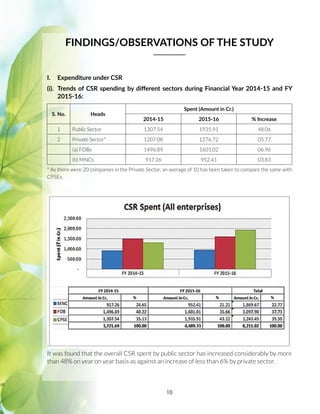

This document provides a summary of a study conducted by Bhartiya Vitta Salahkar Samiti (BVSS) on Corporate Social Responsibility (CSR) activities in India from 2014-2016. The study analyzed spending patterns of top listed companies from government, family-owned businesses, and multinational companies in manufacturing and services. It found varied approaches to CSR spending between these groups. The study also identified challenges faced by companies and provides suggestions to improve transparency and effectiveness of CSR implementation. The document acknowledges contributions from Ekal Abhiyan, an organization working on rural development, in conducting this study on the interface between corporations and social development initiatives.

![i

FOREWORD

“Businesses need to go beyond the interest of their companies to the communities they serve”

– Ratan Tata

From inactive philanthropy to the incorporation of the stakeholders’ interest in the business

model, the Indian business sector practices various methods of discharging its social

responsibility. While a lot of human and economic energy is available for utilization in this area,

a suitable mechanism was required to channelize this energy. For which the Government,

included Corporate Social Responsibility in the newly enacted Companies Act, 2013.

I am pleased to share that Ekal, in association with Bhartiya Vitta Salahkar Samiti (BVSS) has

jointly conducted the present study on Corporate Social Responsibility (CSR). The theme of

the study is to compare, analyse and understand the behavior of CSR spent during last two

years, by top listed companies operating under Government, Family Owned Businesses

(FOBs) and Multi-National Companies (MNCs) tag with varied interest in manufacturing and

service sector. The study also covers the challenges faced by them and suggestions for better

& transparent implementation and presentation.

I hope that this joint study would give rich insight to all the stakeholders and create greater

awarenessaboutdifferentaspectsrelatingtoCSRtogetherwithsuggestionstothechallenges

faced by companies in India.

Dr. Subhash Chandra

Member, Rajya Sabha,

Chairman, Ekal Global

New Delhi

March 28, 2017

uo lEor~ üú÷þ] pS=k] çfrink](https://image.slidesharecdn.com/csr-astudybybvss-200426191634/85/CSR-Activities-in-India-3-320.jpg)

![iii

CHAIRMAN’S MESSAGE

Provisions of Companies Act, 2013, relating to Corporate Social Responsibility (CSR) have

been used by the government not only to ensure sustainable development for companies, but

also to help and support under-privileged section of society living primarily in tribal and rural

Bharat.

It has been nearly three years since CSR was mandated and the behavior of spent under CSR

is a reality now. Bhartiya Vitta Salahkar Samiti (BVSS) has been addressing issues relating to

CSR by oraganising workshops, seminars and discussions. We at BVSS felt that a publication

on some critical and comparative study of CSR spent during Financial Year 2014-15 and

2015-16 may be beneficial to various stakeholders including Companies, Government, NPOs,

General Public and of course Professionals engaged with CSR.

BVSS entrusted this assignment to its senior professionals CA Anil Sharma and CA Sushil

Gupta, who have done an excellent job by putting their time and experience in bringing out

this publication and for that I on my behalf and on behalf of BVSS put on record deep gratitude

and appreciation for them.

BVSS is also thankful to Ekal Abhiyan for their valuable inputs in carrying out the present

endeavor.

The study is also suggesting few inputs for the regulators for improved implementation of

CSR provisions.

BVSS is hopeful that the publication shall serve the purpose and shall be a good reference

material as the professional update on the subject.

CA Subhash C. Aggarwal

Chairman, Advisory Board - BVSS

New Delhi

March 28, 2017

uo lEor~ üú÷þ] pS=k] çfrink](https://image.slidesharecdn.com/csr-astudybybvss-200426191634/85/CSR-Activities-in-India-5-320.jpg)

![ix

PREFACE

Introduction of corporate social

responsibility as a part of corporate

legislation was a praiseworthy action. It

was expected that large portion of rural

population especially located in tribal and

remote areas, which hitherto could not taste

the fruits of economic development, would

be benefitted with these provisions.

