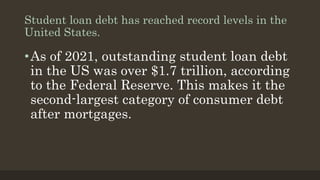

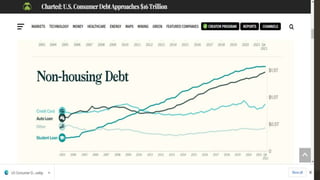

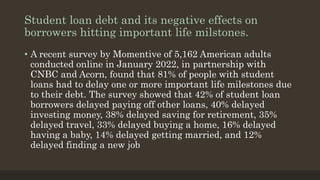

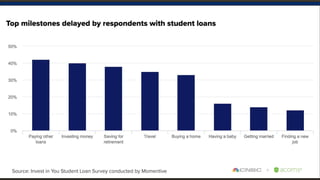

Student loan debt in the US has reached over $1.7 trillion, the second largest category of consumer debt after mortgages. A survey found that 81% of people with student loans had to delay important life milestones like home buying, marriage, or retirement savings due to debt. Student loan debt disproportionately affects minority and low-income borrowers. The author proposes a solution that college tuition would be repayable based on post-graduation income, incentivizing careers that pay well and reducing the burden of student loan debt. Nonprofits advocate for policies that address affordability and protect borrowers.