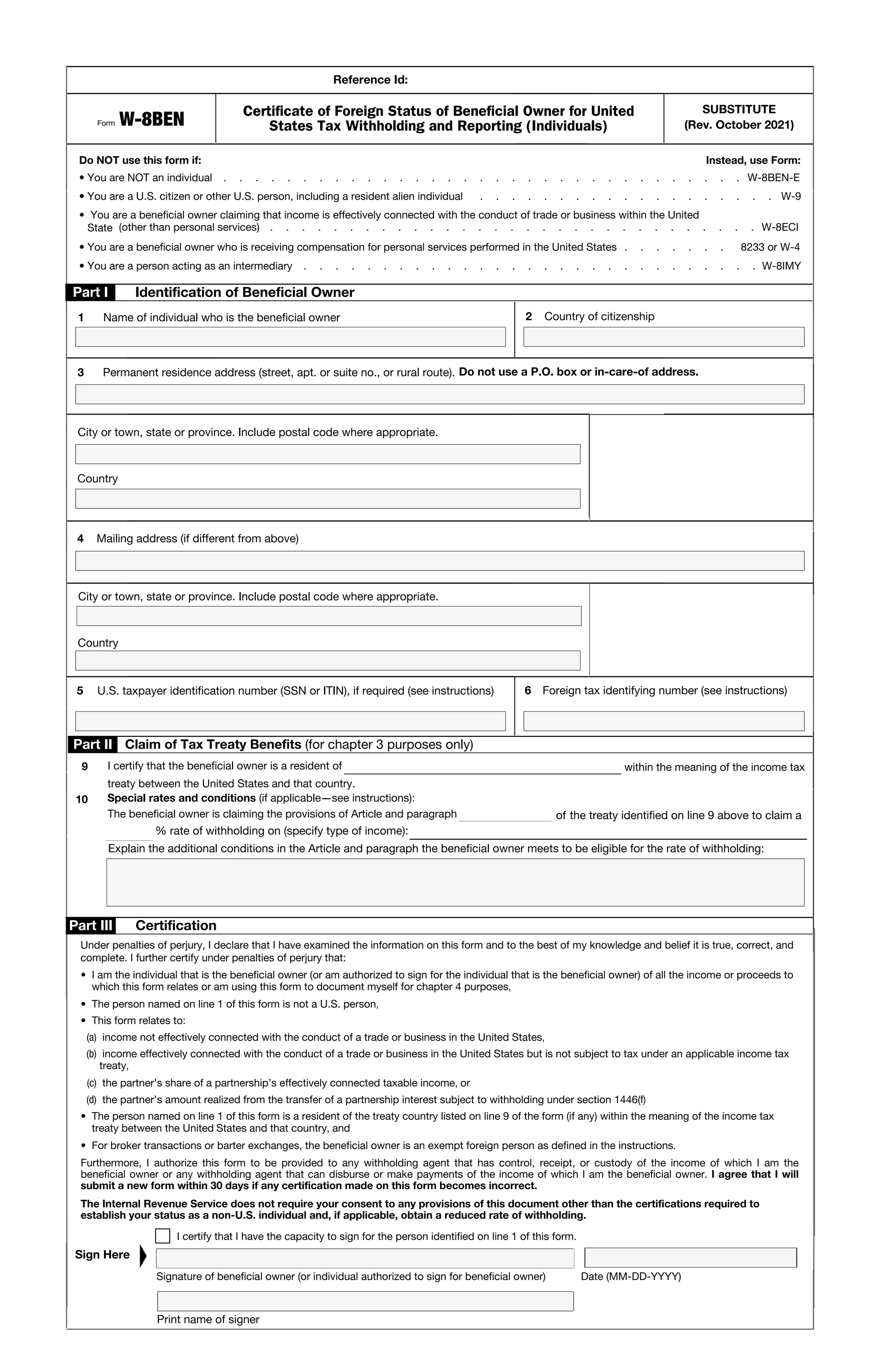

This document is the Form W-8BEN, which is used by non-resident alien individuals to certify their foreign status for US tax withholding and reporting purposes. The form includes sections for identifying the beneficial owner, certifying foreign status and country of residence, and claiming tax treaty benefits. It notes that other forms should be used depending on the person or entity's specific tax and status situation.