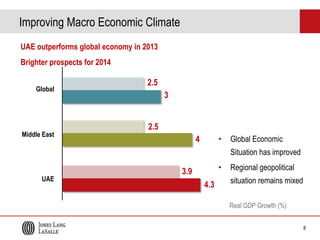

The document discusses the top real estate trends for the UAE in 2014 as identified by Jones Lang LaSalle. The key trends include avoiding another property bubble in Dubai through more measured development, the return of major mega-projects, future areas of growth, limited impact of Expo 2020 in 2014, varied approaches to real estate financing, a two-speed investment market, increased corporate activity driving workplace transformation, more hotel investment sales, sustainability moving from talk to action, and improved valuation and measurement standards. The trends are expected to have differing impacts across major UAE real estate markets like Dubai and Abu Dhabi.