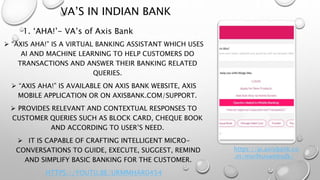

The document discusses the use of virtual assistants in the banking sector in India. It begins with an introduction to customer service in banks and discusses how virtual assistants can enhance that service. It then provides examples of virtual assistants used by several major Indian banks like SBI's SIA and HDFC Bank's EVA. The case study of HDFC Bank highlights how it was one of the first to implement a virtual assistant called EVA. In conclusion, virtual assistants are becoming more advanced and important for improving customer experience in the banking industry.