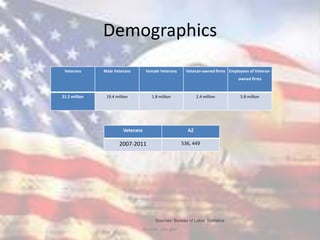

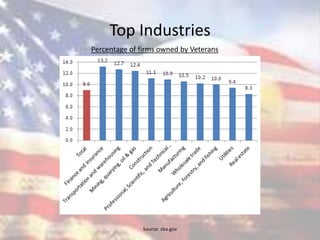

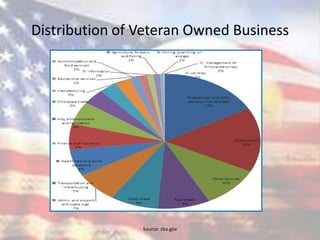

This document provides an overview of resources available to veteran-owned businesses through the Small Business Administration. It discusses demographics of veteran entrepreneurs, top industries for veteran-owned businesses, and classifications like Veteran-Owned Business and Service-Disabled Veteran-Owned Small Business. It also summarizes funding opportunities such as the SBIR program and Patriot Express loans, as well as first steps for starting a business like obtaining tax IDs. Networking recommendations are provided, along with a list of veteran business resources.