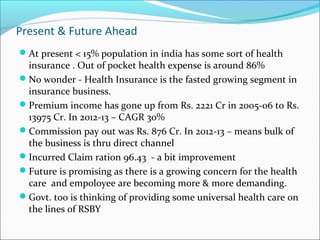

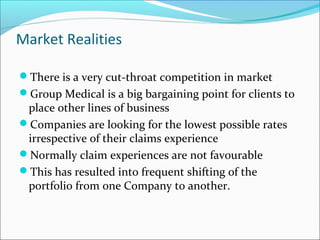

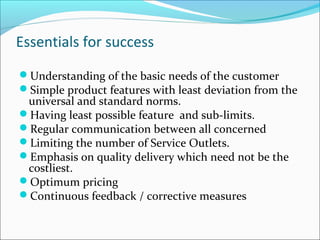

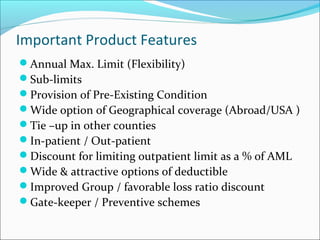

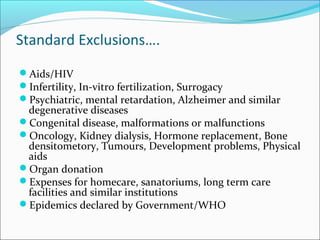

The document discusses health insurance and medical benefits for employees in India. It notes that while not legally required, many employers provide some level of healthcare for workers. Group medical insurance is presented as a comprehensive solution that outsources this non-core activity while providing benefits to both employers and employees. The future of health insurance in India is promising as awareness and demand are growing, though more widespread coverage is still needed as most people currently pay medical costs out-of-pocket.