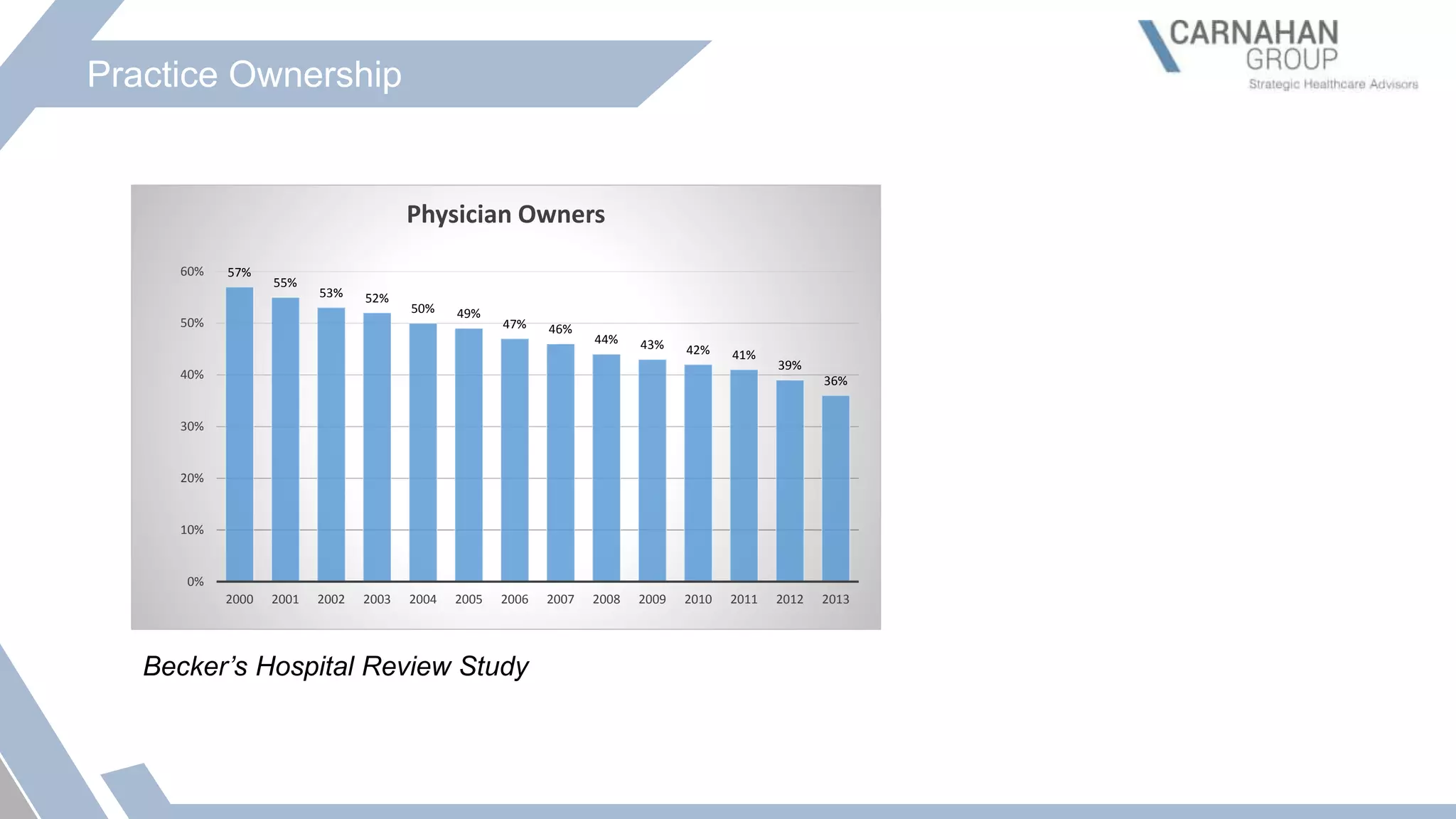

The document discusses the valuation of physician practices and outlines key regulatory frameworks, including Stark Law and the Anti-Kickback Statute, that influence healthcare decisions and transactions. It highlights trends in healthcare mergers and acquisitions, detailing factors affecting physician practice ownership and the methodologies for evaluating medical practices. The presentation also emphasizes the importance of fair market value standards to prevent fraud and abuse in healthcare transactions.