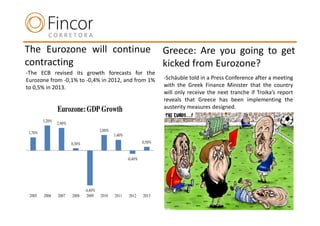

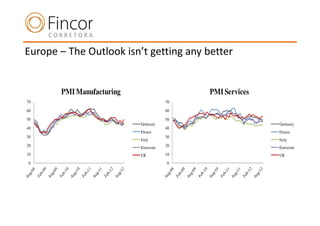

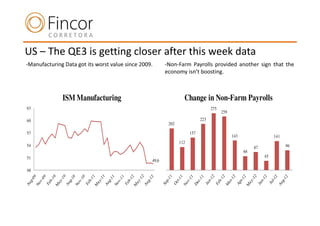

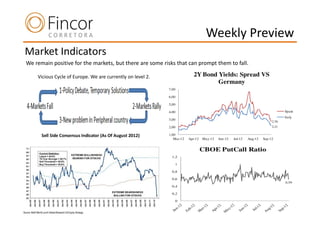

The document is a weekly market perspectives report from Fincor- Sociedade Corretora, S.A. dated September 10th, 2012. It provides a summary of recent economic events and data in Europe and the US, as well as previews of key events and data expected for the coming week. Specifically, it discusses the ECB's new bond-buying program, weak economic data from Europe and the US, expectations for further monetary easing from the Fed, and suggests buying shares of the Portuguese bank BES.