Bhartiya Vitta Salahkar Samiti (BVSS), a

not- for-profit organization, run by finance

professionals, regularly conducts various

programs related to professional and

social issues. Based on specific studies and

workshops conducted, it provides inputs

to the governments and other respective

regulators.

Ekal Abhiyan is an integrated program for

rural development and its activities include

running Ekal Schools in more than 54,000

remotevillagesinvariouspartsofthecountry

and to propagate health consciousness and

sense of self- reliance in the rural folks.

Nearly 30 years of uninterrupted journey

of Ekal gave BVSS a prefect reason and

inspiration to take up the present Study

to understand the interface between the

corporate sector and various development

initiatives for marginalized people.

The Study highlights the pattern of spending

by various corporate models under CSR

initiatives over the last two years of its

implementation. The Study also aims to

suggest suitable amendments in relevant

lawsandrulestomakeCSRmoremeaningful,

transparent and objective.

We place on record our sincere thanks to

Hon’ble Shri Shyam Ji (Founder Ekal), CA

Bajrang Lal Bagra Ji (Ex-CMD, NALCO and

President, Central Executive Committee,

Ekal Abhiyan), Dr. Subhash Chandra Ji

(Hon'ble Member of Parliament, Chairman

Essel Gourp and Ekal Global), CA Subhash

Aggarwal Ji (Chairman SMC Group and

Chairman, Advisory Board-BVSS) and CA

Raj Kumar Agarwal ji (President BVSS) for

their inspiration and guidance.

We also wish to thank Adv. Imran Ahmed

Siddiqui for his hard work in bringing out this

Study.

In any publication there is always a scope

for further improvement. We would be

grateful to users to offer their suggestions /

comments for further refinement.

For Team BVSS

CA Sushil Gupta

CA Anil Sharma

New Delhi

March 28, 2017

uo lEor~ üú÷þ] pS=k] çfrink](https://image.slidesharecdn.com/csr-astudybybvss-200426191634/85/CSR-Activities-in-India-11-320.jpg)

![4

INTRODUCTION

Social Responsibility is not a new concept in

India. Our thousands of years old civilization

carries a resonance legacy delivering duties

and responsibilities at every sphere of

our life, be it family, friends or society as a

whole. Roots of social responsibility lie in

philanthropic activities such as giving money,

goods, services or time to the unfortunates,

either directly or by means of an organized

structure of a charitable trust, without

any expectation of some benefit in return.

Various practices prevalent in India, such as

DaaninHinduism,ZakatandFitrainMuslims,

Dasvand in Sikhism and Tethe in Christians

are explicit evidences. The basic aim of all has

been to help under-privileged. Hence, roots

of social responsibility are found in religious

belief and practices. Those who were unable

to serve society directly, but were able to

provide money and other material resources,

either established charitable institutions and

built Dharamshalas, Schools, Orphanages,

Homes for destitute and the like; and,

donated funds to run them. Some benevolent

individuals established endowments to

provide monetary help in perpetuity for

some charitable cause. Traditionally, most

forms of social obligations are concerned

with providing basic necessities such as food,

water, clothing, education, healthcare and

shelter.

An old belief is:

Adatt Danachha Bhavet Daridra

A vnÙk nkukPp Hkosr~ nfjnz A

Daridra Bhavachha Karuti Papam

A nfjnz HkoPp djksfr ikie A

Papam Prabhavat Narakam Prayanti

A ikie izHkkor ujde iz;kfUr A

Punaha Daridra Punarepa Papi

A iqu% nfjnz iqujsik ikih A

Which means if one does not donate, the

person is penniless and being in misery, he

performs evil deeds. By performing evil

deeds he ends up in here and after taking

rebirth, he once again ends up in the vicious

cycle of misery and evil deeds.

in Geeta, Chapter 17, shloka 20 defines the

saatvika daan (pure charity):

nkrO;fefr ;íkua nh;rs ^uqidkfj.ks A

ns'ks dkys p ik=ks p ríkua lkfÙoda Le`re AA

that giving is called saattvika (pure) which

is given with the intent that ‘I must give’, to

someone who can’t return the favor; and

given in the right place, time and to the

worthy/needy recipient.

