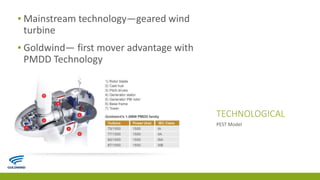

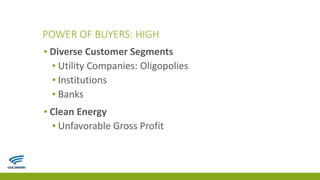

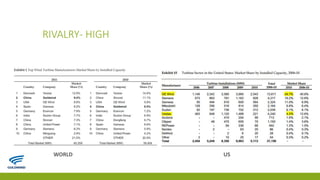

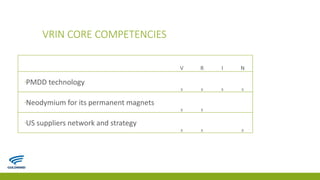

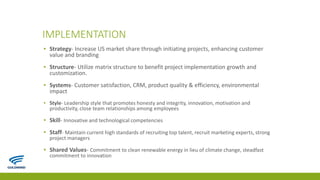

Goldwind Science and Technology is a Chinese wind turbine manufacturer that wants to expand its sales overseas. It established Goldwind USA in 2010 to target the US market, with a goal of capturing a larger market share. However, it faces complications such as competition from larger rivals like GE and challenges around grid parity and government subsidies. To overcome these, Goldwind can leverage its strengths like technological expertise in permanent magnet direct drive technology and experience in manufacturing to better serve US customers and projects.