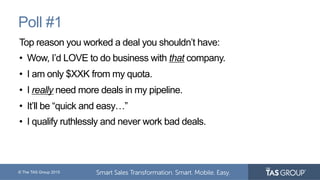

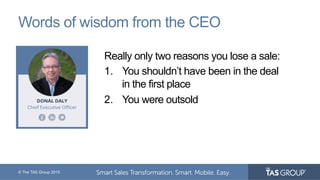

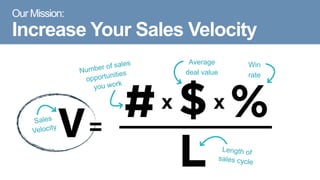

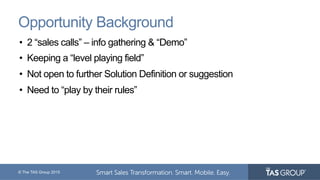

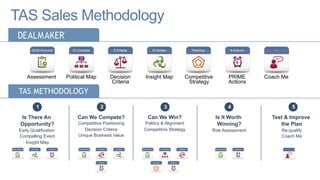

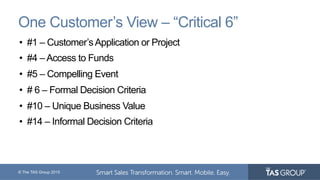

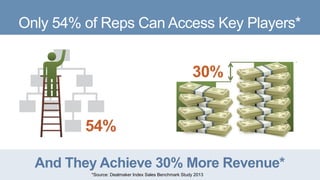

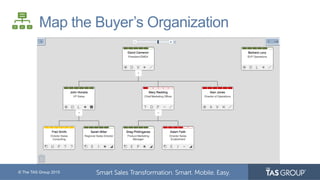

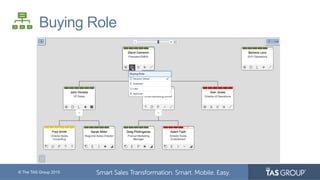

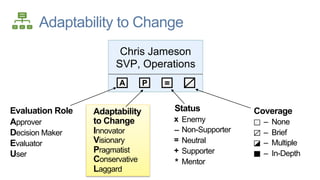

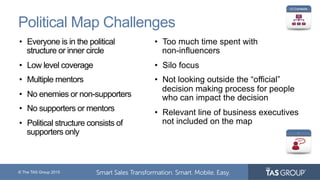

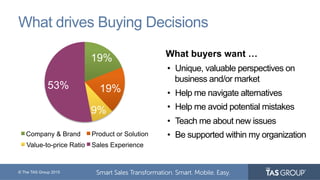

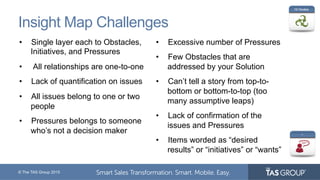

This document discusses opportunity management strategies to increase sales velocity. It suggests focusing on early qualification of opportunities to avoid working deals that should be avoided. Political mapping is presented as a way to assess whether a deal can be won by understanding who the key players and influencers are. Building a customer insight map is also presented as a way to align a company's solutions with a customer's goals, pressures and initiatives to increase the chances of winning deals. The presentation aims to help salespeople work the right opportunities, access the right people and position solutions effectively.