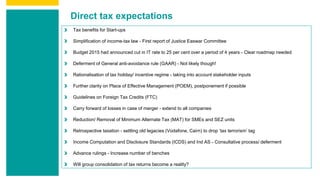

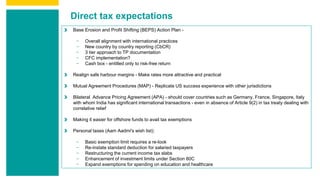

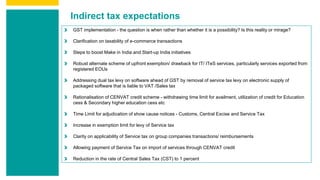

The document discusses key expectations from the upcoming Union Budget 2016 in India. It is expected that the budget will provide tax benefits for start-ups and simplify income tax laws. It may offer clarity on issues related to indirect taxation such as the implementation of GST and rationalization of service tax rates. The budget could also target reforms such as reducing corporate tax rates and resolving legacy tax disputes to improve India's business environment and help attract more foreign investment. Overall, the budget aims to balance the need for economic growth with political pressures through targeted reforms and incentives.