ç[;kr lektlsoh LoxhZ; Jh ukukth ns'keq• us dgk

Fkk

¶eSa vius fy, ugha] viuksa ds fy, gw¡A

vkSj vius vFkkZr~] oks lc tks misf{kr gSa] oafpr gSaA¸

This message equally applies to corporate

citizens. Indian companies have had a

long tradition of being engaged in social

initiatives that have gone beyond meeting a

company’s immediate financial objectives.

Business organisation, have been making

decisions based not only on financial factors,

but also on the social and environmental

consequences, while meeting the interests](https://image.slidesharecdn.com/csr-astudybybvss-200426191634/85/CSR-Activities-in-India-18-320.jpg)

![36

accordance with the provisions of section

198.”

Schedule VII to the Companies Act, 2013

ACTIVITIES WHICH MAY BE INCLUDED

BY COMPANIES IN

THEIR CORPORATE SOCIAL

RESPONSIBILTY POLICIES

Activities relating to:-

1) Eradicating hunger, poverty and

malnutrition, promoting health care

including preventive Health care] and

sanitation [including contribution to

the Swach Bharat Kosh set-up by the

Central Government for the promotion

of Sanitation] and making available safe

drinking water;

2) Promoting education, including special

education and employment enhancing

vocation skills especially among children,

women, elderly, and the differently abled

and livelihood enhancement projects;

3) Promoting gender equality, empowering

women, setting up homes and hostels for

women and orphans; setting up old age

homes, day care centres and such other

facilities for senior citizens and measures

for reducing inequalities faced by socially

and economically backward groups;

4) Ensuring environmental sustainability,

ecological balance, protection of flora

and fauna, animal welfare, agro forestry,

conservation of natural resources

and maintaining quality of soil, air and

water[including contribution to the

Clean Ganga Fund set-up by the Central

Government for the rejuvenation of river

Ganga ];

5) Protection of national heritage, alt and

culture including restoration of buildings

and sites of historical importance

and works of art; setting up public

libraries; promotion and development of

traditional arts and handicrafts;

6) Measures for the benefit of armed

forces veterans, war widows and their

dependents;

7) Training to promote rural sports,

nationally recognised sports,

Paralympics sports and Olympic

sports;

8) Contribution to the Prime Minister's

National Relief Fund or any other fund

set up by the Central Government for

socio-economic development and relief

and welfare of the Scheduled Castes,

the Scheduled Tribes, other backward

classes, minorities and women;

9) Contributions or funds provided to

technology incubators located within

academicinstitutionswhichareapproved

by the Central Government;

10) Rural development projects.

11) Slum area Development *

*Explanation - For the purposes of this item,

the term ‘Slum area’ shall means any area

declared as such by the Central Government

or any State Government or any other

competent Authority under any law for the

time being in force.

Companies (Corporate Social

Responsibility Policy) Rules, 2014

In exercise of the powers conferred under

section 135 and sub-sections (1) and (2) of

section 469 of the Companies Act, 2013,

the Central Government hereby makes the

following rules, namely:-

Short title and commencement.

Rule 1: (1) These rules may be called the

Companies (Corporate Social Responsibility

Policy) Rules, 2014.](https://image.slidesharecdn.com/csr-astudybybvss-200426191634/85/CSR-Activities-in-India-50-320.jpg)

![38

of clause (a) of sub-section (1) of section 381

and section 198 of the Act.

(2) Every company which ceases to be a

company covered under subsection

(1) of section 135 of the Act for three

consecutive financial years shall not be

required to—

(a) Constitute a CSR Committee; and

(b) Comply with the provisions

contained in sub-sections (2) to (5)

of the said section, till such time it

meets the criteria specified in sub-

section (1) of section 135.

CSR Activities

Rule 4: (1) The CSR activities shall be

undertaken by the company, as per its stated

CSR Policy, as projects or programs or

activities (either new or ongoing), excluding

activities undertaken in pursuance of its

normal course of business.

(2) The Board of a company may decide to

undertake its CSR activities approved by

the CSR Committee, through

(a) a company established under section

8 of the Act or a registered trust or a

registered society, established by the

company, either singly or along with

any other company, or

(b) a company established under section

8 of the Act or a registered trust or

a registered society, established by

the Central Government or State

Governmentoranyentityestablished

under an Act of Parliament or a State

legislature :

Provided that- if, the Board of a company

decides to undertake its CSR activities

through a company established under

section 8 of the Act or a registered trust or a

registered society, other than those specified

in this sub-rule, such company or trust

or society shall have an established track

record of three years in undertaking similar

programs or projects; and the company has

specified the projects or programs to be

undertaken, the modalities of utilisation of

funds of such projects and programs and the

monitoring and reporting mechanism”

(3) A company may also collaborate with

other companies for undertaking

projects or programs or CSR activities in

such a manner that the CSR Committees

of respective companies are in a position

to report separately on such projects or

programs in accordance with these rules.

