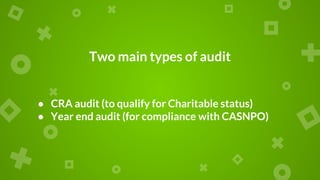

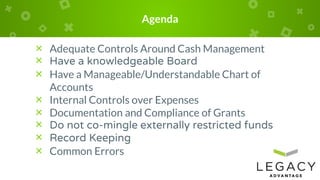

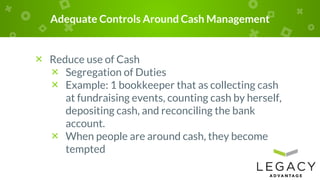

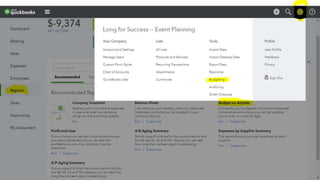

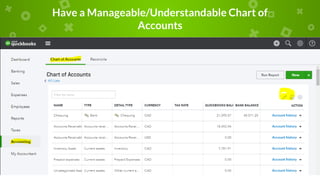

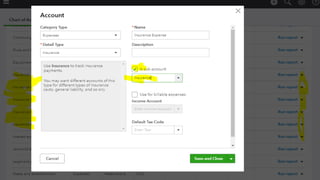

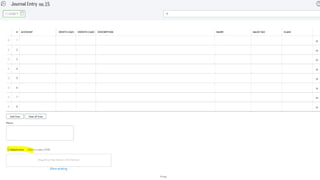

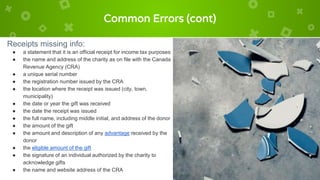

The document outlines essential strategies for nonprofit organizations to ensure they are audit-proof, highlighting the importance of cash management, knowledgeable governance, and proper record-keeping. Key recommendations include implementing internal controls, managing accounts comprehensively, and adhering to grant compliance requirements. It emphasizes avoiding common errors, such as mingling restricted funds and mismanaging receipts, to maintain accountability and transparency.