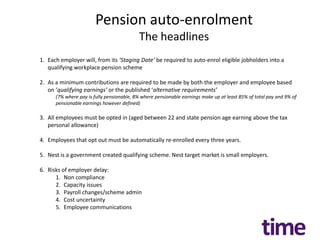

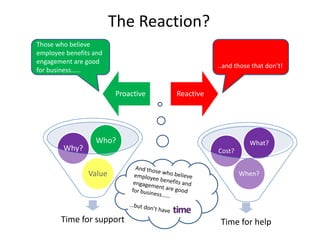

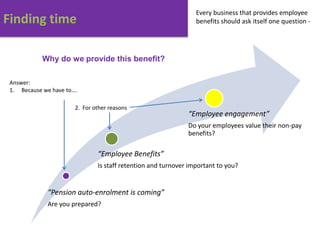

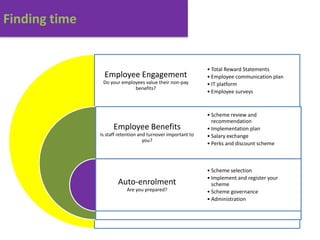

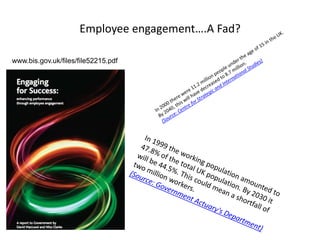

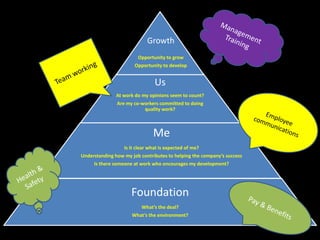

TIME is a trading style of Premier Financial Protection Ltd, an authorized and regulated financial services company with over 30 independent financial advisors across the UK who provide advice to both individual and corporate clients ranging from small to large businesses on pensions, financial protection and employee benefits. The document discusses the challenges facing the UK pension system and the government's Pension Auto-Enrollment program, which will require employers to automatically enroll eligible employees into a workplace pension scheme. It also addresses some of the reactions employers may have and considerations around being prepared for and gaining value from auto-enrollment.