This document discusses various methods for calculating the cost of capital for companies, including:

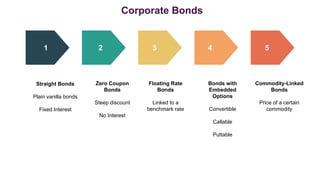

- Calculating the before-tax and after-tax cost of debt for corporate bonds issued at a discount.

- Using the Gordon growth model to calculate the required rate of return for shareholders given the current share price, expected dividend, and constant dividend growth rate.

- Using a two-stage dividend growth model to calculate a company's cost of equity based on current share price, initial dividend, growth rates over two periods, and a terminal growth rate.

- Calculating the cost of internal and external equity using dividend growth rates and issue prices for new shares.

- Using the Capital Asset Pricing Model