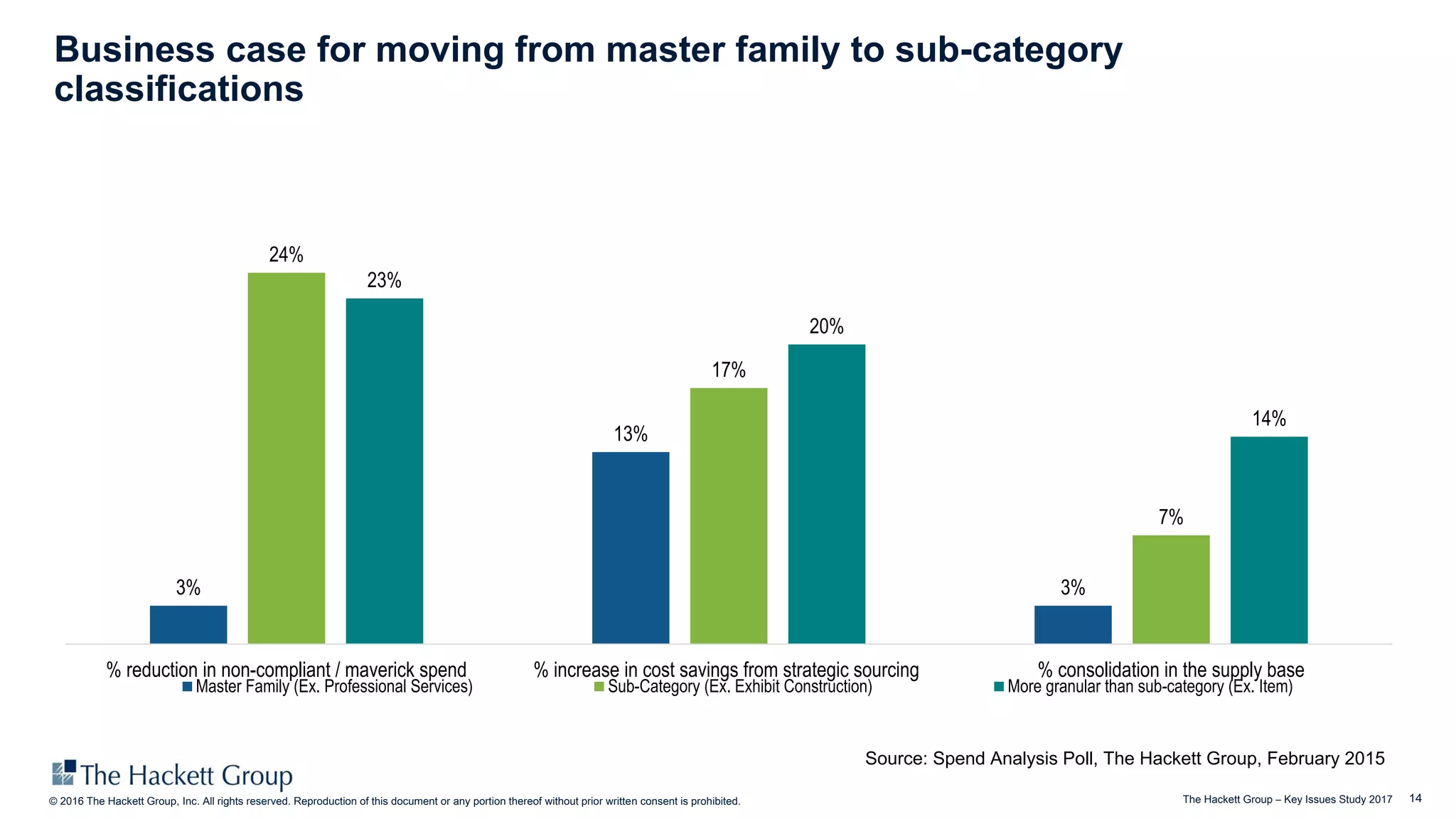

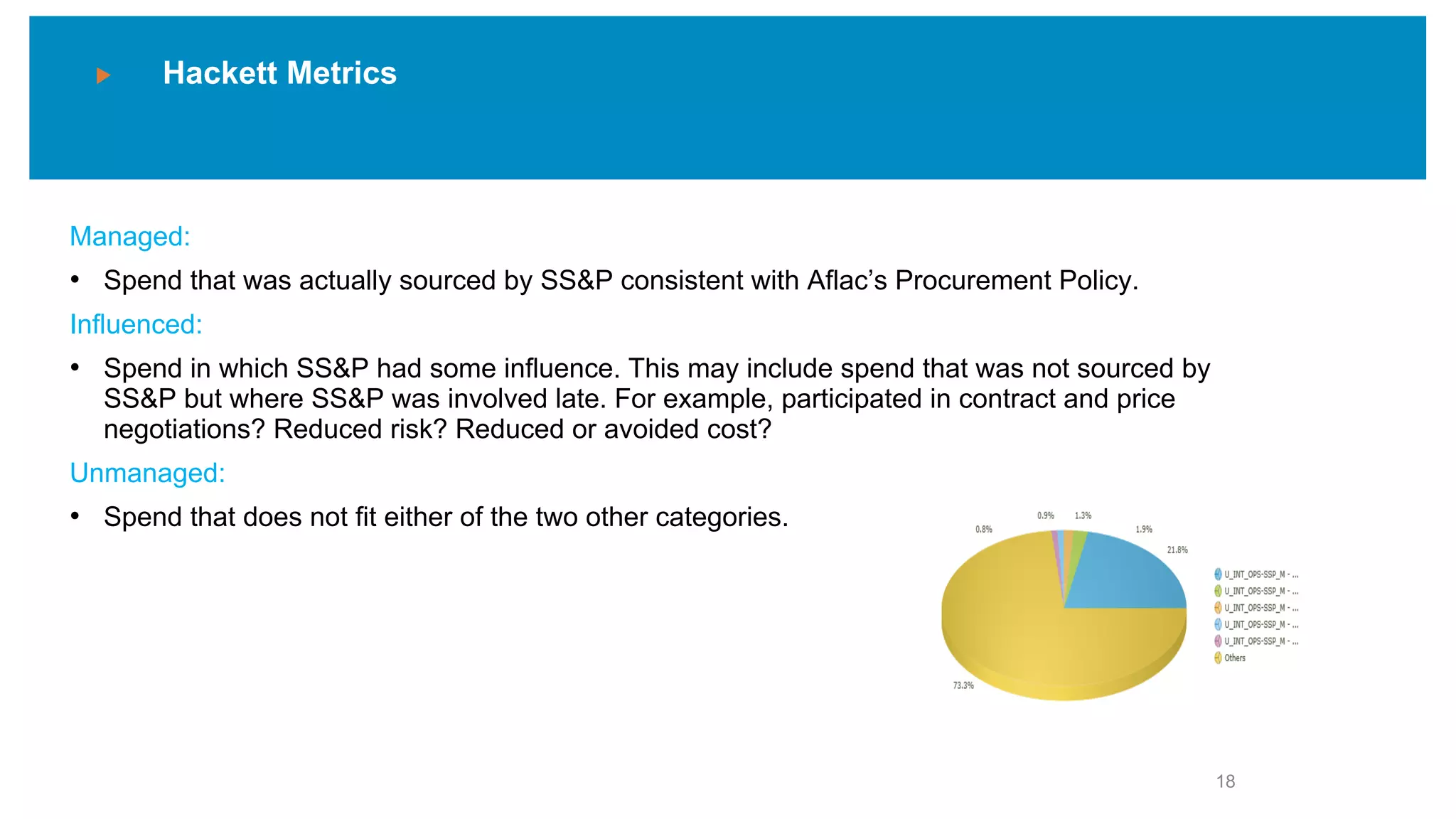

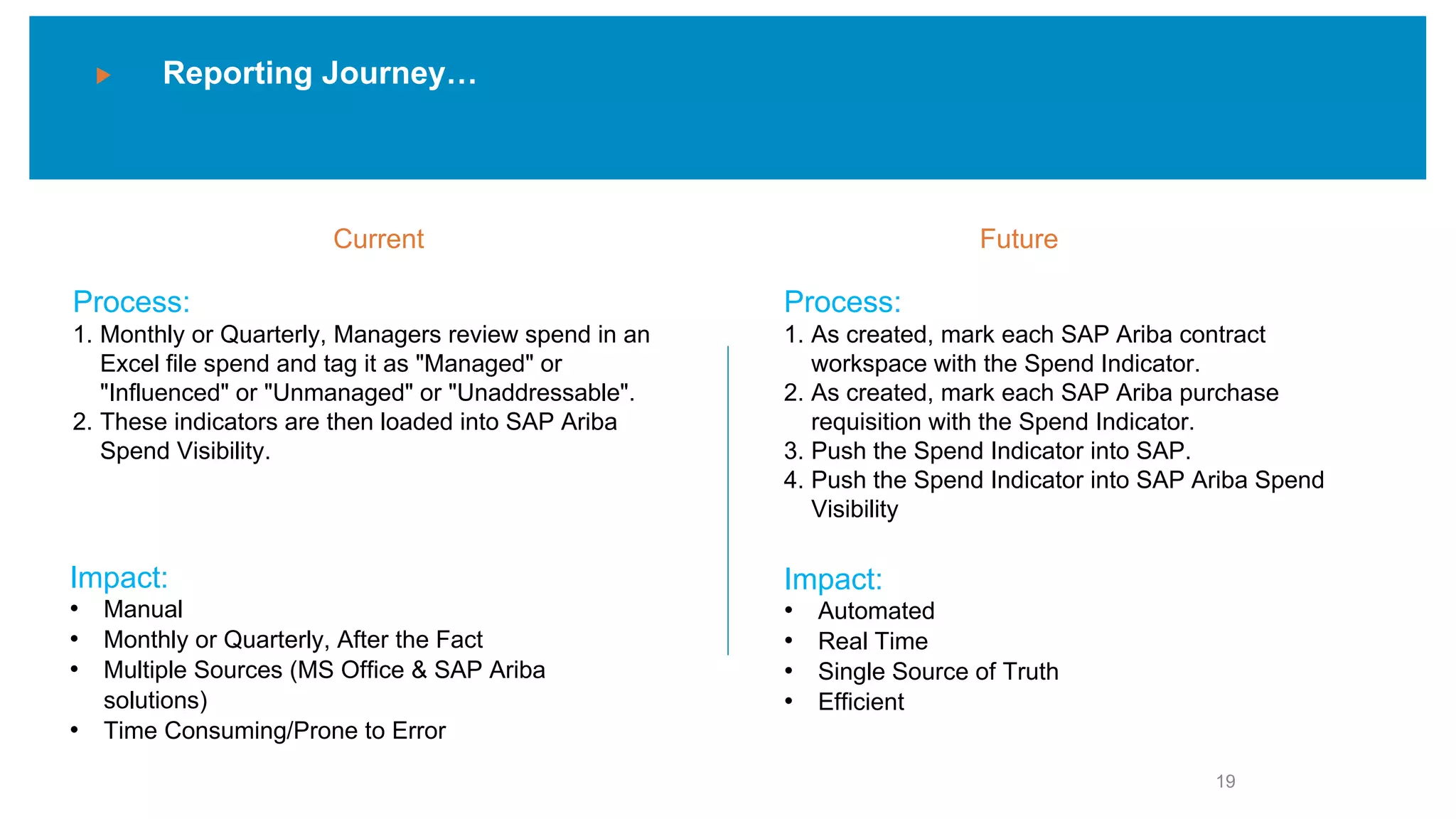

