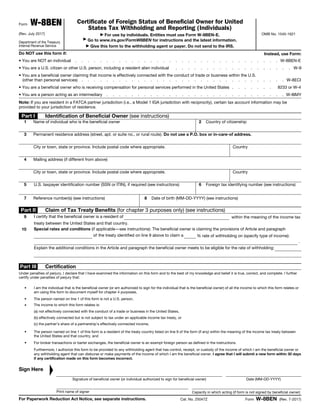

This document is the Form W-8BEN, which is used by individuals to certify their foreign status for U.S. tax withholding and reporting purposes. The form provides instructions for individuals to give certain identifying and tax residency information. It also allows individuals to claim tax treaty benefits by certifying that they are a tax resident of a particular country with which the U.S. has a tax treaty. By signing the form, the individual certifies that the information provided is true and authorizes the form to be provided to withholding agents.