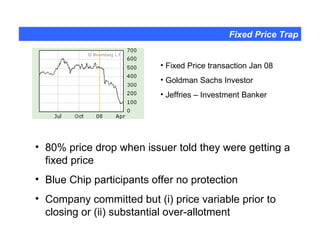

Variable pricing for equity transactions has advantages over fixed pricing in certain situations. Variable pricing allows the issuer to determine when they need capital and provides immediate commitment, which is ideal when funds will be expended quickly over 6-18 months on milestones. Fixed pricing is better when there is no immediate need for funds and time is needed for investor due diligence. Announcing a large funding commitment can increase a company's stock price by an average of 69% as it resolves future funding concerns. Fixed pricing can trap issuers if the stock price drops significantly before closing.