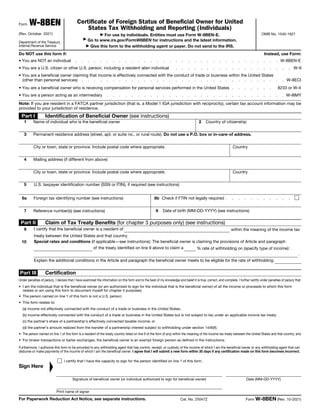

This document is Form W-8BEN, which is used by individuals to certify their foreign status for U.S. tax withholding and reporting purposes. The form provides instructions for its use and identifies other forms that should be used instead in certain cases. It collects identification information about the beneficial owner, allows them to claim tax treaty benefits, and requires certification of foreign status and authorization to provide the form to withholding agents.