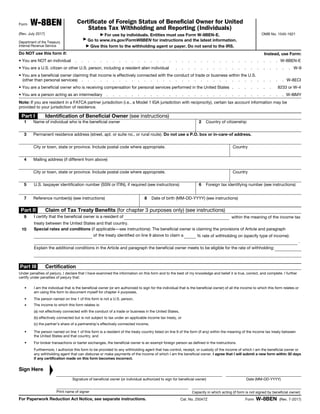

This document is the Form W-8BEN, which is used by individuals to certify their foreign status for U.S. tax withholding and reporting purposes. The form provides instructions for individuals to identify themselves and claim tax treaty benefits. It also certifies that the individual is a foreign person and that any income related to this form is not effectively connected to a U.S. trade or business or is exempt under an income tax treaty. The individual must sign and date the form to authorize it to be provided to withholding agents.