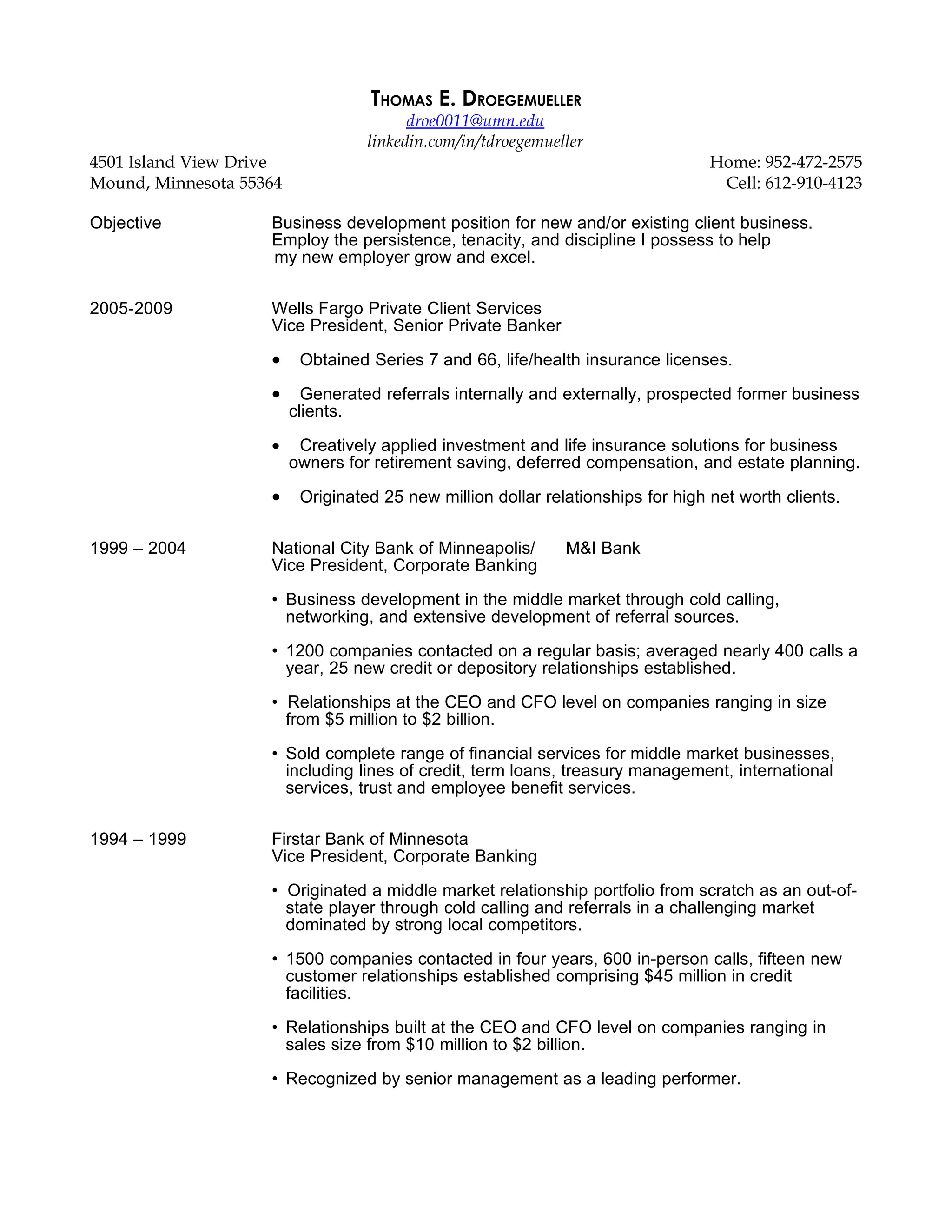

Thomas Droegemueller has over 30 years of experience in business development and relationship management in the banking and finance industries. He has a proven track record of originating new clients and growing existing business through cold calling, networking, and referrals. Some of his accomplishments include obtaining 25 new million dollar relationships, establishing over 40 new credit or depository relationships, and contributing over $1 million annually to corporate bank earnings. He is seeking a new business development position where he can employ his strong client focus, persistence, and sales skills.