(4) Subject to provisions of sub-section (5) of

section 135 of the Act, the CSR projects

or programs or activities undertaken

in India only shall amount to CSR

Expenditure.

(5) The CSR projects or programs or

activities that benefit only the employees

of the company and their families shall

not be considered as CSR activities in

accordance with section 135 of the Act.

(6) Companies may build CSR capacities

of their own personnel as well as

those of their Implementing agencies

through Institutions with established

track records of at least three financial

years but such expenditure [including

expenditure on administrative

overheads] shall not exceed five per

cent of total CSR expenditure of the

company in one financial year.

(7) Contribution of any amount directly or

indirectly to any political party under

section 182 of the Act, shall not be

considered as CSR activity.

CSR Committees

Rule 5: (1) The companies mentioned in the](https://image.slidesharecdn.com/csr-astudybybvss-200426191634/85/CSR-Activities-in-India-52-320.jpg)

![41

General Circular No-21/2014 dated 18th

June, 2014

Clarifications with regard to provisions

of Corporate Social Responsibility under

section 135 of the Companies Act, 2013.

ThisMinistryhasreceivedseveralreferences

and representation from stakeholders

seekingclarificationsontheprovisionsunder

Section 135 of the Companies Act, 2013

(herein after referred as ‘the Act’) and the

Companies (Corporate Social Responsibility

Policy) Rules, 2014, as well as activities to

be undertaken as per Schedule VII of the

Companies Act, 2013. Clarifications with

respect to representations received in the

Ministry on Corporate Social Responsibility

(hereinafterreferredas(‘CSR’)areasunder:-

(i) The statutory provision and provisions of

CSR Rules, 2014, is to ensure that while

activities undertaken in pursuance of the

CSR policy must be relatable to Schedule

VII of the Companies Act 2013, the

entries in the said Schedule VII must be

interpreted liberally so as to capture the

essence of the subjects enumerated in

the said Schedule. The items enlisted in

the amended Schedule VII of the Act, are

broad-based and are intended to cover

a wide range of activities as illustratively

mentioned in the Annexure.

(ii) It is further clarified that CSR activities

should be undertaken by the companies

in project/ programme mode [as referred

in Rule 4 (1) of Companies CSR Rules,

2014].One-offeventssuchasmarathons/

awards/ charitable contribution/

advertisement/ sponsorships of TV

programmes etc. would not be qualified

as part of CSR expenditure.

(iii) Expenses incurred by companies for

the fulfilment of any Act/ Statute of

regulations (such as Labour Laws, Land

Acquisition Act etc.) would not count as

CSR expenditure under the Companies

Act.

(iv) Salaries paid by the companies to regular

CSR staff as well as to volunteers of the

companies (in proportion to company’s

time/hours spent specifically on CSR)

can be factored into CSR project cost as

part of the CSR expenditure.

(v) “Any financial year” referred under Sub-

Section (1) of Section 135 of the Act read

with Rule 3(2) of Companies CSR Rule,

2014, implies ‘any of the three preceding

financial years’.

(vi) ExpenditureincurredbyForeignHolding

Company for CSR activities in India

will qualify as CSR spend of the Indian

subsidiary if, the CSR expenditures are

routed through Indian subsidiaries and if

the Indian subsidiary is required to do so

as per section 135 of the Act.

(vii) ‘Registered Trust’ (as referred in Rule

4(2) of the Companies CSR Rules,

2014) would include Trusts registered

under Income Tax Act 1956, for those

States where registration of Trust is not

mandatory.

