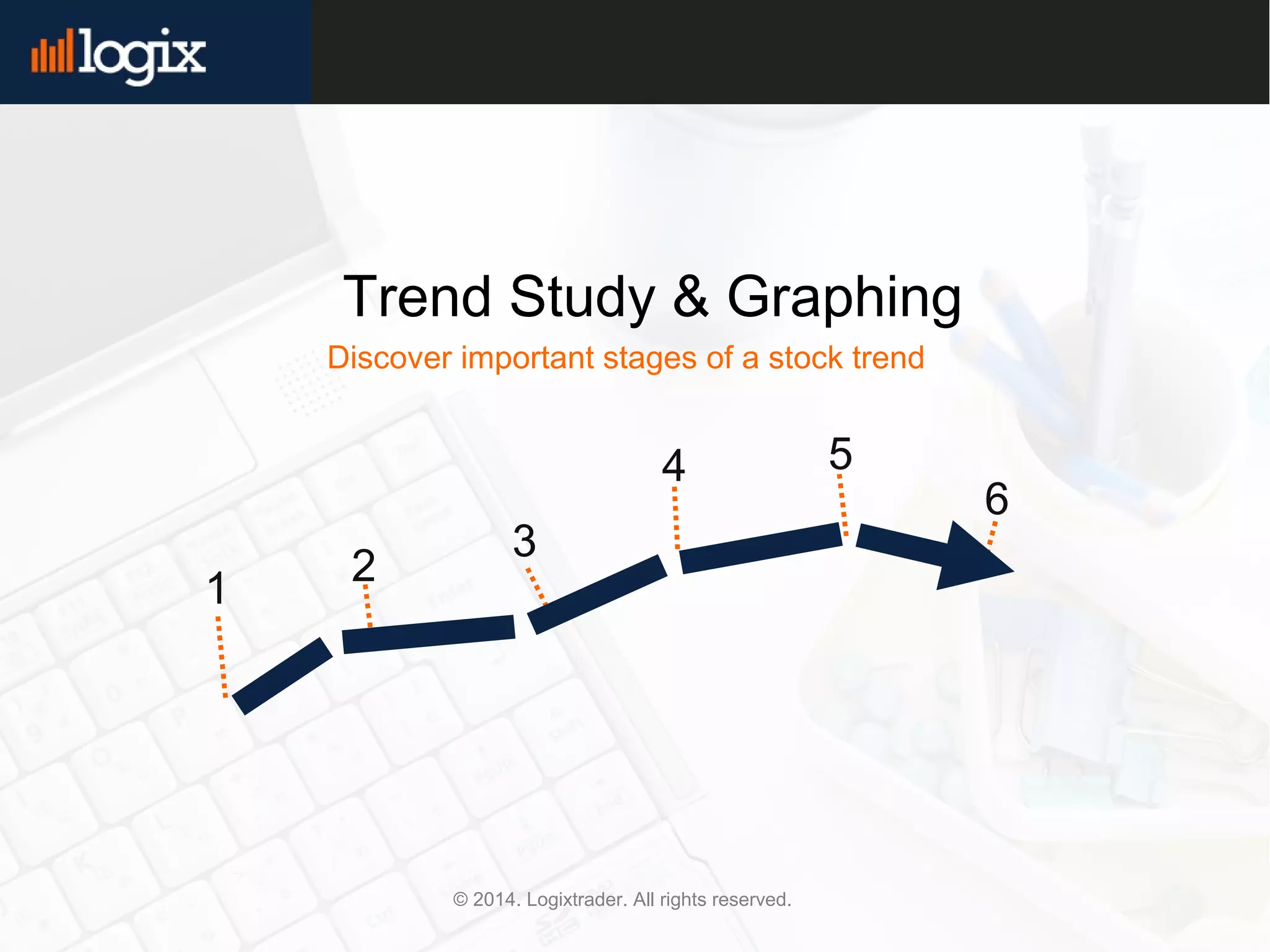

1. The document discusses the different stages of a stock trend, including accumulation, consolidation, retracement, distribution, and continuation of the trend.

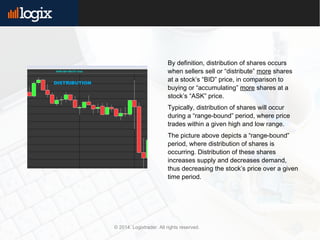

2. Accumulation occurs when demand is high and buyers are purchasing shares, which increases the stock price over time. Distribution is the opposite, as more shares are sold than bought, decreasing the stock price.

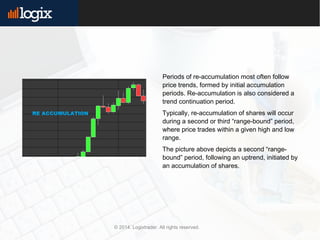

3. Other stages include consolidation when the price trades in a range with little movement, retracement which is a temporary pause or reversal in the trend, and continuation when the trend resumes in the same direction. Understanding these stages can help investors time their purchases and sales of shares.