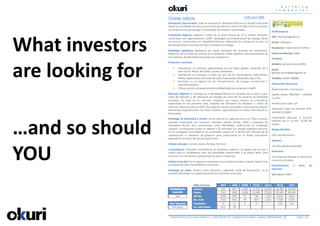

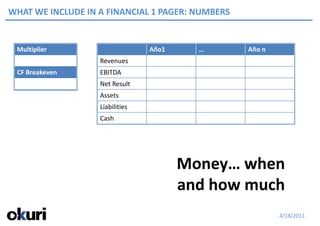

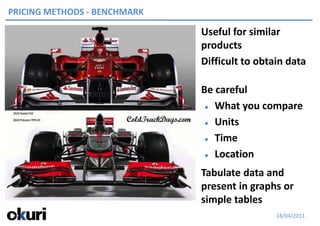

This document summarizes key concepts from two sessions on finance for entrepreneurs. Session 1 introduced technical students to key financial concepts, principles, equations, investors' objectives and stages of investing. Session 2 covered the business plan, pricing methods, business models, and other financial tools. The sessions aimed to help participants understand important financial indicators and how to apply models to value startups and present financial projections to investors.