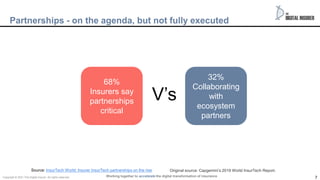

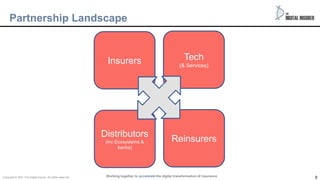

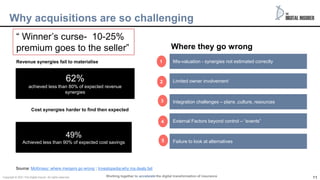

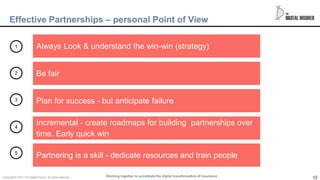

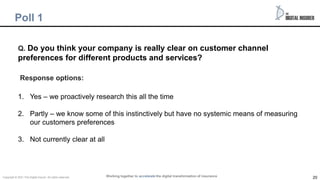

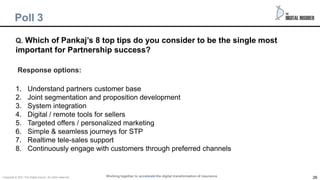

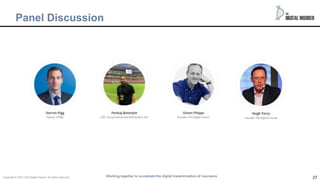

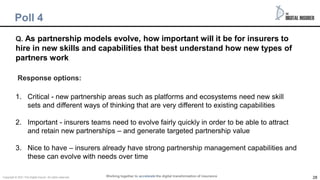

The document discusses a panel discussion on partnering for success in a digital world. The agenda includes opening remarks, opportunities in the industry from KPMG, insurer perspectives from AIA, and a panel discussion. There will also be updates from The Digital Insurer and a wrap up. The document provides information on the panellists and how to participate in the discussion through questions in the Q&A or comments in the chat. It also includes polls to gauge participants' views on key topics.