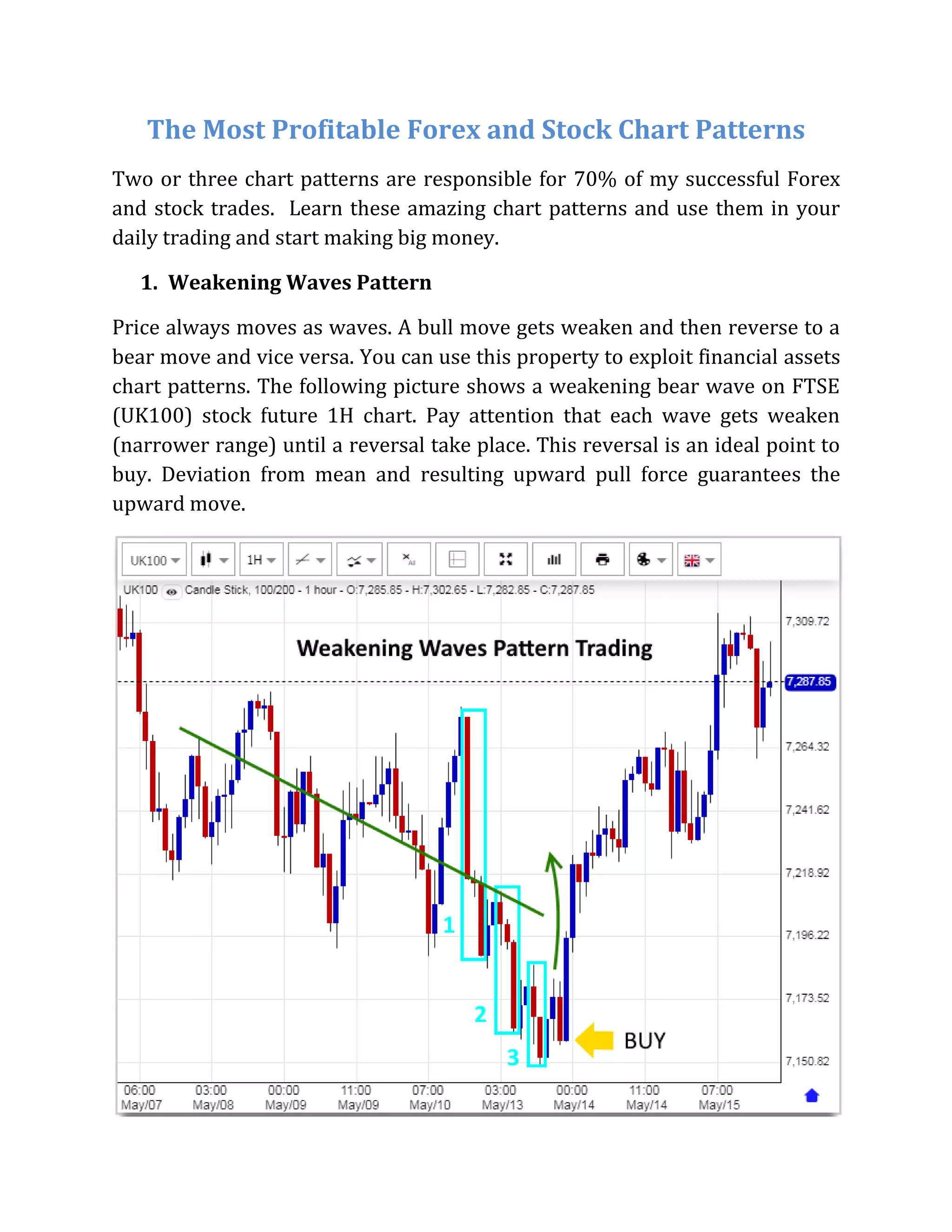

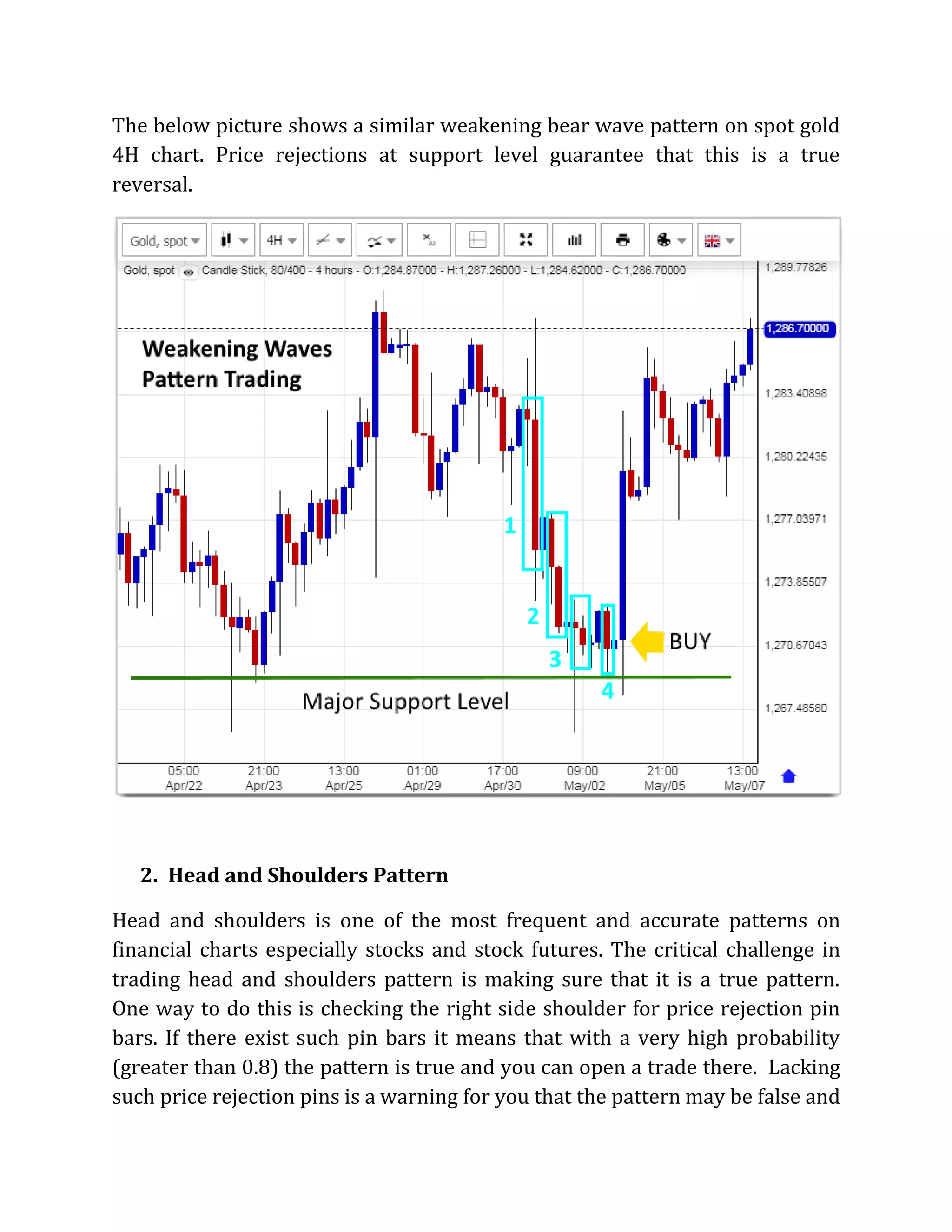

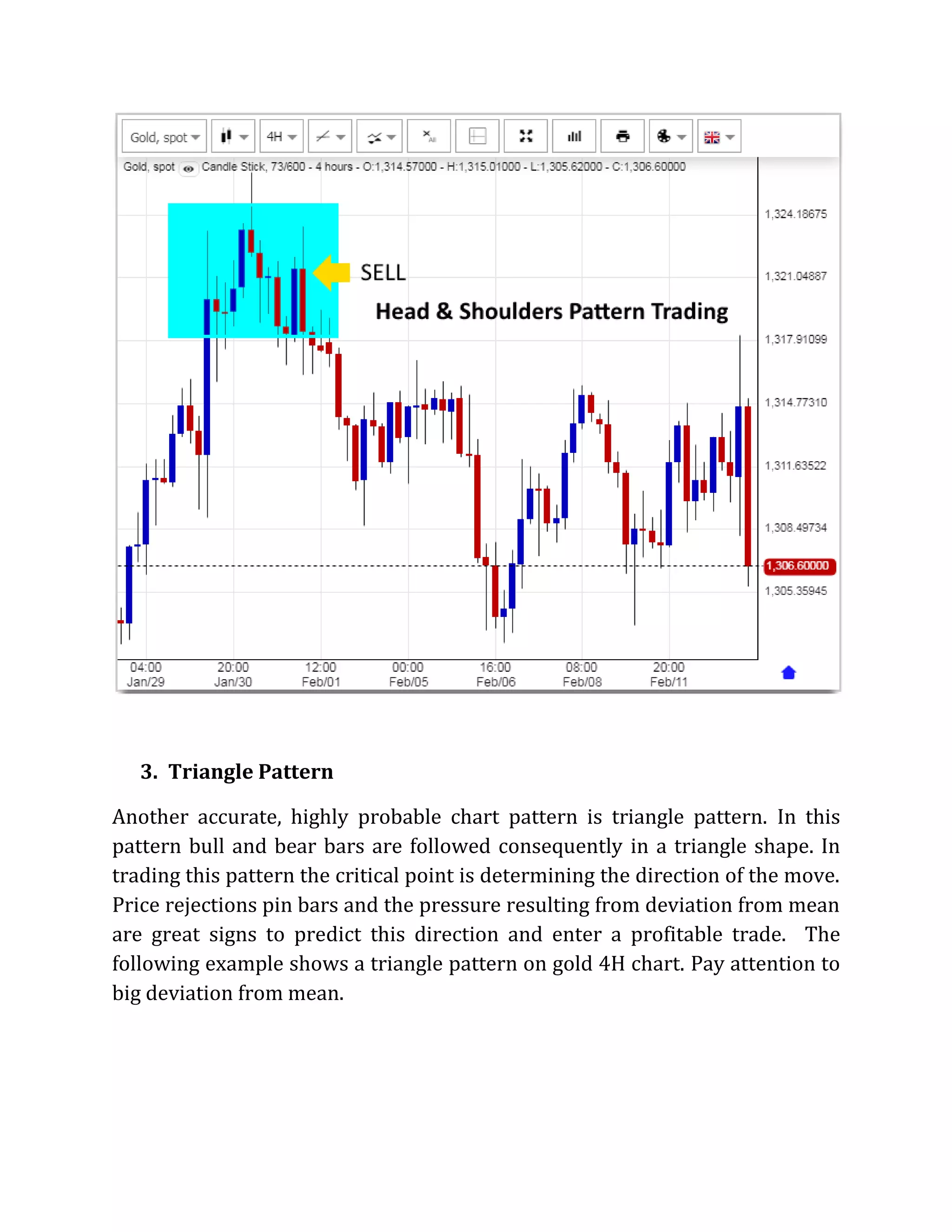

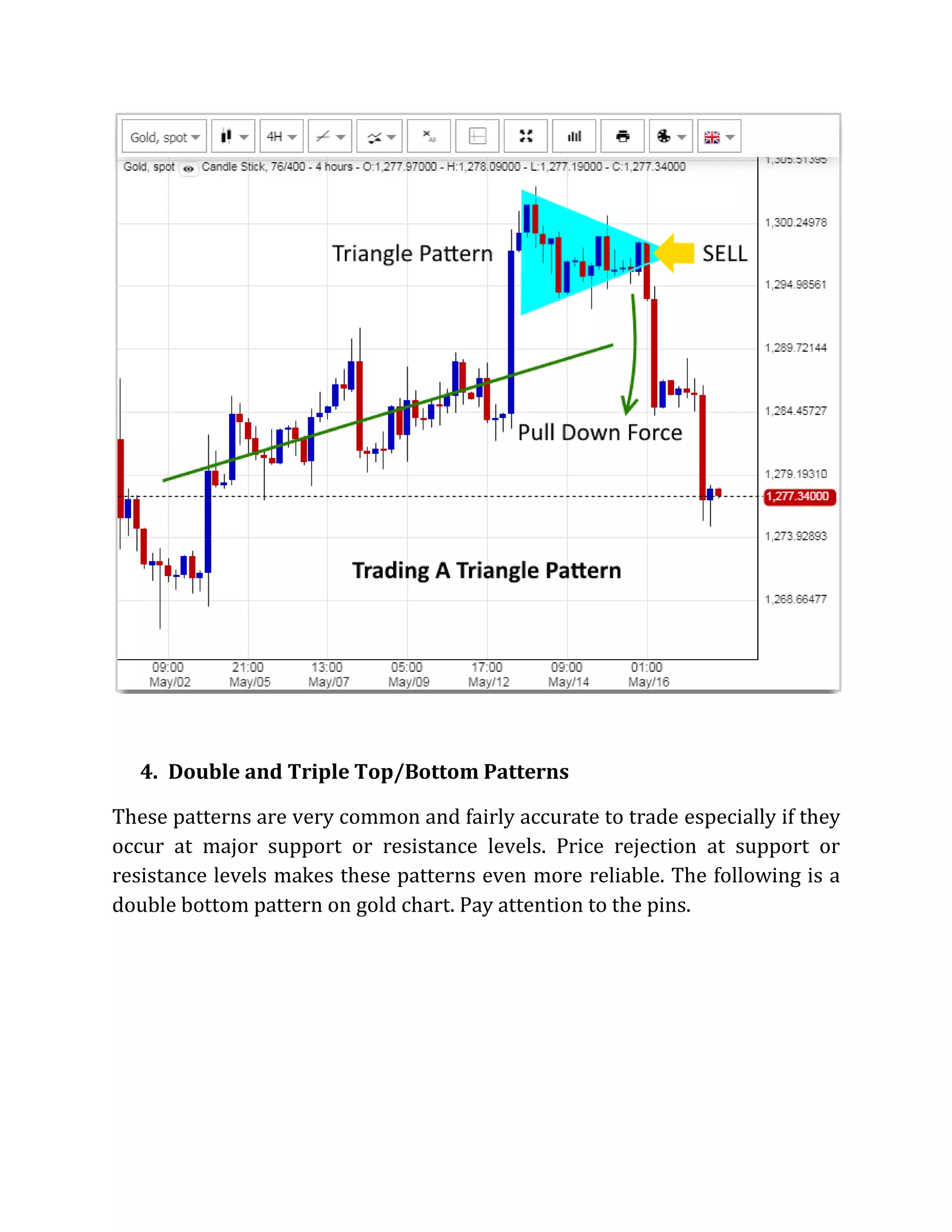

The document outlines key forex and stock chart patterns that significantly enhance trading success, including weakening waves, head and shoulders, triangle patterns, and double and triple tops/bottoms. Each pattern is described with visual examples and trading strategies, emphasizing critical indicators like price rejections and deviations from trends. The document encourages readers to learn from the referenced book for comprehensive strategies in forex and stock trading.