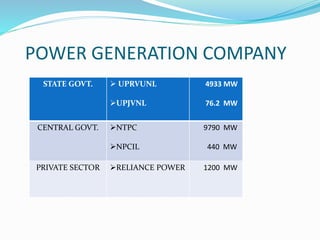

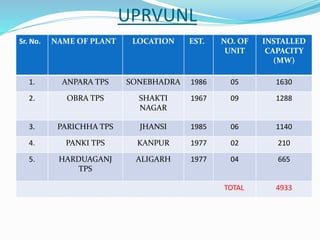

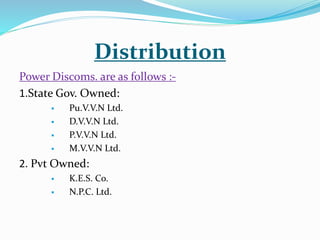

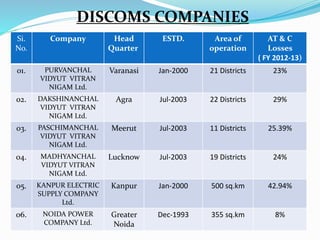

This document provides information about power generation and distribution in Uttar Pradesh. It details the installed capacity of various power plants in the state run by entities like UPRVUNL, NTPC, and private operators. It also lists upcoming power projects. Distribution is handled by four state-owned discoms and two private discoms. The document performs SWOT analyses of the generation and distribution sectors and describes the UDAY scheme aimed at improving discom efficiency. Overall, it comprehensively outlines the power infrastructure and key entities involved in the sector in Uttar Pradesh.