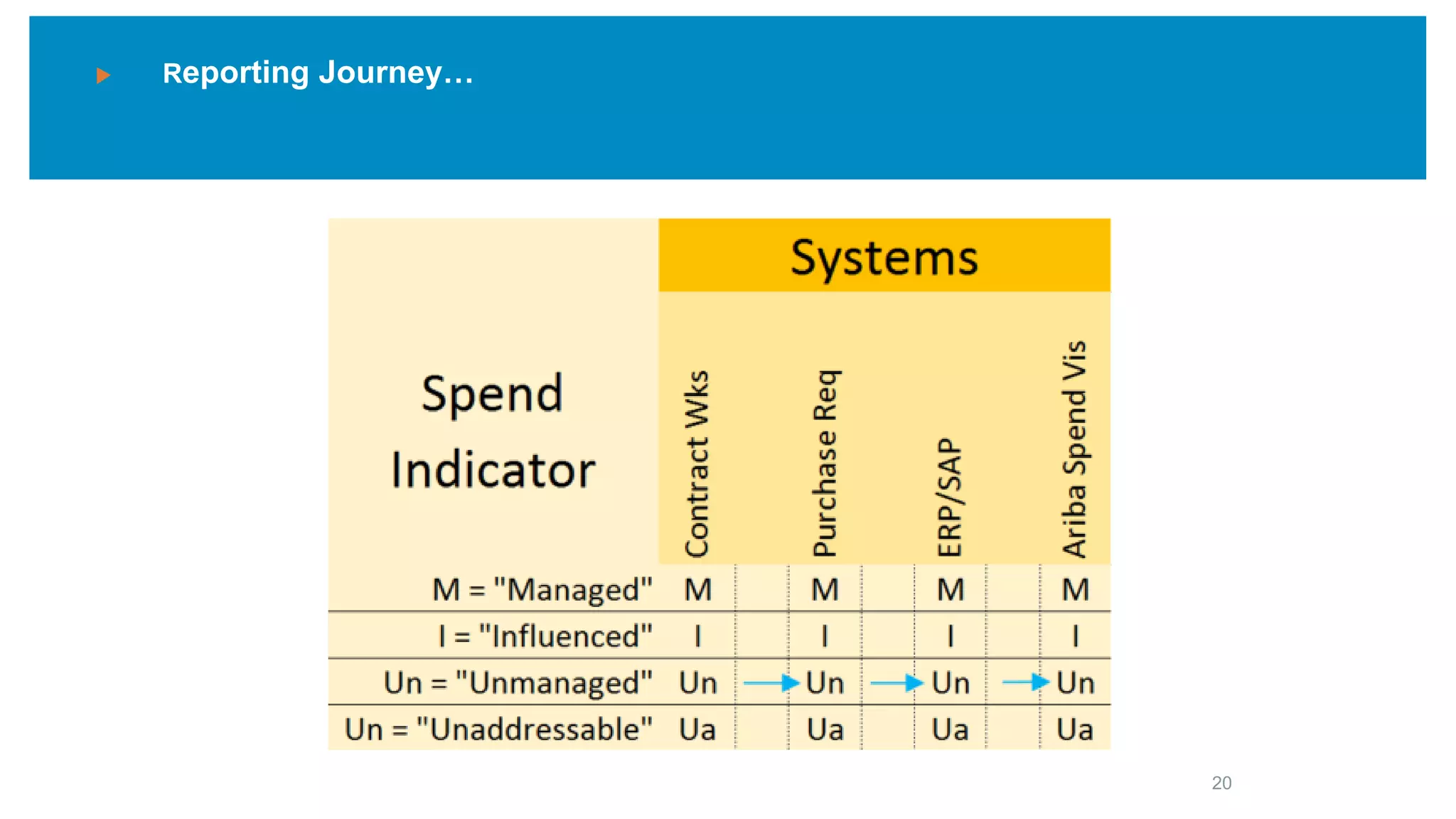

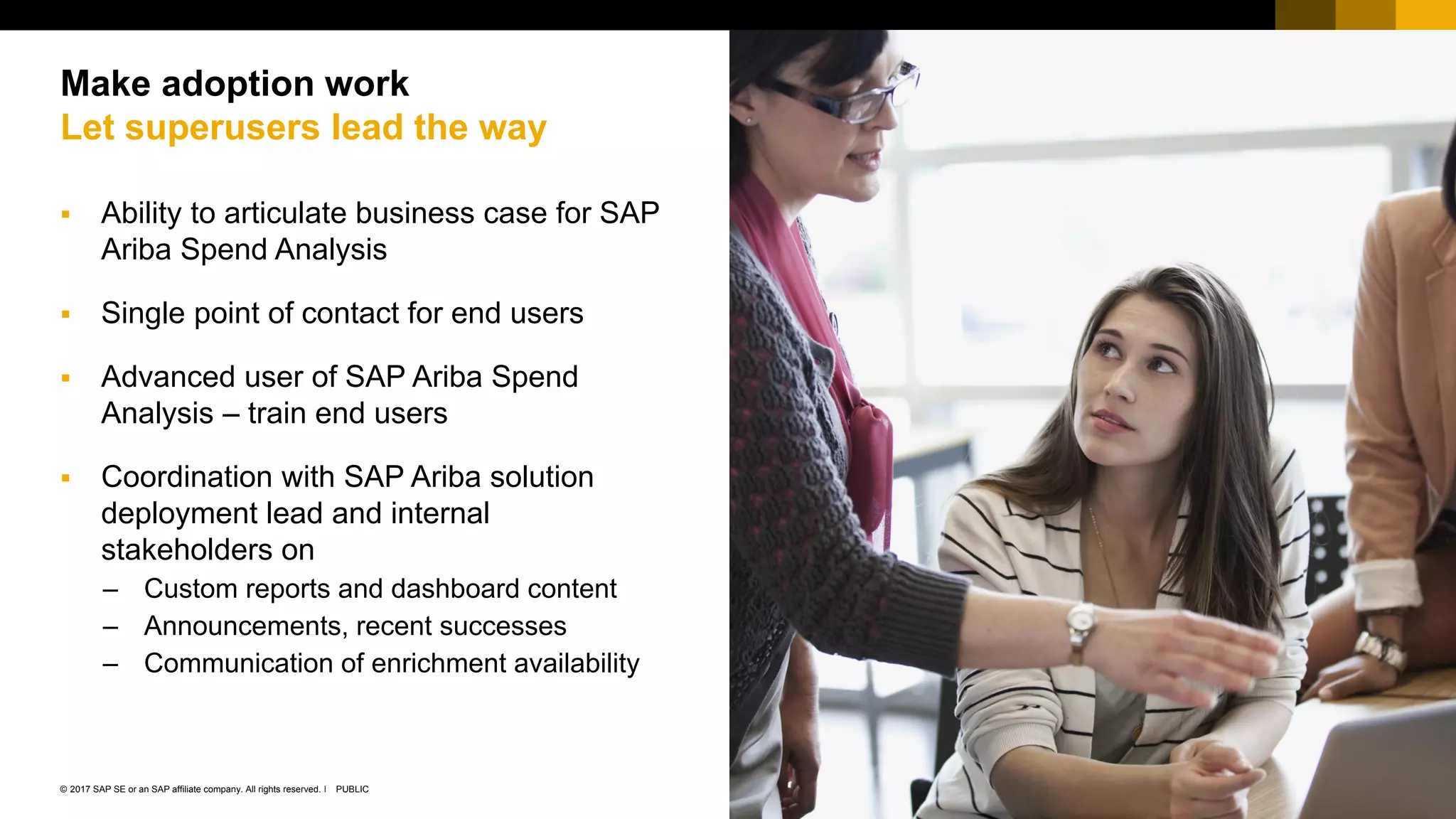

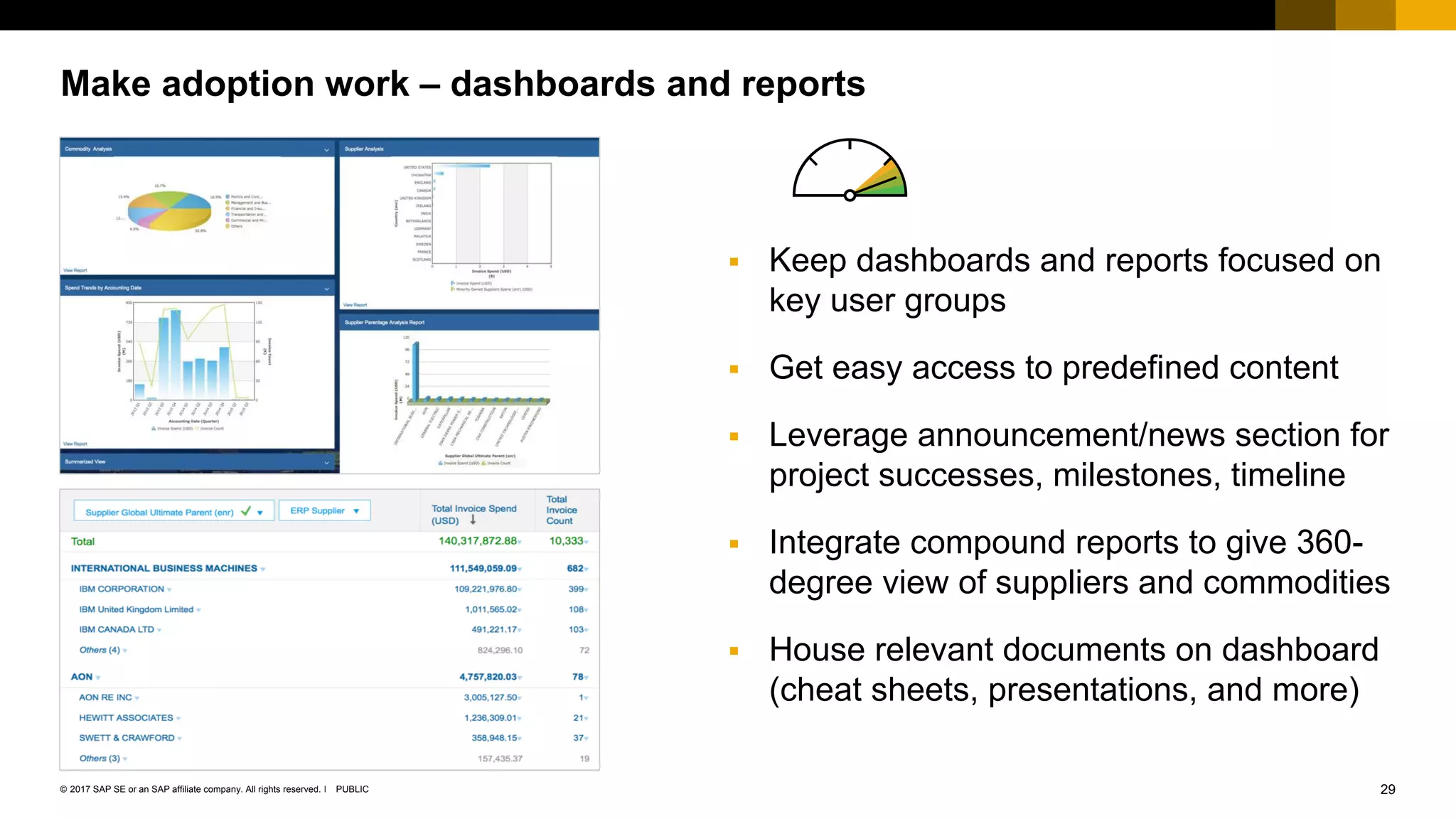

