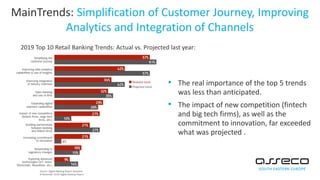

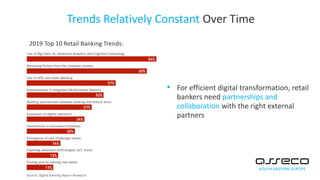

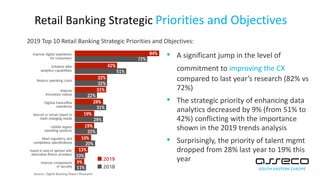

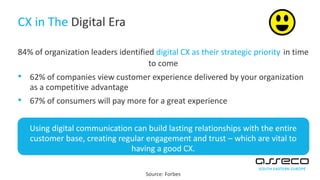

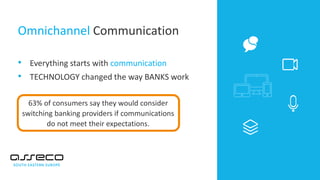

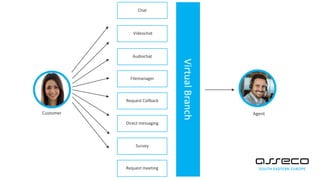

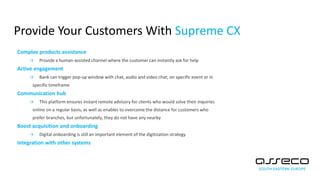

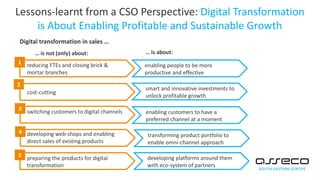

The document discusses the evolving landscape of digital transformation within the retail banking sector, highlighting the pressures and opportunities created by technology and shifting consumer expectations. It outlines key trends, strategic priorities, and the importance of customer experience, emphasizing the need for effective digital communication and partnerships. The insights are supported by data indicating that executives increasingly recognize the transformative potential of digital strategies, though many organizations still struggle to align these strategies with tangible business outcomes.