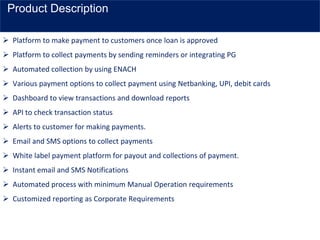

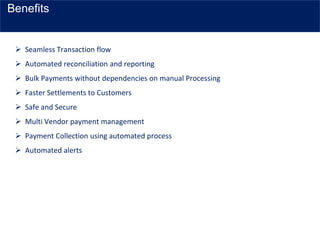

Safexpay is a comprehensive payment gateway platform designed for NBFCs, fintech, and lending companies, enabling easy integration and feature rollouts. It supports multi-country and multi-currency transactions and offers various payment methods with advanced security measures, including 256-bit encryption and PCI compliance. The platform provides automated processes, customizable reporting, and a wide range of payment solutions, catering to the diverse needs of clients and merchants.