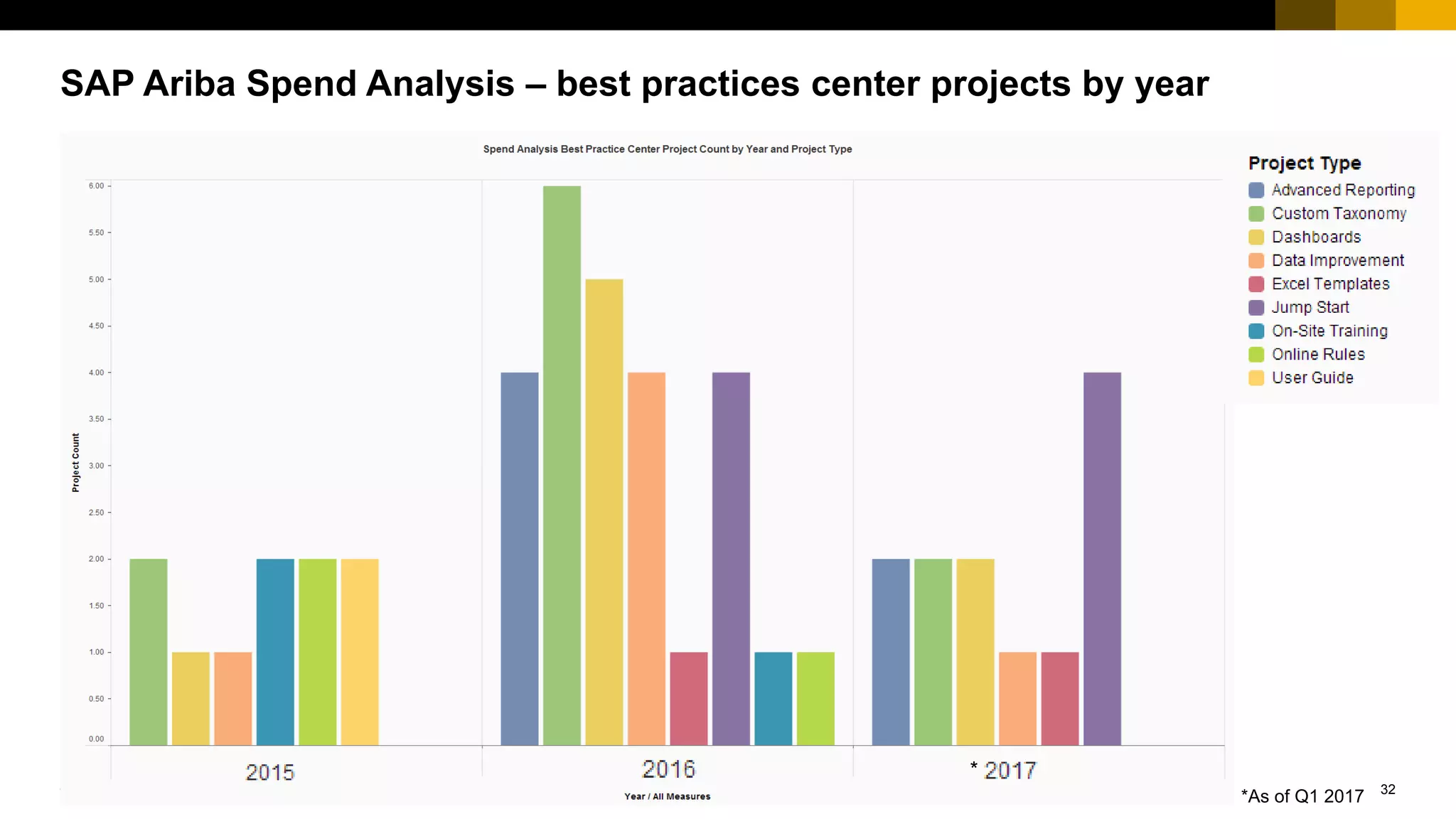

The document presents insights from a panel discussion on spend analysis, featuring experts from the Hackett Group and Aflac, focusing on the significance of spend data in procurement to enhance business agility and achieve trusted advisor status. Key findings highlight the importance of spend analysis in identifying cost-saving opportunities and enhancing reporting accuracy, with a strong emphasis on adopting best practices for user engagement and data trustworthiness. The discussion also underlines the growing role of advanced spend analysis tools and custom taxonomies in strategic sourcing and supplier management.