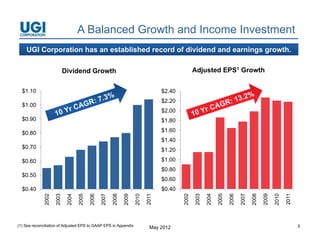

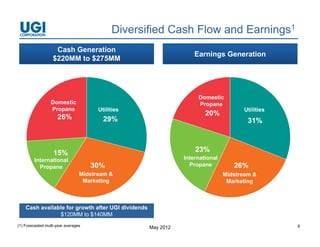

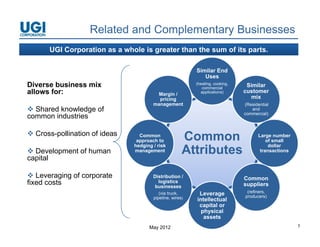

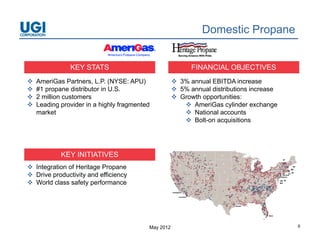

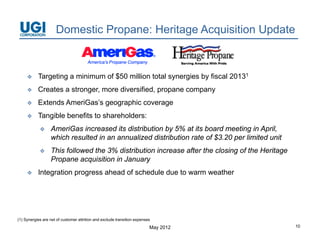

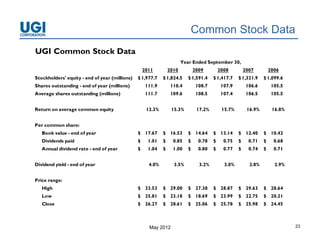

UGI Corporation is a distributor and marketer of energy products and services with a diversified portfolio of businesses including domestic propane, international propane, midstream and marketing, and utilities. The company has a proven strategy of achieving 6-10% EPS growth and 4% dividend growth through operational excellence, investments, and acquisitions. UGI pursues balanced growth and income through a growing dividend and capital investments totaling over $100 million annually across its businesses.