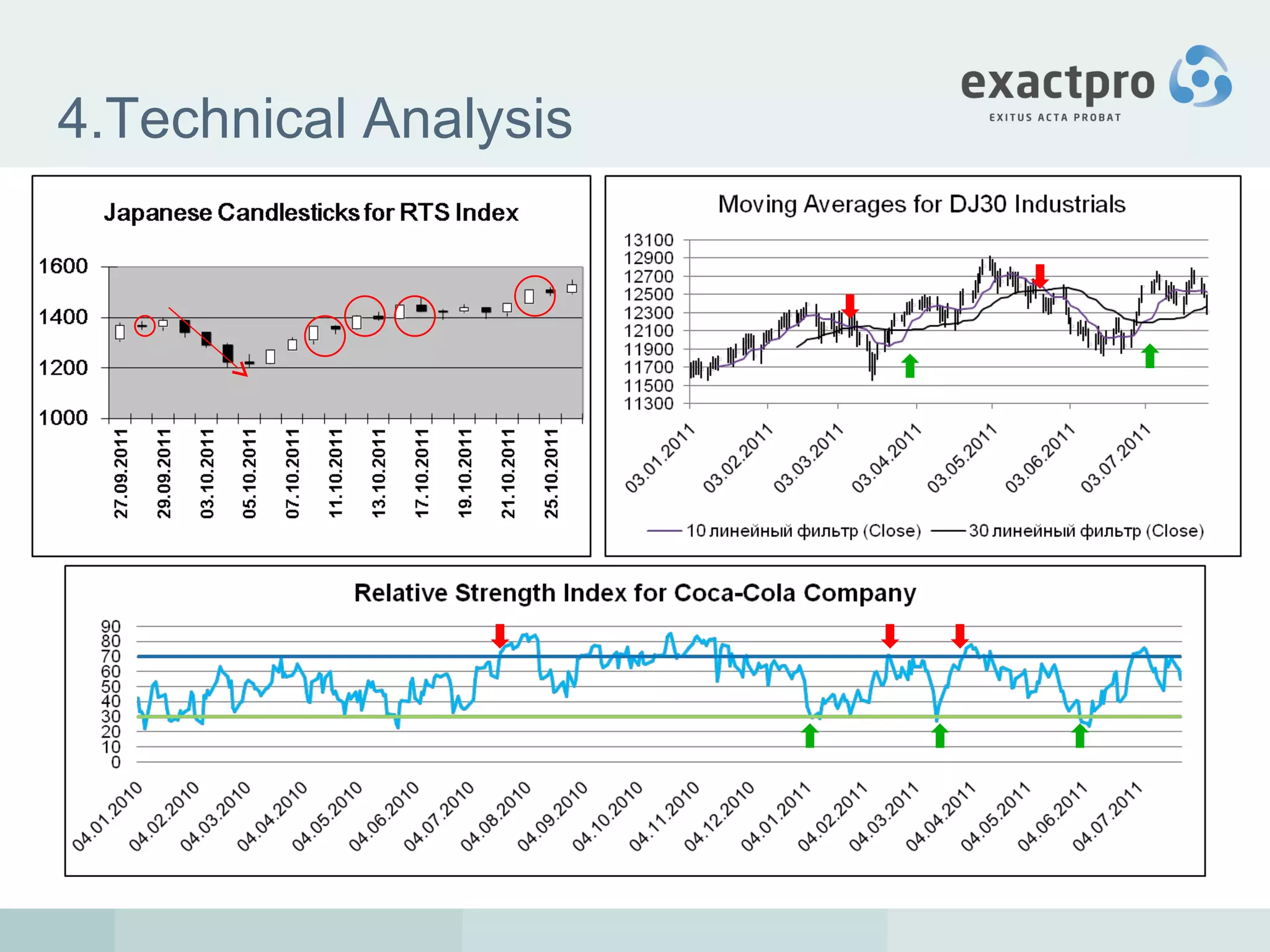

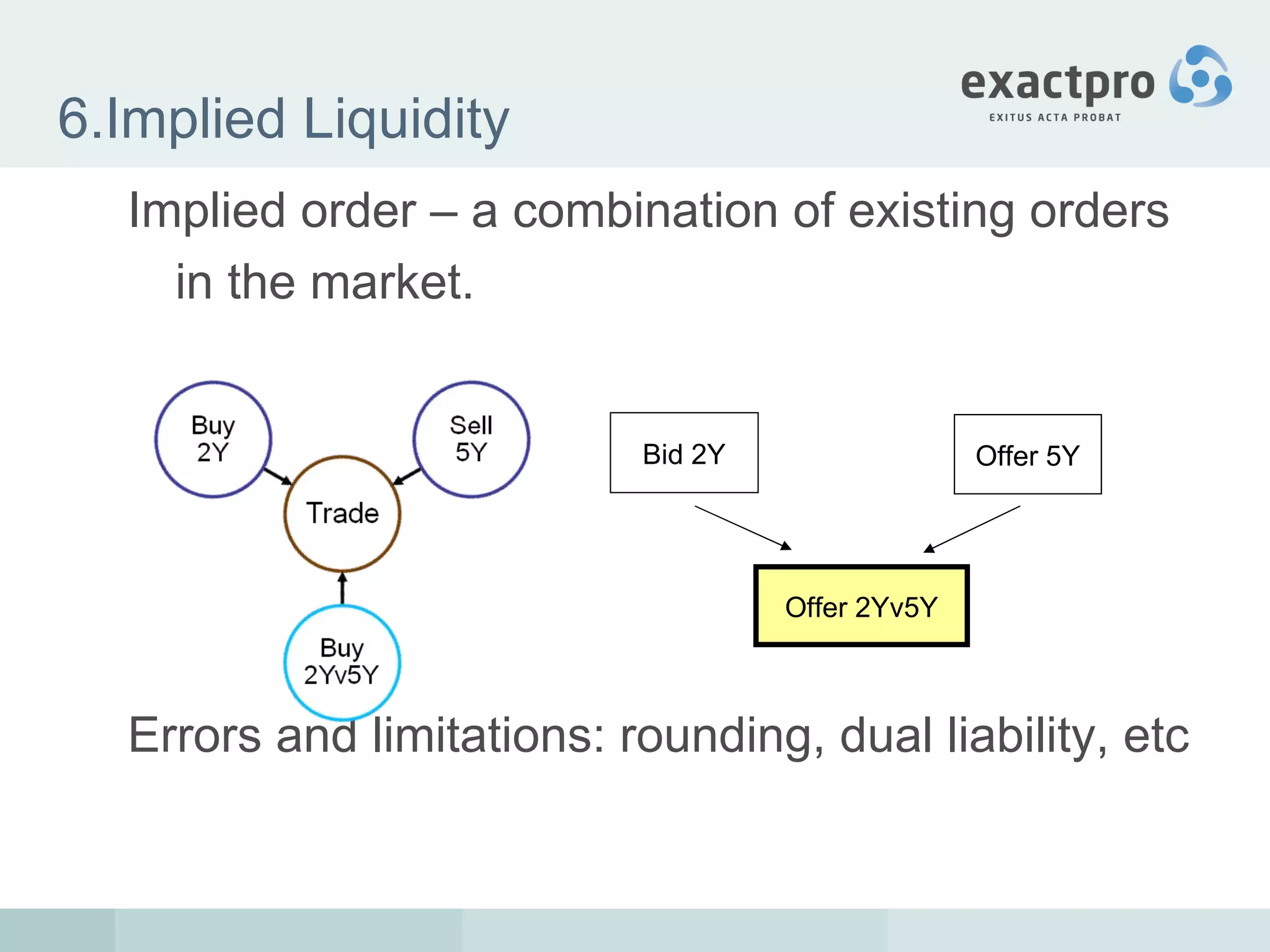

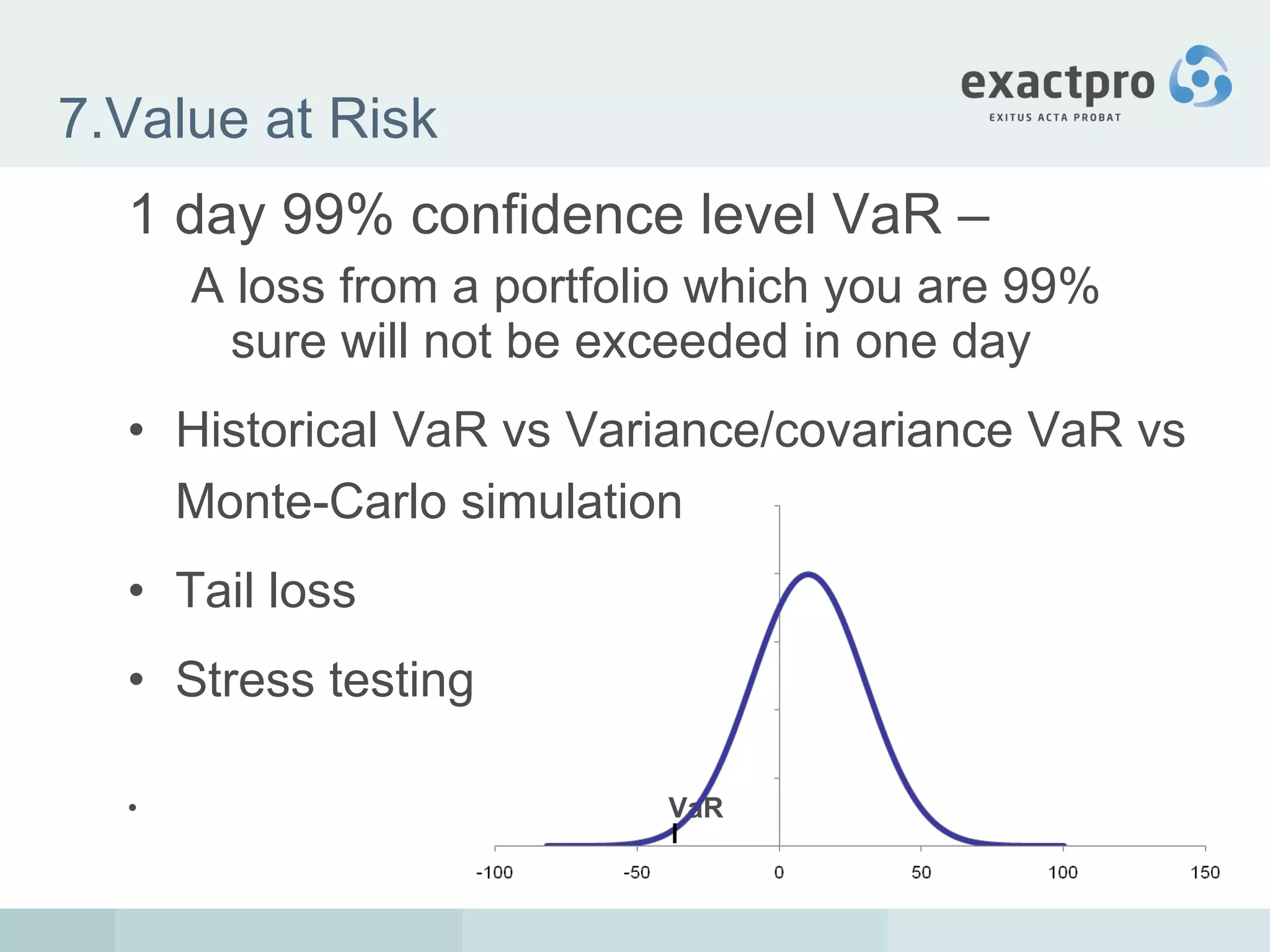

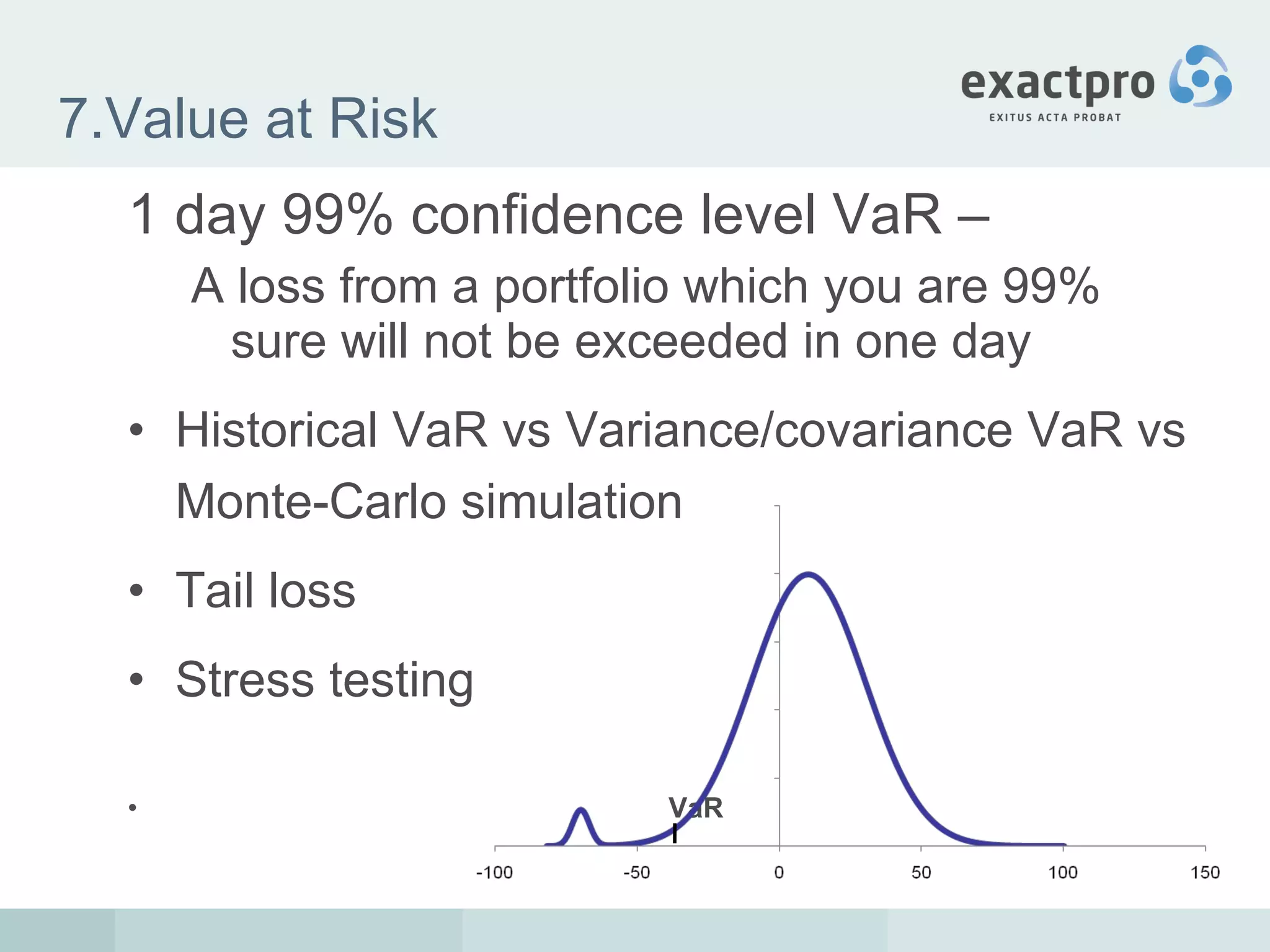

The document discusses the verification of financial models, emphasizing the importance of correctness, internal consistency, and calibration. It covers model implementation, applications in areas such as derivatives pricing and value at risk, as well as the risks and error limitations that can arise. The summary highlights the need for effective verification methods to prevent failures and improve model reliability without duplicating efforts.