UGL story

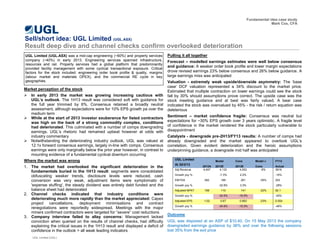

- 1. Market perception of the stock In early 2013 the market was growing increasing cautious with UGL’s outlook. The 1H13 result was considered soft with guidance for the full year trimmed by 6%. Consensus retained a broadly neutral assessment, although expectations were for 10% EPS growth pa over the medium term While at the start of 2013 investor exuberance for listed contractors was high on the back of a strong commodity complex, conditions had deteriorated. This culminated with a number of comps downgrading earnings. UGL’s rhetoric had remained upbeat however at odds with industry commentary Notwithstanding the deteriorating industry outlook, UGL was valued at 12.1x forward consensus earnings, largely in-line with comps. Consensus earnings were only marginally below the prior year however, in contrast to mounting evidence of a fundamental cyclical downturn occurring Where the market was wrong 1. The market had overlooked the significant deterioration in the fundamentals buried in the 1H13 result: segments were consolidated obfuscating weaker trends, disclosure levels were reduced, cash conversion was very weak, adjustment items were symptomatic of 'expense stuffing', the steady dividend was entirely debt funded and the balance sheet had deteriorated 2. Channel checks indicated that industry conditions were deteriorating much more rapidly than the market appreciated: Capex project cancellations, deployment minimisations and contract renegotiations were reportedly widespread. Meetings with the major miners confirmed contractors were targeted for “severe” cost reductions 3. Company interview failed to allay concerns: Management lacked conviction when queried on the results of channel checks, had difficulty explaining the critical issues in the 1H13 result and displayed a deficit of confidence in the outlook > all weak leading indicators Sell/short idea: UGL Limited (UGL.ASX) Result deep dive and channel checks confirm overlooked deterioration Fundamental idea case study Mark Cox, CFA UGL Limited (UGL.ASX) was a mid-cap engineering (~60%) and property services company (~40%) in early 2013. Engineering services spanned infrastructure, resources and rail. Property services had a global platform that predominantly provided facility management with some cyclical transactional exposure. Critical factors for the stock included: engineering order book profile & quality, margins (labour market and materials OPEX), and the commercial RE cycle in key geographies. Pulling it all together Forecast – modelled earnings estimates were well below consensus and guidance: A weaker order book profile and lower margin expectations drove revised earnings 23% below consensus and 26% below guidance. A large earnings miss was anticipated Valuation - extremely weak upside/downside asymmetry: The ‘base case’ DCF valuation represented a 34% discount to the market price. Estimated that multiple contraction on lower earnings could see the stock fall by 30% should assumptions prove correct. The upside case was the stock meeting guidance and at best was fairly valued. A bear case indicated the stock was overvalued by 45% - the risk / return equation was deleterious Sentiment – market confidence fragile: Consensus was neutral but expectations for ~30% EPS growth over 3 years optimistic. A fragile level of confidence in the market rendered the stock particularly vulnerable to disappointment Catalysts - downgrade pre-2H13/FY13 results: A number of comps had already downgraded and the market appeared to overlook UGL’s correlation. Given evident deterioration and the heroic assumptions underpinning guidance, a downgrade mid half was anticipated Outcome UGL was disposed at an ASP of $10.40. On 15 May 2013 the company downgraded earnings guidance by 36% and over the following sessions lost 35% from the exit price UGL Limited (UGL) UGL Limited Model Cons Model v FY13 At 20/3/13 2012A 2013E 2013E Cons Actual Adj Revenue 4,457 4,133 4,553 -9% 3816 Growth yoy % -7.3% 2.2% -14% EBITDA 282 189 291 -35% 203 Growth yoy % -32.8% 3.3% -28% Adjusted NPAT 168 110 141 -22% 92.1 Growth yoy % -34.5% -16.5% -45% Adjusted EPS 1.02 0.67 0.863 -23% 0.554 Growth yoy % -34.5% -15.3% -46%

- 2. 1. What was the idea’s ‘edge’? What was new or unique the market was missing? Channel checking industry sources provided an early warning on the rapidly changing industry dynamics in early 2013 > the market did not appear to factor in the credible downside risks to earnings quickly enough A deep dive on 1H13 revealed numerous red flags of a demonstrably poor quality result that clearly indicated that 2H13 would be problematic > the market did not fully appreciate how poor the 1H13 result was and its implications for 2H Insightful preparation for a management meeting yielded dividends when responses to probing questions all but confirmed concerns > the market overlooked key ‘tells’ that management lacked conviction in the outlook Forecasting future earnings in a detailed model clearly indicated meeting consensus EPS in FY13 would be exceptionally unlikely given the fundamental view on the stock’s critical factors 2. Identifiable future catalysts to move the market towards the investment thesis: The convergence catalyst was a downgrade event prior to 2H13 reporting. On May 15 UGL downgraded 2H earnings. The fall back catalyst was 2H/FY results where UGL would miss and downgrade FY14 3. Research backed by sound analysis – mitigate heuristic and cognitive error probability: Consulted with two industry contacts (at competitors) on key issues which provided front line proprietary insights Met with the management. Thoughtful preparation yielded enough information that could be triangulated with other data to corroborate the sell case Consulted with a resource sector colleague that had recent meetings with major customers – confirmed contractors were their number 1 target in aggressive cost cutting programs Performed a deep dive confirming the demonstrably poor quality 1H13 result – considered comparables and conducted a food chain review on key customers outlook statements / indicators Considered the UGL demerger thesis was tenuously supporting the stock – concluded it was no panacea to earnings risks and made the stock more vulnerable to disappointment Refined the model to consider a larger number of indicator and input factors – forecast future earnings based on detailed analysis and derived scenario valuations to consider risk / return asymmetry 4. Expose and consider risk factors. Acknowledge an idea conviction level: Explicitly considered where the ‘sell thesis’ could be wrong on each key issue. Listed downside risk factors Conducted a SWOT analysis on the investment thesis to sanity check key assumptions UGL Limited (UGL.ASX) Internal testing: Quality of investment thesis Fundamental idea case study Mark Cox, CFA