(viii) Contribution to Corpus of a Trust/

society/ section 8 companies etc. will

qualify as CSR expenditure as long as (a)

the Trust/ society/ section 8 companies

etc.iscreatedexclusivelyforundertaking

CSR activities or (b) where the corpus is

created exclusively for a purpose directly

relatabletoasubjectcoveredinSchedule

VII of the Act.](https://image.slidesharecdn.com/csr-astudybybvss-200426191634/85/CSR-Activities-in-India-55-320.jpg)

![43

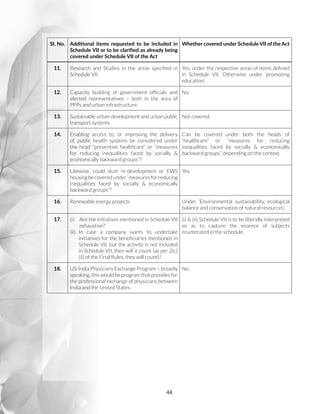

SI. No. Additional items requested to be included in

Schedule VII or to be clarified as already being

covered under Schedule VII of the Act

Whether covered under Schedule VII of the Act

(ii) Protecting consumer’s health and safety,

sustainable consumption, consumer service,

support and complaint resolution.

(iii) Consumer protection activities.

(iv) Consumer Rights to be mandated.

(v) all consumer protection programs and

activities”onthesamelinesasRuralDevelopment,

Education etc.

5. a) Donations to IIM [A] for conservation of

buildings and renovation of classrooms

would qualify as “promoting education” and

hence eligible for compliance of companies

with Corporate Social Responsibility.

b) Donations to IIMA for conservation of

buildings and renovation of classrooms

would qualify as “protection of national

heritage, art and culture, including

restoration of buildings and sites of

historical importance” and hence eligible for

compliance of companies with CSR.

Conservation and renovation of school buildings

and classrooms relates to CSR activities under

Schedule VII as “promoting education”.

6. Non Academic Technopark TBI not located

within an academic Institution but approved

and supported by Department of Science and

Technology.

Schedule VII (ii) under “promoting education”,

if approved by Department of Science and

Technology.

7. Disaster Relief Disaster relief can cover wide range of activities

that can be appropriately shown under various

items listed in Schedule VII. For example,

(i) medical aid can be covered under ‘promoting

health care including preventive health care.’

(ii) food supply can be covered under eradicating

hunger, poverty and malnutrition.

(iii) supply of clean water can be covered under

‘sanitation and making available safe drinking

water’.

8. Trauma care around highways in case of road

accidents.

Under ‘health care’.

9. Clarity on rural development projects” Any project meant for the development of rural

India will be covered under this.

10. Supplementing of Govt. schemes like mid-day

meal by corporates through additional nutrition

would qualify under Schedule VII.

Yes. Under Schedule VII, item no. (i) under

‘poverty and malnutrition’.](https://image.slidesharecdn.com/csr-astudybybvss-200426191634/85/CSR-Activities-in-India-57-320.jpg)

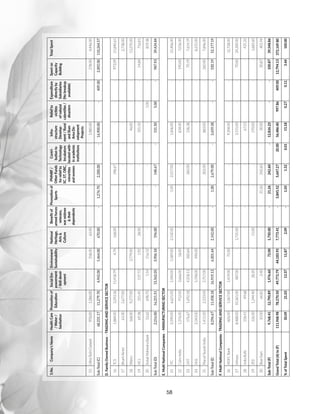

![63

Annexure 2.2 (a)

Summary of CSR Expenditure as per Audited Financial Statements for

Financial Year 2014-15

A. MANUFACTURING SECTOR (CPSEs)

( R in crore)

S.

No.

Name of the Company Govt

Holding

%

Average

Net Profit

Prescribed

spent for

CSR

Amount actually spent Amount

unspent

Direct Through

Implementation

Agencies

Total

Spent

1 Oil Natural Gas Corporation

Limited (ONGC)

68.94 3,030.00 660.61 - 495.23 495.23 165.38

2 National Thermal Power

Corporation Limited (NTPC)

74.96 4,173.78 283.48 - 205.19 205.19 78.30

3 National Mineral Dev Corp Ltd

(NMDC Ltd.)

80 9,979.14 210.56 49.40 139.05 188.45 21.91

4 Bharat Heavy Electricals Ltd

(BHEL)

63.06 8,222.33 164.45 84.49 18.02 102.51 62.94

5 Gas Authority of India Ltd

(GAIL)

56.11 5,933.37 118.67 - 17.15 17.15 77.31

(Balance

provided

for)

Sub Total (A) 1,338.62 1,437.77 133.89 874.64 1,008.53 328.53

B. SERVICE / TRADING SECTOR (CPSEs)

( R in crore)

S.

