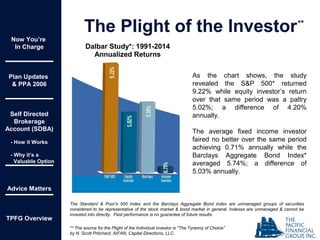

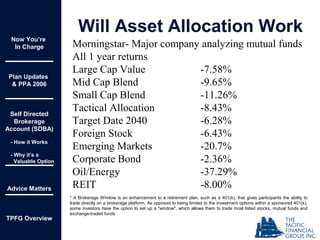

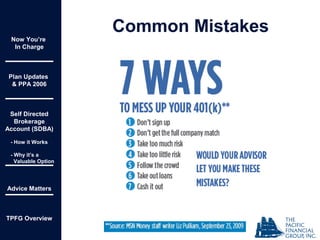

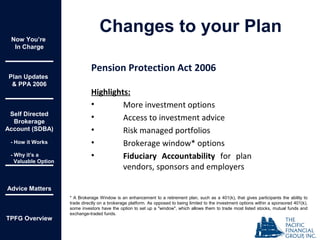

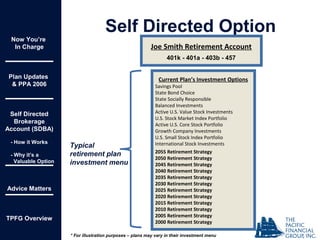

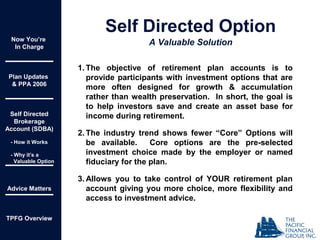

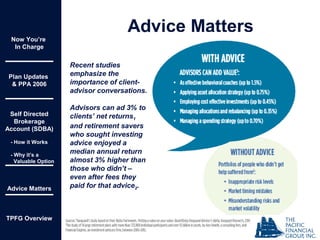

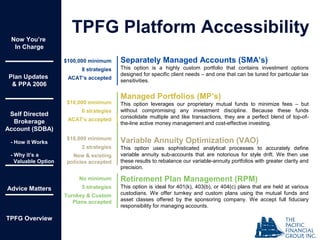

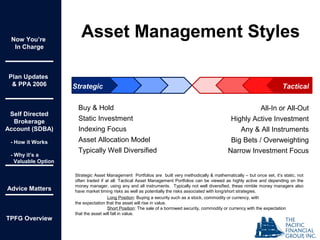

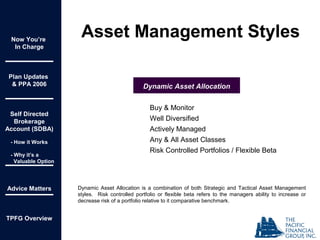

This document discusses enhancing investment choices and flexibility for retirement accounts like 401(k), 403(b), and 457 plans, emphasizing the benefits of self-directed brokerage accounts. It highlights risks associated with different investment strategies and the importance of seeking professional investment advice, which can significantly improve investment returns. Additionally, the document describes various asset management styles and the features of a brokerage window that enables more active trading options for investors.