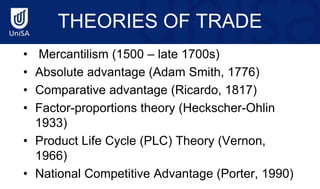

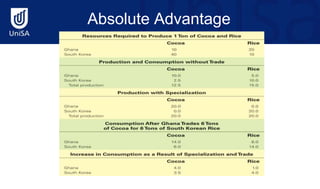

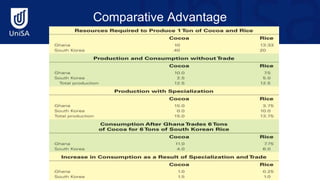

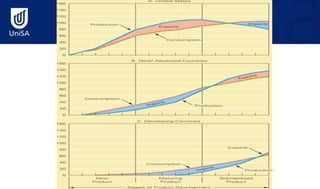

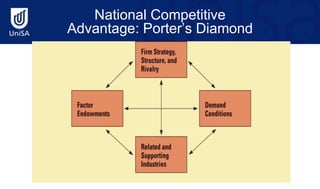

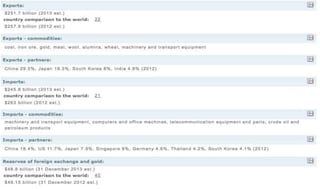

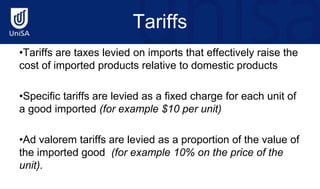

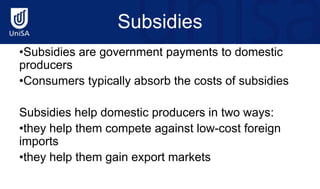

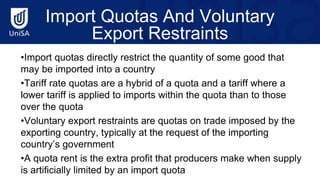

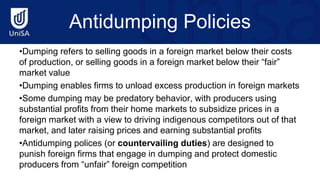

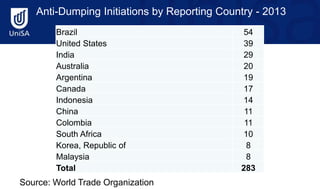

This document discusses various theories of international trade, including mercantilism, absolute advantage, comparative advantage, factor proportions theory, product life cycle theory, and theories of national competitive advantage. It also outlines common instruments of trade policy such as tariffs, subsidies, quotas, and anti-dumping policies. Finally, it discusses political and economic arguments that governments use to intervene in international trade such as protecting infant industries and pursuing strategic trade policy.