No.

Name of the Company Govt

Holding

%

Average

Net Profit

Prescribed

spent for

CSR

Amount actually spent Amount

unspent

Direct Through

Implementation

Agencies

Total

Spent

1 Power Finance Corporation

Limited (PFC)

72.8 5,874.47 117.49 2.77 48.92 51.69 65.81

2 Power Grid Corporation of

India Limited

57.9 5,525.52 110.51 4.10 43.32 47.42 63.09

3 Rural Electrification

Corporation Limited

65.64 5,162.24 103.25 0.02 46.02 46.04 57.21

4 Oil India Ltd (OIL) 67.64 4,909.38 98.19 72.79 60.52 133.31 -

5 Container Corporation of India

Ltd (CONCOR)

61.8 1,226.00 26.90 1.11 19.45 20.56 5.69

Sub Total (B) 22,697.61 456.34 80.79 218.23 299.02 191.80

Grand Total [(A)+(B)] 94,036.23 1,894.11 214.68 1,092.87 1,307.55 520.33](https://image.slidesharecdn.com/csr-astudybybvss-200426191634/85/CSR-Activities-in-India-77-320.jpg)

![64

Annexure 2.2 (b)

Summary of CSR Expenditure as per Audited Financial Statements for

Financial Year 2015-16

A. MANUFACTURING SECTOR (CPSEs)

( R in crore)

S.

No.

Name of the Company Govt

Holding

%

Average

Net Profit

Prescribed

spent for

CSR

Amount actually spent Amount

unspent

Direct Through

Implementation

Agencies

Total Spent

(Including

L/Y spent,

if any)*

1 Oil Natural Gas Corporation

Limited (ONGC)

68.94 29,684.80 593.69 16.49 402.57 419.06 172.70

2 National Thermal Power

Corporation Limited (NTPC)

74.96 13,567.43 271.35 252.69 239.12 491.81 -

3 National Mineral Dev Corp Ltd

(NMDC Ltd.)

80 9,664.05 193.28 104.04 106.05 210.09 -

4 Indian Oil Corporation Ltd

(IOCL)

58.57 7,075.00 141.50 101.60 55.08 156.68 4.43

5 Bharat Petroleum Corporation

Limited (BPCL)

55.79 5,629.89 112.60 25.45 70.13 95.58 17.02

Sub Total (A) 65,621.17 1,312.42 500.27 872.95 1,373.22 194.15

B. SERVICE / TRADING SECTOR (CPSEs)

( R in crore)

S.

No.

Name of the Company Govt

Holding

%

Average

Net Profit

Prescribed

spent for

CSR

Amount actually spent Amount

unspent

Direct Through

Implementation

Agencies

Total Spent

(Including

L/Y spent,

if any)*

1 Power Finance Corporation

Limited (PFC)

72.8 7,289.31 145.79 - 195.52 195.52 -

2 Rural Electrification

Corporation Limited

65.64 6,372.65 127.45 0.02 128.18 128.20 -

3 Power Grid Corporation of

India Limited

57.9 6,089.70 121.79 19.35 96.44 115.79 6.01

4 Oil India Limited 67.64 4,415.73 88.31 48.85 43.36 92.21 -

5 Container Corporation of India

Ltd (CONCOR)

61.8 1,263.59 25.27 - 30.96 30.96 -

Sub Total (B) 25,430.98 508.61 68.22 494.46 562.68 6.01

Grand Total [(A)+(B)] 91,052.15 1,821.03 568.49 1,367.41 1,935.90 200.16

* Bifurcation of yearly spent not available. The figure may include amount pertaining to previous year also.](https://image.slidesharecdn.com/csr-astudybybvss-200426191634/85/CSR-Activities-in-India-78-320.jpg)

![65

Annexure 2.2 (c)

Summary of CSR Expenditure as per Audited Financial Statements for

Financial Year 2014-15

A. MANUFACTURING SECTOR (FOBs)

( R in crore)

S.

No.

