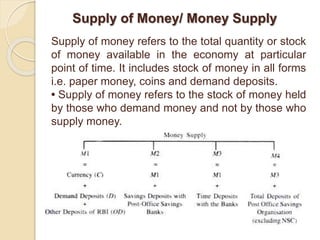

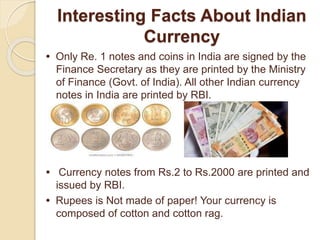

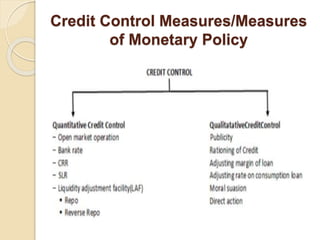

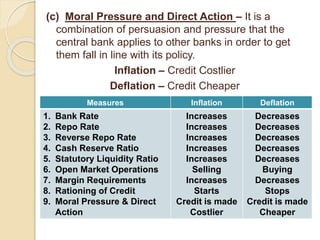

The document discusses the limitations of the barter system, highlighting issues like the lack of a common unit of value and double coincidence of wants, which led to the evolution of money as a more efficient medium of exchange. It details the different forms of money, such as commodity, metallic, paper, and electronic money, and the functions of money in measuring value, storing wealth, and facilitating transactions. Additionally, it explains the role of central banks in regulating the monetary system, controlling credit, and managing the supply of money in the economy.