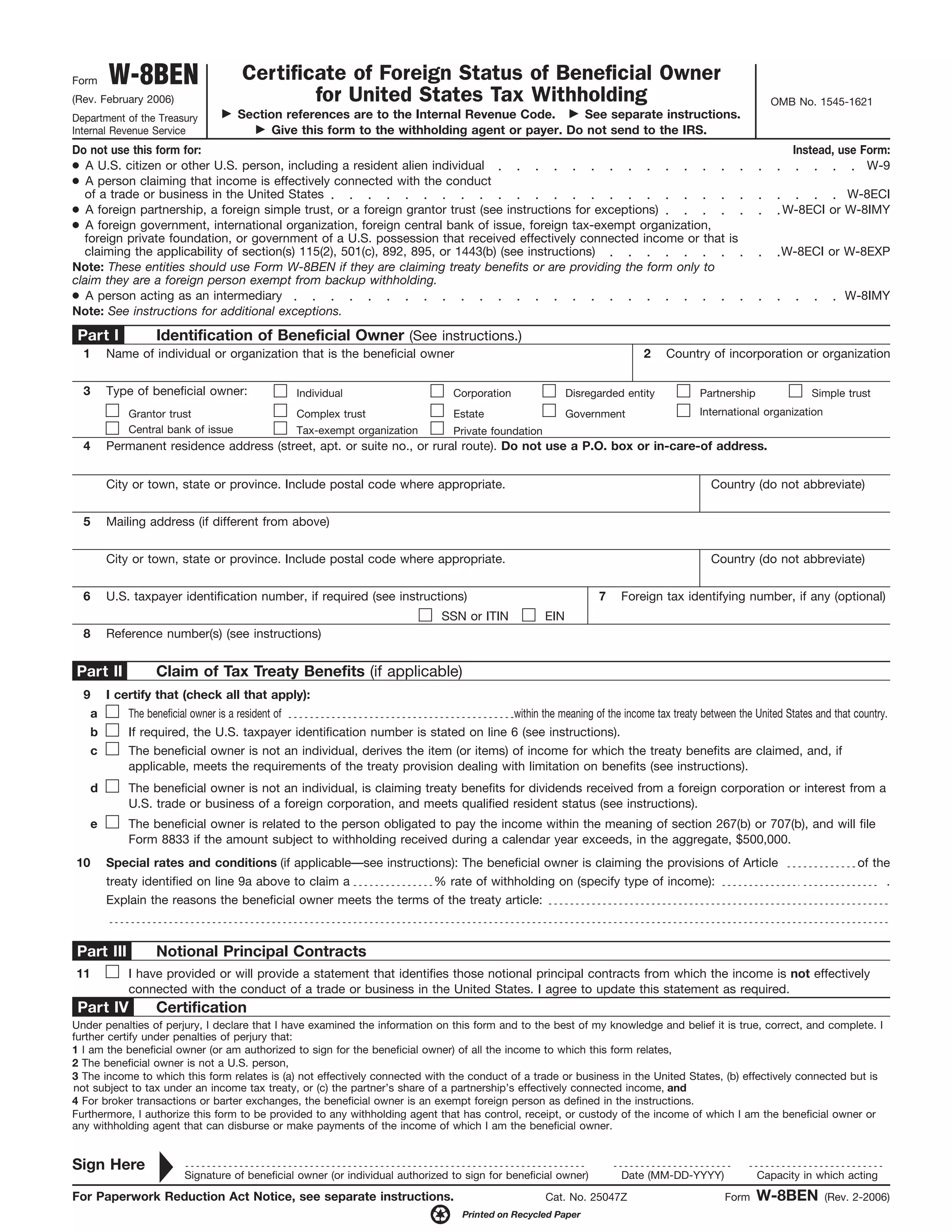

This document is the Form W-8BEN, which is used by foreign individuals and entities to certify their foreign status for U.S. tax withholding purposes. The form provides instructions on who should and should not use the form, including exceptions. It collects identification information about the beneficial owner and their country. The beneficial owner can claim tax treaty benefits by certifying their treaty qualification. The form requires certification of the beneficial owner's foreign status and that the income is not effectively connected to a U.S. trade or business.