Name of the Company Promoters'

Holding %

Average

Net Profit

Prescribed

spent for

CSR

Amount actually spent Amount

unspent

Direct Through

Implementation

Agencies

Total Spent

1 Reliance Industries Ltd 45.24 26,648.00 532.96 25.30 735.28 760.58 -

2 Tata Steel 31.35 8,412.82 168.26 171.46 - 171.46 -

3 Bajaj Auto Ltd 49.24 4,316.49 86.33 42.91 - 42.91 43.42

4 Mahindra Mahindra Ltd. 25.55 4,151.74 83.03 10.37 72.87 83.24 -

5 UltraTech Cement Limited 61.69 3,076.00 61.51 44.46 - 44.46 17.05

Sub Total (A) 46,605.05 932.09 294.50 808.15 1,102.65 60.47

B. SERVICE / TRADING SECTOR (FOBs)

( R in crore)

S.

No.

Name of the Company Promoters'

Holding %

Average

Net Profit

Prescribed

spent for

CSR

Amount actually spent Amount

unspent

Direct Through

Implementation

Agencies

Total

Spent

1 Tata Consultancy Services Ltd 73.89 14,250.00 285.00 60.90 157.50 218.40 66.00

2 Bharti Airtel Ltd 43.72 6,998.60 140.00 - 27.38 27.38 98.9

(Balance

provided

for)

3 Wipro Ltd 73.39 6,415.40 128.30 - 132.70 132.70 -

4 HCL Technologies Limited 45.57 4,499.27 89.99 - 7.17 7.17 83.83

5 Kotak Mahindra Bank Limited 40.02 1,959.79 39.20 - 8.59 8.59 Balance

provided

for

Sub Total (B) 34,123.06 682.49 60.90 333.34 394.24 149.83

Grand Total [(A)+(B)] 80,728.11 1,614.58 355.40 1,141.49 1,496.89 210.30](https://image.slidesharecdn.com/csr-astudybybvss-200426191634/85/CSR-Activities-in-India-79-320.jpg)

![66

Annexure 2.2 (d)

Summary of CSR Expenditure as per Audited Financial Statements for

Financial Year 2015-16

A. MANUFACTURING SECTOR (CPSEs)

( R in crore)

S.

No.

Name of the Company Promoters'

Holding %

Average

Net Profit

Prescribed

spent for

CSR

Amount actually spent Amount

unspent

Direct Through

Implementation

Agencies

Total Spent

(Including

L/Y spent,

if any)*

1 Reliance Industries Ltd 45.24 27,889.00 557.78 - 651.57 651.57 -

2 Tata Steel 31.35 7,518.00 150.00 99.87 104.60 204.47 -

3 Bajaj Auto Ltd 49.24 4,323.05 86.46 - 86.72 86.72 -

4 Mahindra Mahindra Ltd. 25.55 4,247.45 84.95 7.68 78.24 85.92 -

5 UltraTech Cement Limited 61.69 2,891.00 57.82 50.89 - 50.89 6.93

Sub Total (A) 46,868.50 937.01 158.44 921.13 1,079.57 6.93

B. SERVICE / TRADING SECTOR (FOBs)

( R in crore)

S.

No.

Name of the Company Promoters'

Holding %

Average

Net Profit

Prescribed

spent for

CSR

Amount actually spent Amount

unspent

Direct Through

Implementation

Agencies

Total Spent

(Including

L/Y spent,

if any)*

1 Tata Consultancy Services Ltd 73.89 17,994.00 360.00 1.45 292.78 294.23 66.00

2 Wipro Ltd 73.39 7,800.20 156.00 - 159.82 159.82 -

3 HCL Technologies Limited 45.57 6,106.44 122.13 - 12.37 12.37 111.61

4 Bharti Airtel Ltd 43.72 9,450.20 189.00 4.33 39.61 43.94 135.53

(Balance

provided

for)

5 Kotak Mahindra Bank Limited 40.02 2,366.37 47.33 - 11.10 11.10 36.23

Sub Total (B) 43,717.21 874.46 5.78 515.68 521.46 213.84

Grand Total [(A)+(B)] 90,585.71 1,811.47 164.22 1,436.81 1,601.03 220.77

* Bifurcation of yearly spent not available. The figure may include amount pertaining to previous year also.](https://image.slidesharecdn.com/csr-astudybybvss-200426191634/85/CSR-Activities-in-India-80-320.jpg)

![67

Annexure 2.2 (e)

Summary of CSR Expenditure as per Audited Financial Statements for

Financial Year 2014-15

A. MANUFACTURING SECTOR (MNCs)

( R in crore)

S.

No.

