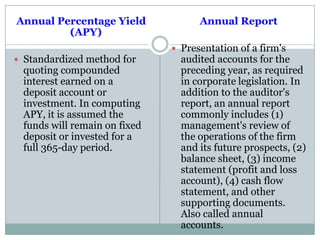

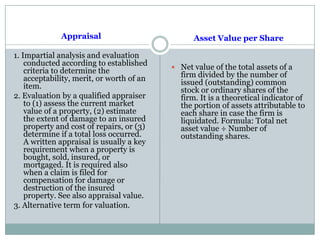

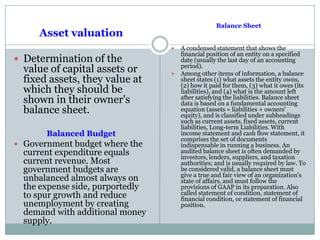

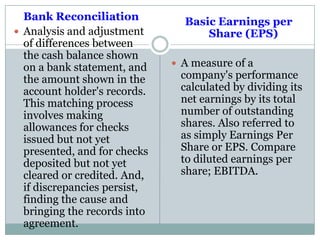

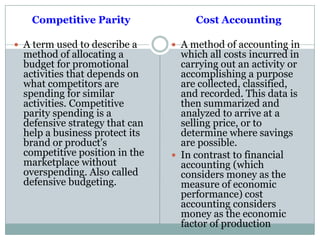

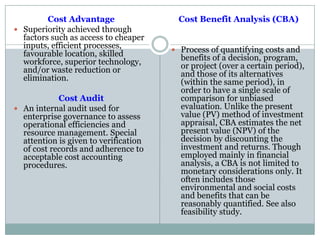

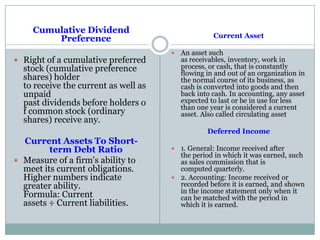

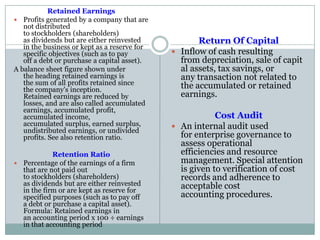

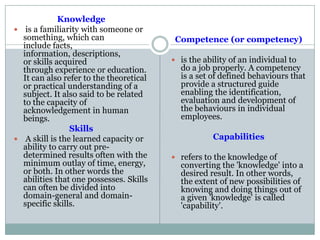

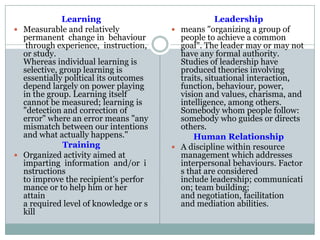

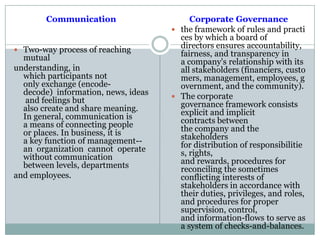

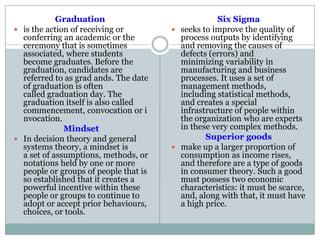

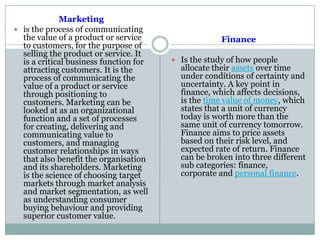

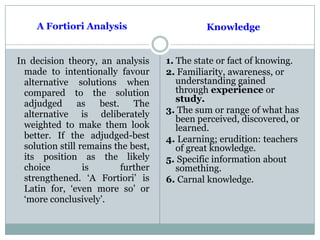

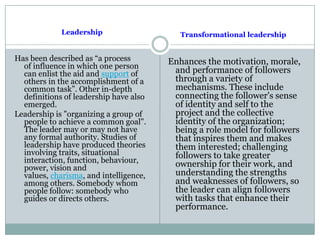

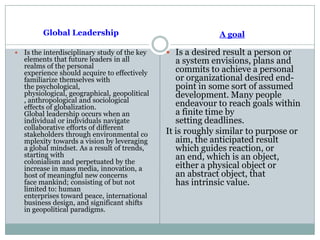

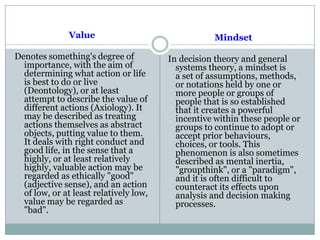

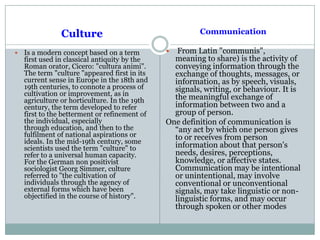

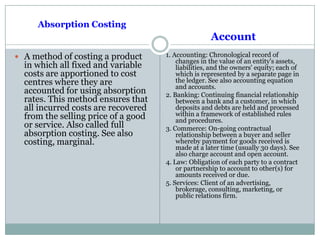

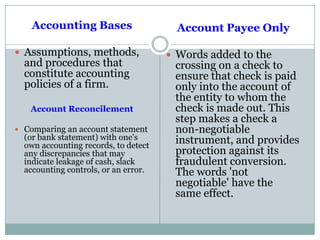

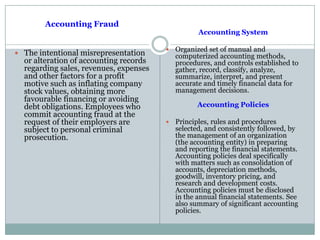

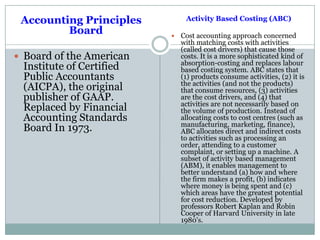

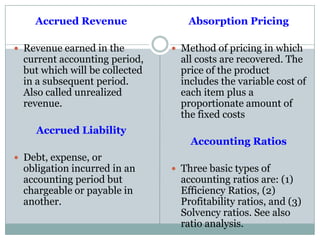

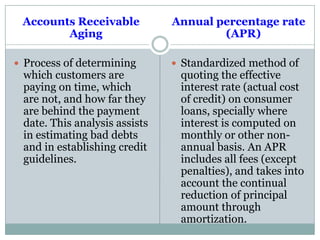

This document defines various accounting and business terms. It provides concise definitions for terms like a fortiori analysis, knowledge, leadership, transformational leadership, global leadership, goals, value, mindset, culture, communication, absorption costing, and many other accounting and business concepts. The definitions aim to concisely explain the key elements and meanings of each term.

![Activity Based

Budgeting (ABB)

Resource allocation

based on relationship

between activities and

costs, and which

provides greater detail

on overheads than the

normal financial

budgeting. See also

activity based costing.

Ad Valorem

Method for charging a

duty, fee, or tax

according to the value of

goods and services,

instead of by a fixed rate,

or by weight or quantity.

Latin for, [according] to

the value.](https://image.slidesharecdn.com/usefuldefinitions-130617052457-phpapp02/85/Useful-definitions-17-320.jpg)