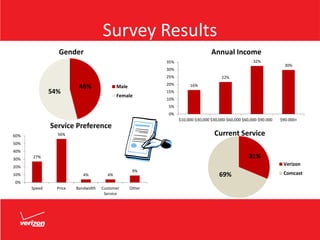

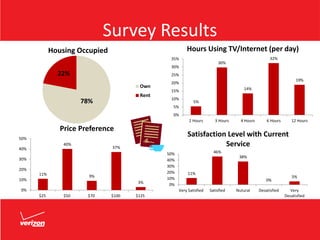

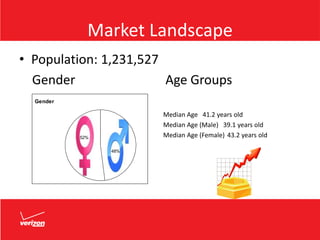

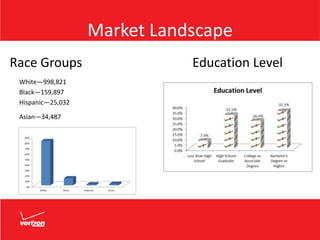

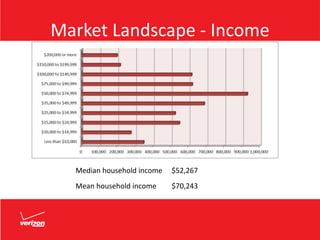

Verizon aims to increase market share of its FiOS services among mature customers in Pittsburgh. A survey found Comcast has majority market share and price is most important factor. The marketing plan recommends offering lower prices, extended contracts, and trial subscriptions. It will launch a campaign featuring NFL star Terry Bradshaw to promote a special $69.99 triple play offer for mature customers, including AARP membership and free installation. Tactics include direct mail, TV, radio, and signage on buses and access vehicles starting July 15th.