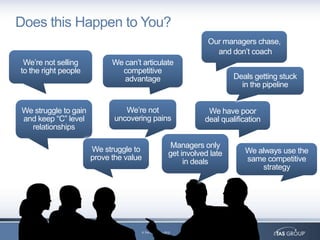

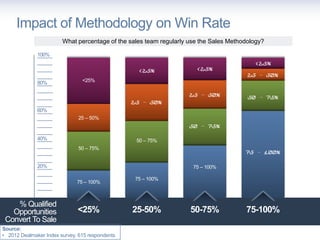

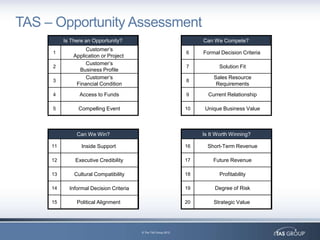

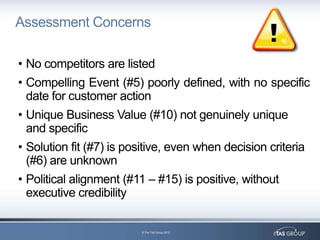

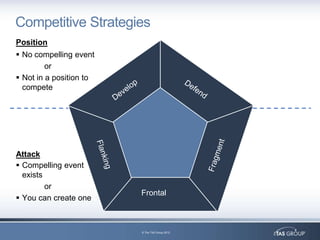

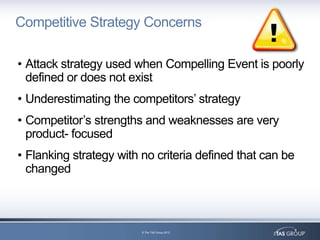

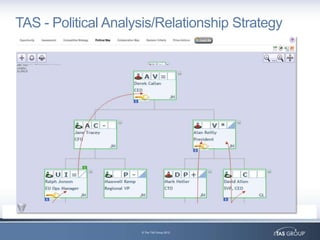

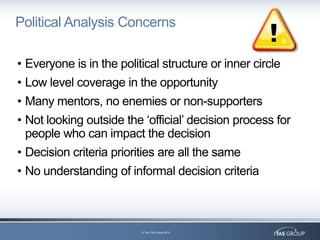

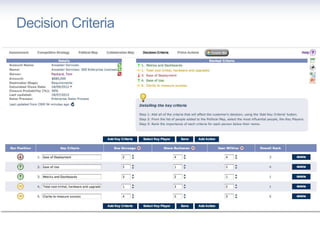

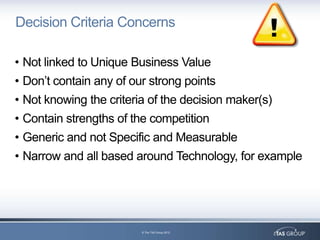

Tim Foster, Sales Director for The TAS Group in EMEA, presented a webinar on improving sales effectiveness through using a sales methodology and opportunity assessment process. The webinar covered common sales challenges, assessing opportunities and competitors, developing strategies, mapping political relationships, and prioritizing decision criteria. It highlighted research finding sales teams using TAS Group's methodology achieved 54% higher quota attainment. The webinar encouraged attendees to register for upcoming events and access free sales resources on TAS Group's website and social media.