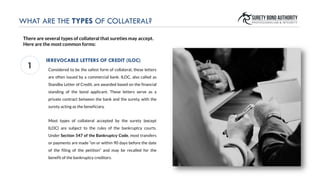

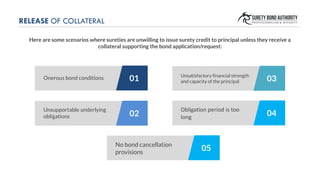

The document explains the concept of collateral in surety bonds, detailing its purpose to reduce the surety's risk and the various forms of acceptable collateral, such as irrevocable letters of credit, certificates of deposit, and fixed assets. It outlines the documents required for collateral, including collateral receipts and indemnity agreements, as well as the conditions under which sureties will release collateral. Additionally, it discusses scenarios requiring collateral and the implications when changing sureties.