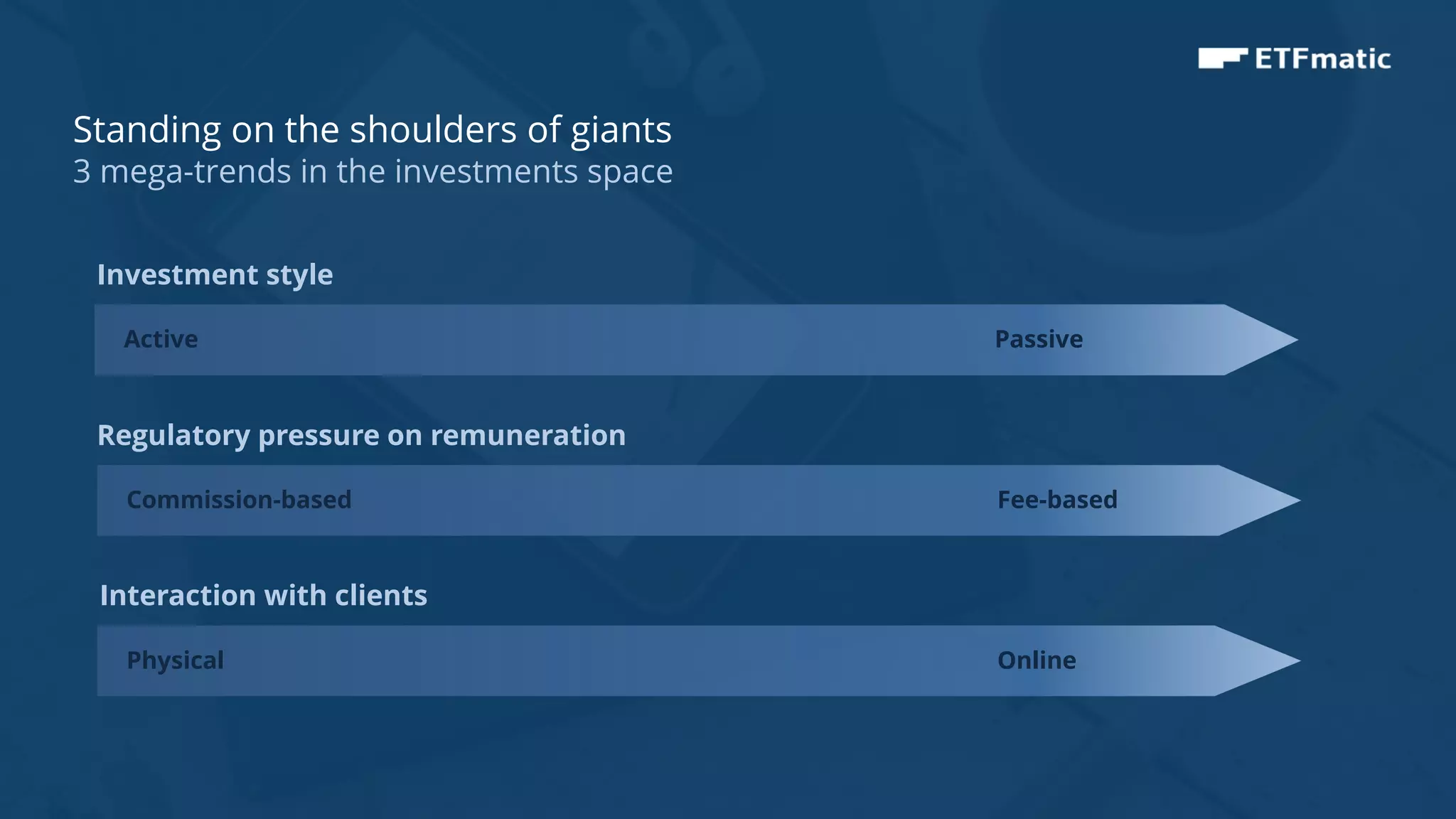

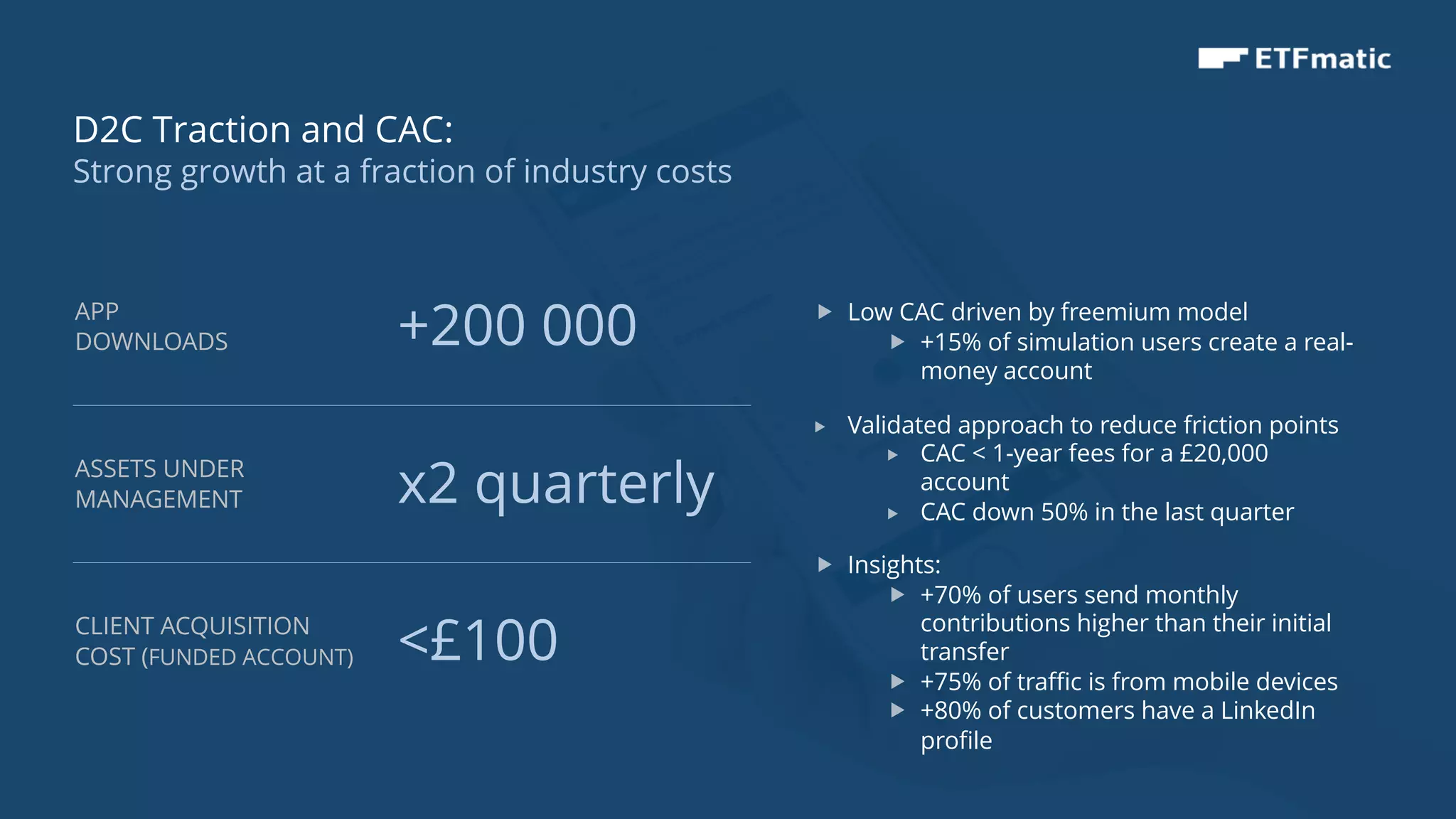

ETFmatic is a robo-advisor authorized to operate in 32 European countries. It has over 200,000 app downloads and is the most downloaded robo-advisor in Europe. ETFmatic aims to achieve break-even in 2019 by continuing to grow its direct-to-consumer business while also developing new business-to-business partnerships throughout Europe. It offers competitive fees from 0.29-0.48% on assets under management and seeks to raise £5 million in an institutional funding round in late 2018.