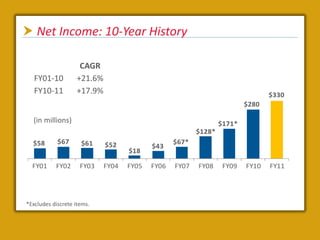

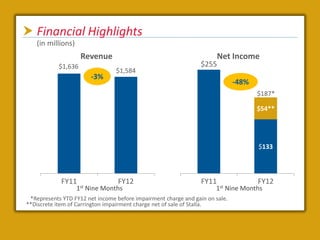

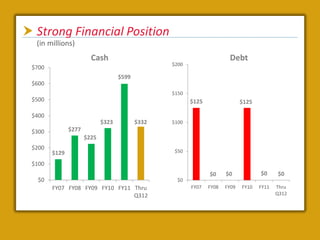

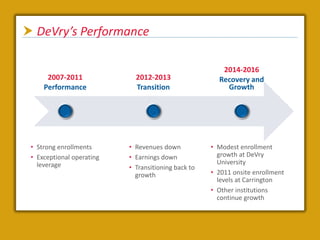

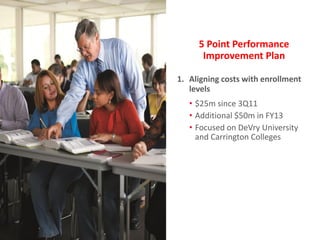

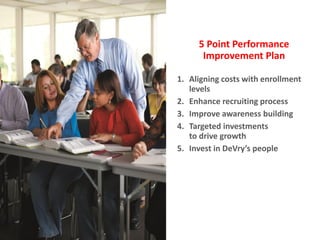

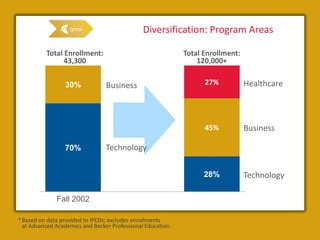

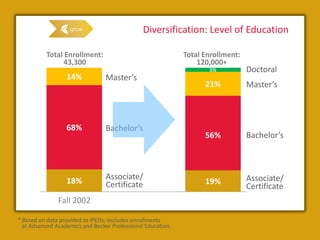

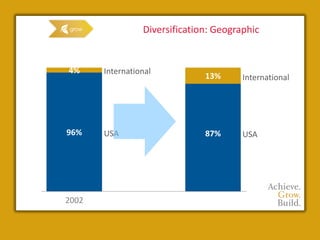

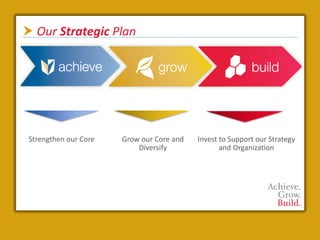

This document summarizes DeVry's strategic plan to strengthen its core business of providing career-oriented education through investments in areas like technology and faculty, while also diversifying its business across different academic programs, education levels, and geographies. It discusses DeVry's history of growth and financial performance, current challenges around enrollment and earnings declines, and a 5-point plan to improve performance through cost alignment, recruiting enhancements, awareness building, targeted investments, and developing faculty.