Name of the Company FDI % Average

Net Profit

Prescribed

spent for

CSR

Amount actually spent Amount

unspent

Direct Through

Implementation

Agencies

Total Spent

1 ITC Ltd. 51.64 10,646.11 212.92 0.01 214.05 214.06 -

2 Cairn India Ltd 65.27 6,489.82 129.80 62.42 7.94 70.36 59.44

3 Larsen Toubro Limited 25.55 5,310.29 106.21 59.39 17.15 76.54 29.67

4 Hindustan Unilever Limited 61.69 3,990.93 79.82 54.85 27.50 82.35 -

5 Maruti Suzuki India Limited 80.29 3,269.10 65.40 75.44 3.02 78.46 -

Sub Total (A) 29,706.25 594.15 252.11 269.66 521.77 89.11

B. SERVICE / TRADING SECTOR (MNCs)

( R in crore)

S.

No.

Name of the Company FDI % Average

Net Profit

Prescribed

spent for

CSR

Amount actually spent Amount

unspent

Direct Through

Implementation

Agencies

Total Spent

1 HDFC Bank Ltd 45.24 12,385.00 248.00 9.98 117.30 127.28 53.19

(Balance

provided

for)

2 Infosys Ltd 31.35 12,133.00 243.00 - 243.00 243.00 3.46

3 Indiabulls Housing Finance Ltd 61.69 1,159.97 23.20 - 4.35 4.35 Balance

provided

for

4 Zee Entertainment Enterprises

Ltd

68.17 965.80 19.34 - 16.84 16.84 2.50

5 Blue Dart Express Ltd 82.99 193.80 3.88 0.33 3.69 4.02 -

Sub Total (B) 26,837.57 537.42 10.31 385.18 395.49 5.96

Grand Total [(A)+(B)] 56,543.82 1,131.57 262.42 654.84 917.26 95.07](https://image.slidesharecdn.com/csr-astudybybvss-200426191634/85/CSR-Activities-in-India-81-320.jpg)

![68

Annexure 2.2 (f)

Summary of CSR Expenditure as per Audited Financial Statements for

Financial Year 2015-16

A. MANUFACTURING SECTOR (MNCs)

( R in crore)

S.

No.

Name of the Company FDI % Average

Net Profit

Prescribed

spent for

CSR

Amount actually spent Amount

unspent

Direct Through

Implementation

Agencies

Total Spent

(Including

L/Y spent,

if any)*

1 ITC Ltd. 51.64 12,338.22 246.76 - 247.50 247.50 -

2 Cairn India Ltd 65.27 5,360.30 107.21 51.50 - 51.50 55.71

3 Larsen Toubro Limited 25.55 5,073.00 101.46 38.42 81.47 119.89 -

4 Hindustan Unilever Limited 61.69 4,597.07 91.94 62.81 29.31 92.12 -

5 Maruti Suzuki India Limited 80.29 3,269.10 65.40 72.84 5.62 78.46 -

Sub Total (A) 0,637.69 612.77 225.57 363.90 589.47 55.71

B. SERVICE / TRADING SECTOR (MNCs)

( R in crore)

S.

No.

Name of the Company FDI % Average

Net Profit

Prescribed

spent for

CSR

Amount actually spent Amount

unspent

Direct Through

Implementation

Agencies

Total Spent

(Including

L/Y spent,

if any)*

1 HDFC Bank Ltd 45.24 12,385.00 248.00 9.98 117.30 127.28 53.19

(Balance

provided

for)

2 Infosys Ltd 31.35 12,800.00 256.01 83.24 119.06 202.30 53.71

3 Indiabulls Housing Finance Ltd 51.79 1,591.05 31.82 - 10.53 10.53 Balance

provided

for

4 Zee Entertainment Enterprises Ltd 68.17 1,107.10 22.14 - 22.83 22.83 1.80

5 Blue Dart Express Ltd 82.99 202.22 4.05 - - - 1.01

(Balance

provided

for)

Sub Total (B) 8,085.37 562.02 93.22 269.72 362.94 55.51

Grand Total [(A)+(B)] 8,723.06 1,174.79 18.79 633.62 952.41 111.22

* Bifurcation of yearly spent not available. The figure may include amount pertaining to previous year also.](https://image.slidesharecdn.com/csr-astudybybvss-200426191634/85/CSR-Activities-in-India-82-320.jpg)