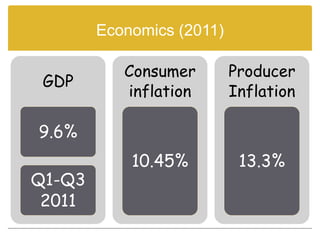

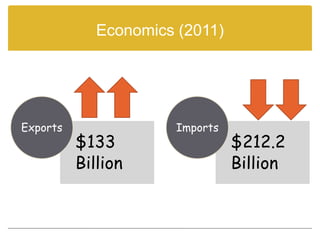

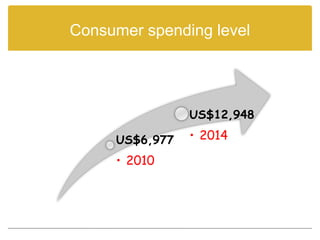

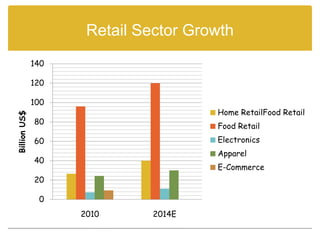

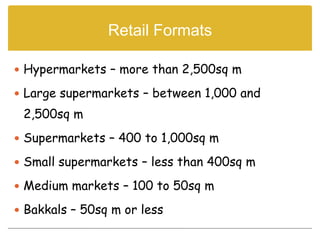

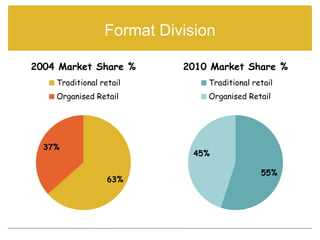

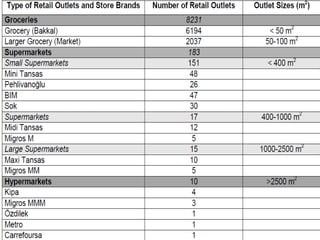

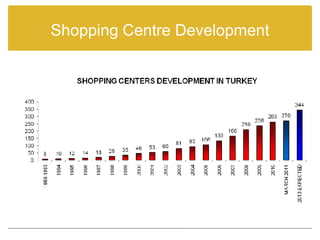

Turkey is a transcontinental country located in both Europe and Asia. It has a population of around 80 million people who are mostly Muslim. Turkey has a developing economy and consumer spending has been increasing in recent years. The retail sector in Turkey is dominated by large international retailers and hypermarkets, though traditional small stores still play a role. Major challenges for retailers include EU accession, market consolidation, and bureaucracy, but opportunities exist in expanding chain retailing and private labels.