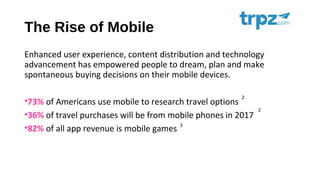

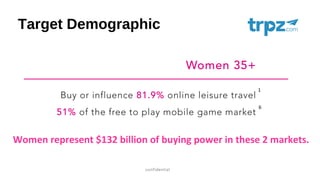

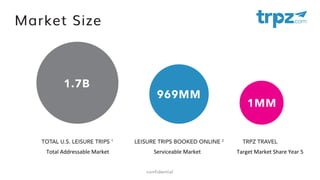

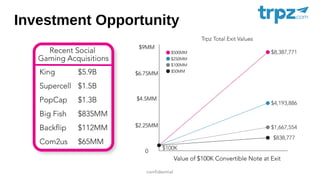

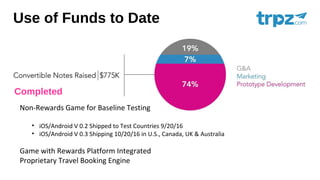

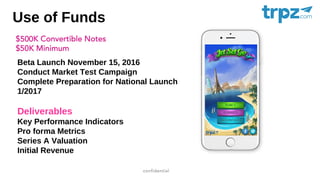

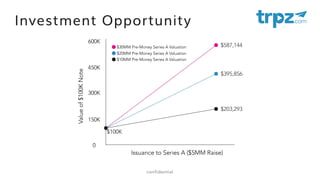

The document discusses the growth of mobile-enabled experiences in travel, highlighting that 73% of Americans use mobile for travel research and projecting that 36% of travel purchases will be made through mobile phones in 2017. It emphasizes a target demographic of women who have significant purchasing power and outlines a strategy for mobile travel games that incorporate rewards and a unique customer value proposition. The document also details the development timeline for a game with a unique travel booking engine, including planned beta launches and key performance indicators.