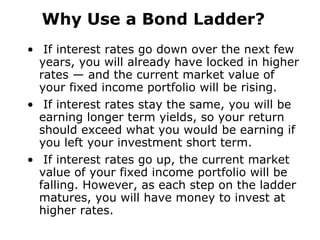

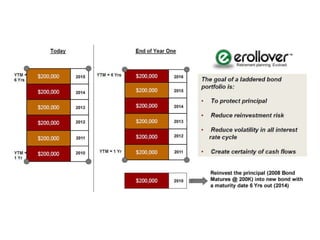

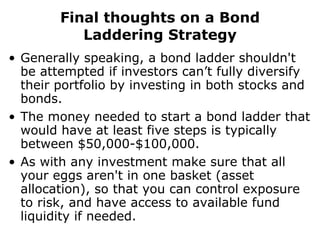

Bond laddering is an investment strategy that involves spreading funds among bonds maturing at different times to manage interest rate risks and optimize returns. It allows for reinvestment of principal from maturing bonds into higher-yield options, making it beneficial for retirement planning. To successfully implement a bond ladder, investors should consider their individual goals, diversify their portfolios, and typically start with an investment of $50,000-$100,000.

![Thank You [email_address] www.twitter.com/erollover http://www.erollover.com](https://image.slidesharecdn.com/bondladdering-100301124736-phpapp02/85/Bond-Laddering-10-320.jpg)